Your Best qualified opportunity zone funds coin are available in this site. Best qualified opportunity zone funds are a exchange that is most popular and liked by everyone this time. You can Find and Download the Best qualified opportunity zone funds files here. Download all royalty-free news.

If you’re looking for best qualified opportunity zone funds pictures information connected with to the best qualified opportunity zone funds topic, you have visit the right blog. Our website frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

Best Qualified Opportunity Zone Funds. Partnerships or corporations can establish Opportunity Zone Funds and then invest in a property located within a Qualified Opportunity ZoneThese investment vehicles are designed to increase economic development and job creation in distressed communities as well as offer tax benefits to investors. As long as the money from these capital gains is not needed right away an Opportunity Fund can help investors use their money to grow their wealth. Opportunity Zone Funds are investment vehicles that provide tax incentives for investors. Derby RR OZ LP.

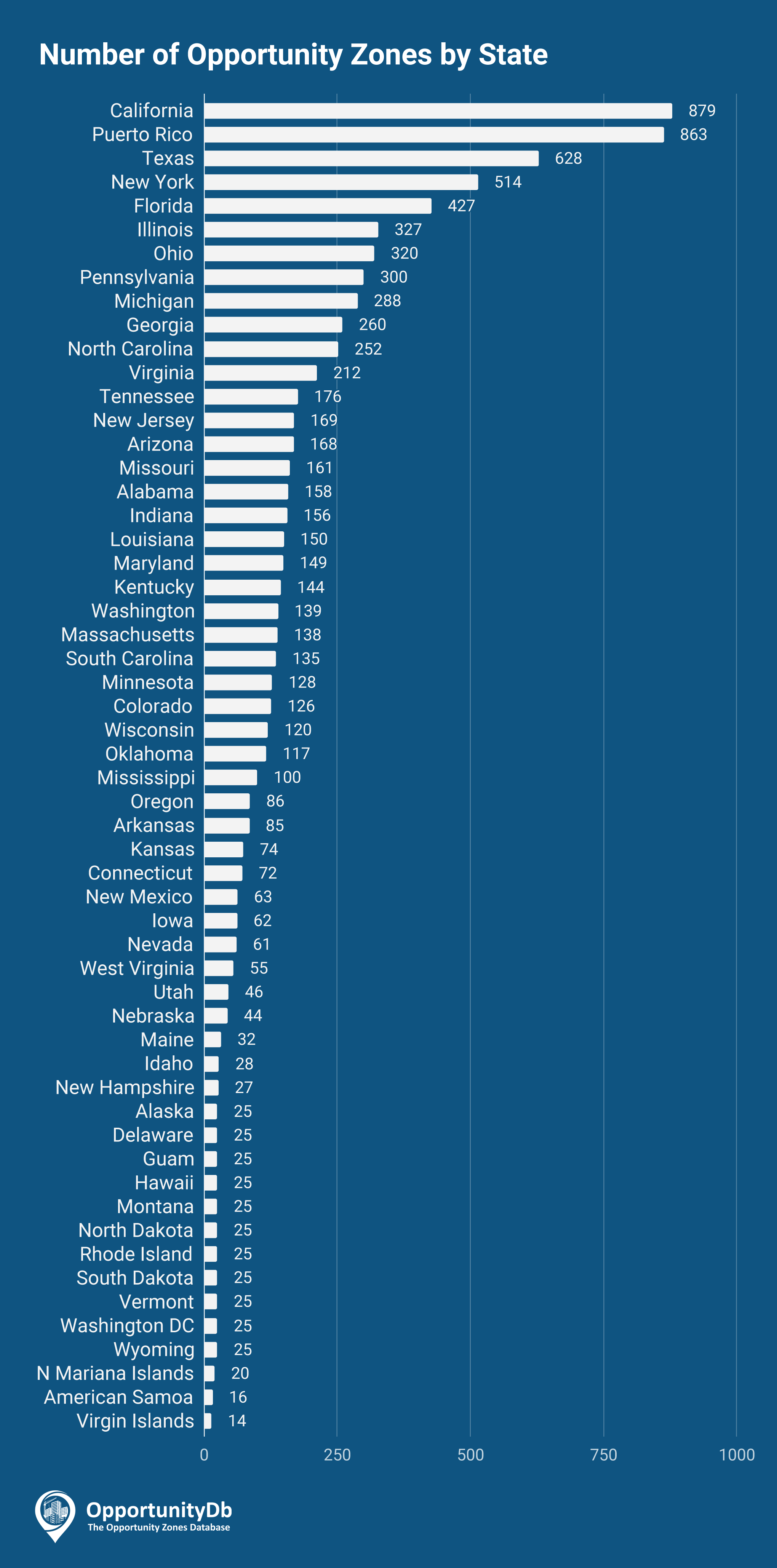

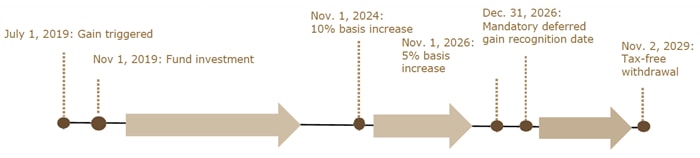

Opportunity Zones By Location Opportunitydb From opportunitydb.com

Opportunity Zones By Location Opportunitydb From opportunitydb.com

But thanks to the tax reform act that created them theyre on a fast track because of the programs timeline. Defer Gain Fund I. Opportunity zones have received a lot of attention since their inception in 2017 having raised an estimated 75 billion in capital by the end of 2019 through the 219 different qualified opportunity funds established as of Nov. Total Fund Size Authorized. Qualified opportunity zone funds allow individuals to roll gains from any capital asset into under-invested communities and defer the income taxes until Dec. A Qualified Opportunity Fund QOF is an entity that self-certifies that at least 90 of its assets are Qualified Opportunity Zone Property QOZP.

Opportunity zones have received a lot of attention since their inception in 2017 having raised an estimated 75 billion in capital by the end of 2019 through the 219 different qualified opportunity funds established as of Nov.

Detroit Ozone Investment Fund. The greatest share of the top scoring Opportunity Zones. The payment of your capital gains until December 31 2028. Opportunity zones have received a lot of attention since their inception in 2017 having raised an estimated 75 billion in capital by the end of 2019 through the 219 different qualified opportunity funds established as of Nov. First an investor can defer tax on any prior eligible gain to the extent that a corresponding amount is timely invested in a Qualified Opportunity Fund QOF. There are three primary advantages to rolling over a capital gain into a qualified Opportunity Zone Fund.

Source: longbeach.gov

Source: longbeach.gov

Detroit Ozone Investment Fund. QOZs are designed to spur economic development by providing tax incentives for investors who invest new capital in businesses operating in one or more QOZs. Opportunity zones have received a lot of attention since their inception in 2017 having raised an estimated 75 billion in capital by the end of 2019 through the 219 different qualified opportunity funds established as of Nov. Several Opportunity Funds and organizations have produced their top picks for Opportunity Zones. Fundrise 1 for example published its list of the top 10 Opportunity Zones in the country with more immediate growth potential.

Source: cremodels.com

Source: cremodels.com

Their unique approach is a product of founders deep experience in urban redevelopment capital markets and decades of cycle-tested commercial real estate experience. Partnerships or corporations can establish Opportunity Zone Funds and then invest in a property located within a Qualified Opportunity ZoneThese investment vehicles are designed to increase economic development and job creation in distressed communities as well as offer tax benefits to investors. First an investor can defer tax on any prior eligible gain to the extent that a corresponding amount is timely invested in a Qualified Opportunity Fund QOF. The developer RBH Group is one of the few funds that have actually gotten money in the ground. The greatest share of the top scoring Opportunity Zones.

Source: slc.gov

Source: slc.gov

A Qualified Opportunity Fund QOF is an entity that self-certifies that at least 90 of its assets are Qualified Opportunity Zone Property QOZP. Several Opportunity Funds and organizations have produced their top picks for Opportunity Zones. Detroit Real Estate Opportunity Fund I. Qualified Opportunity Zone investments are designed to be long-term. While the New York City metro area dominated across all product types office retail multi-family for the highest asking rents unexpected metro areas made it into the top 10 pportunity zones by product type.

Source: badermartin.com

Source: badermartin.com

Downtown and South Los Angeles. Opportunity Zone Funds are investment vehicles that provide tax incentives for investors. Detroit Real Estate Opportunity Fund I. QOZs are designed to spur economic development by providing tax incentives for investors who invest new capital in businesses operating in one or more QOZs. But thanks to the tax reform act that created them theyre on a fast track because of the programs timeline.

Source: opportunitydb.com

Source: opportunitydb.com

Derby RR OZ LP. The Top Opportunity Zone Catalysts. Find out how to defer capital gains taxes and earn higher returns with the right Opportunity Zone Funds. The payment of your capital gains until December 31 2028. Derby RR OZ LP.

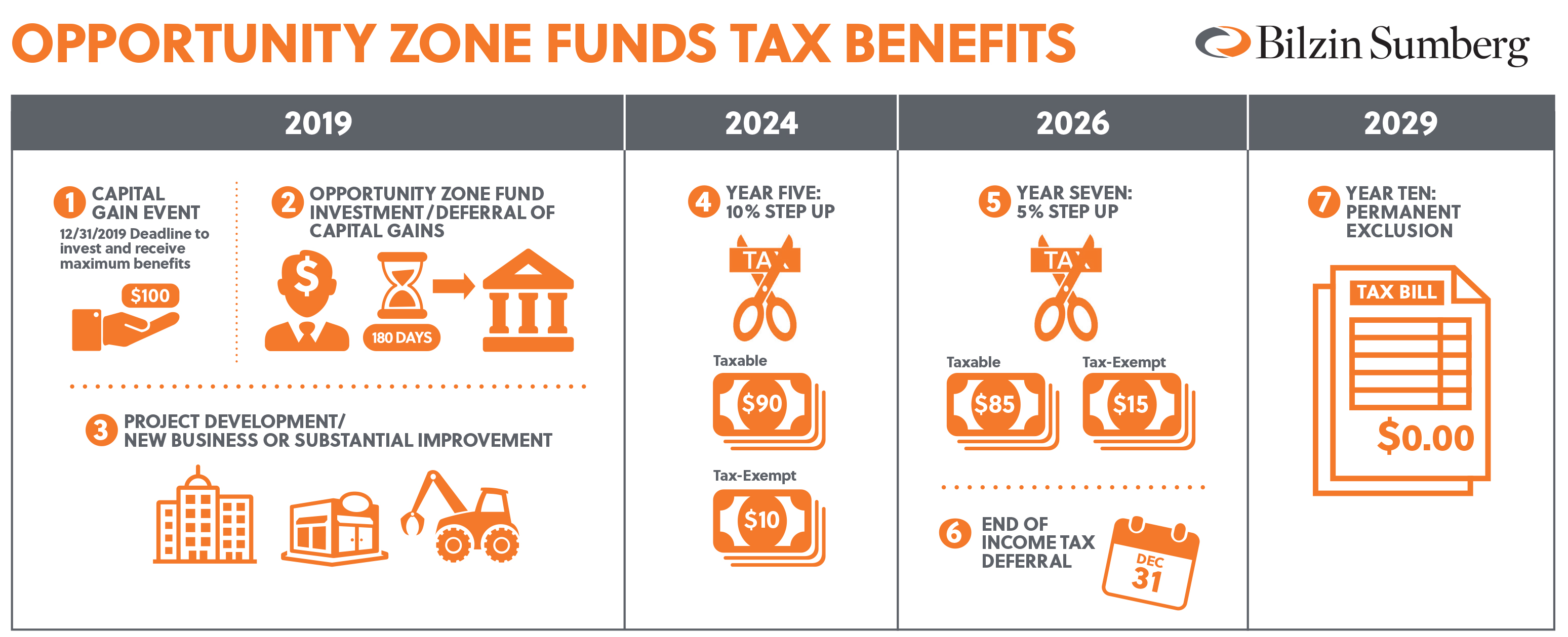

Source: kitces.com

Source: kitces.com

Qualified opportunity zone property consists either of direct investments in qualified opportunity zone business property QOZBP or indirect investments in qualified opportunity zone businesses. Qualified opportunity zone property consists either of direct investments in qualified opportunity zone business property QOZBP or indirect investments in qualified opportunity zone businesses. Qualified opportunity zone funds allow individuals to roll gains from any capital asset into under-invested communities and defer the income taxes until Dec. Defer Gain Fund I. 101 rows Golden Door Partners Opportunity Zone Fund.

Source: calbudgetcenter.org

Source: calbudgetcenter.org

If you have profits from the sale of almost any asset in the last six months eg stocks bonds a business commercial and residential real estate artwork cryptocurrency even baseball cards now is a good time to consider how you can reinvest the proceeds to reduce your capital. Opportunity zones have received a lot of attention since their inception in 2017 having raised an estimated 75 billion in capital by the end of 2019 through the 219 different qualified opportunity funds established as of Nov. Qualified opportunity zone funds allow individuals to roll gains from any capital asset into under-invested communities and defer the income taxes until Dec. While the New York City metro area dominated across all product types office retail multi-family for the highest asking rents unexpected metro areas made it into the top 10 pportunity zones by product type. Find out how to defer capital gains taxes and earn higher returns with the right Opportunity Zone Funds.

Source: opportunitydb.com

Source: opportunitydb.com

Defer Gain Fund I. Comprised of 10 trailblazing community organizations and 10 innovative OZ funds the Forbes OZ. We are debuting the Forbes OZ 20. The Top Opportunity Zone Catalysts. 101 rows Golden Door Partners Opportunity Zone Fund.

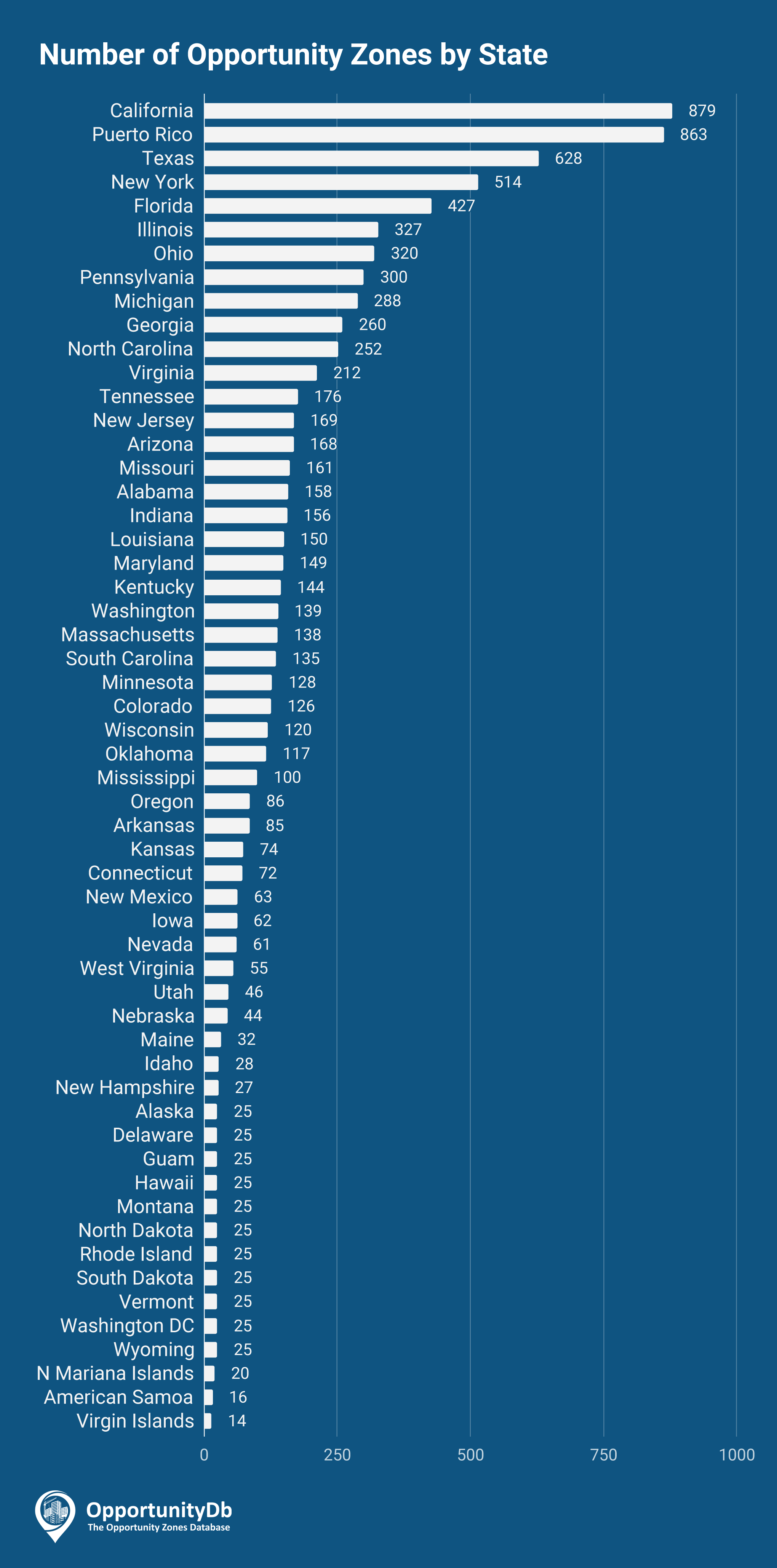

First an investor can defer tax on any prior eligible gain to the extent that a corresponding amount is timely invested in a Qualified Opportunity Fund QOF. A Qualified Opportunity Fund is any investment vehicle that is organized as a corporation or a partnership for the purpose of investing in Qualified Opportunity Zone property other than another Qualified Opportunity Fund that holds at least 90 of its assets in Qualified Opportunity Zone property. The top of the list found Gowanus in South Brooklyn going from having only 03 of households earning over 200000 in 2000 to 216 of households reaching that level 17 years later. Effective January 1 the benefit drops to 10 after 5 years. The payment of your capital gains until December 31 2028.

Source: bilzin.com

Source: bilzin.com

Opportunity zones have received a lot of attention since their inception in 2017 having raised an estimated 75 billion in capital by the end of 2019 through the 219 different qualified opportunity funds established as of Nov. Qualified opportunity zone funds allow individuals to roll gains from any capital asset into under-invested communities and defer the income taxes until Dec. Total Fund Stock Round A. Opportunity Zone Funds are investment vehicles that provide tax incentives for investors. Partnerships or corporations can establish Opportunity Zone Funds and then invest in a property located within a Qualified Opportunity ZoneThese investment vehicles are designed to increase economic development and job creation in distressed communities as well as offer tax benefits to investors.

Total Fund Stock Round A. Downtown and South Los Angeles. Deep Green One Energy Opportunity Fund. Qualified opportunity zone property consists either of direct investments in qualified opportunity zone business property QOZBP or indirect investments in qualified opportunity zone businesses. Fundrise 1 for example published its list of the top 10 Opportunity Zones in the country with more immediate growth potential.

Source: badermartin.com

Source: badermartin.com

We are debuting the Forbes OZ 20. According to Messing it made sense for Skybridge to offer an opportunity zone fund because the firm focuses on reducing volatility for investors. While the tax benefit of investing in or creating a qualified opportunity fund QOF may be appealing theres a lot to know about this avenue of investing. But thanks to the tax reform act that created them theyre on a fast track because of the programs timeline. West Oakland Uptown Jingletown and Coliseum Industrial.

Source: wellsfargo.com

Source: wellsfargo.com

Qualified Opportunity Zone investments are designed to be long-term. Their unique approach is a product of founders deep experience in urban redevelopment capital markets and decades of cycle-tested commercial real estate experience. 300 rows Decennial Opportunity Zone Fund I LLC. If you have profits from the sale of almost any asset in the last six months eg stocks bonds a business commercial and residential real estate artwork cryptocurrency even baseball cards now is a good time to consider how you can reinvest the proceeds to reduce your capital. West Oakland Uptown Jingletown and Coliseum Industrial.

Source: wheda.com

Source: wheda.com

There are three primary advantages to rolling over a capital gain into a qualified Opportunity Zone Fund. A Qualified Opportunity Fund QOF is an entity that self-certifies that at least 90 of its assets are Qualified Opportunity Zone Property QOZP. Defer Gain Fund I. Deep Green One Energy Opportunity Fund. A Qualified Opportunity Fund is any investment vehicle that is organized as a corporation or a partnership for the purpose of investing in Qualified Opportunity Zone property other than another Qualified Opportunity Fund that holds at least 90 of its assets in Qualified Opportunity Zone property.

Source: wheda.com

Source: wheda.com

There are three primary advantages to rolling over a capital gain into a qualified Opportunity Zone Fund. Effective January 1 the benefit drops to 10 after 5 years. Qualified Opportunity Zone investments are designed to be long-term. 300 rows Decennial Opportunity Zone Fund I LLC. Opportunity zones have received a lot of attention since their inception in 2017 having raised an estimated 75 billion in capital by the end of 2019 through the 219 different qualified opportunity funds established as of Nov.

Source: stessa.com

Source: stessa.com

Deep Green One Energy Opportunity Fund. While the tax benefit of investing in or creating a qualified opportunity fund QOF may be appealing theres a lot to know about this avenue of investing. If you have profits from the sale of almost any asset in the last six months eg stocks bonds a business commercial and residential real estate artwork cryptocurrency even baseball cards now is a good time to consider how you can reinvest the proceeds to reduce your capital. The greatest share of the top scoring Opportunity Zones. West Oakland Uptown Jingletown and Coliseum Industrial.

Source: badermartin.com

Source: badermartin.com

The payment of your capital gains until December 31 2028. REVIVE Qualified Opportunity Zone. Opportunity zones have received a lot of attention since their inception in 2017 having raised an estimated 75 billion in capital by the end of 2019 through the 219 different qualified opportunity funds established as of Nov. Detroit Real Estate Opportunity Fund I. According to Messing it made sense for Skybridge to offer an opportunity zone fund because the firm focuses on reducing volatility for investors.

Source: badermartin.com

Source: badermartin.com

According to Messing it made sense for Skybridge to offer an opportunity zone fund because the firm focuses on reducing volatility for investors. To qualify for the full tax break that QOZ investments offer participants must harvest their capital gains and reinvest them in a Qualified Opportunity Zone Fund by the last day of 2019. According to Messing it made sense for Skybridge to offer an opportunity zone fund because the firm focuses on reducing volatility for investors. Total Fund Size Authorized. Opportunity Zone Funds are just one way for wealthier investors to pay back their communities in a tangible way and the benefit of receiving referred and lowered taxes is an added bonus.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title best qualified opportunity zone funds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.