Your Emerging financial instruments exchange are ready. Emerging financial instruments are a news that is most popular and liked by everyone this time. You can Get the Emerging financial instruments files here. News all royalty-free bitcoin.

If you’re looking for emerging financial instruments pictures information related to the emerging financial instruments topic, you have pay a visit to the right blog. Our website frequently provides you with suggestions for viewing the highest quality video and picture content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

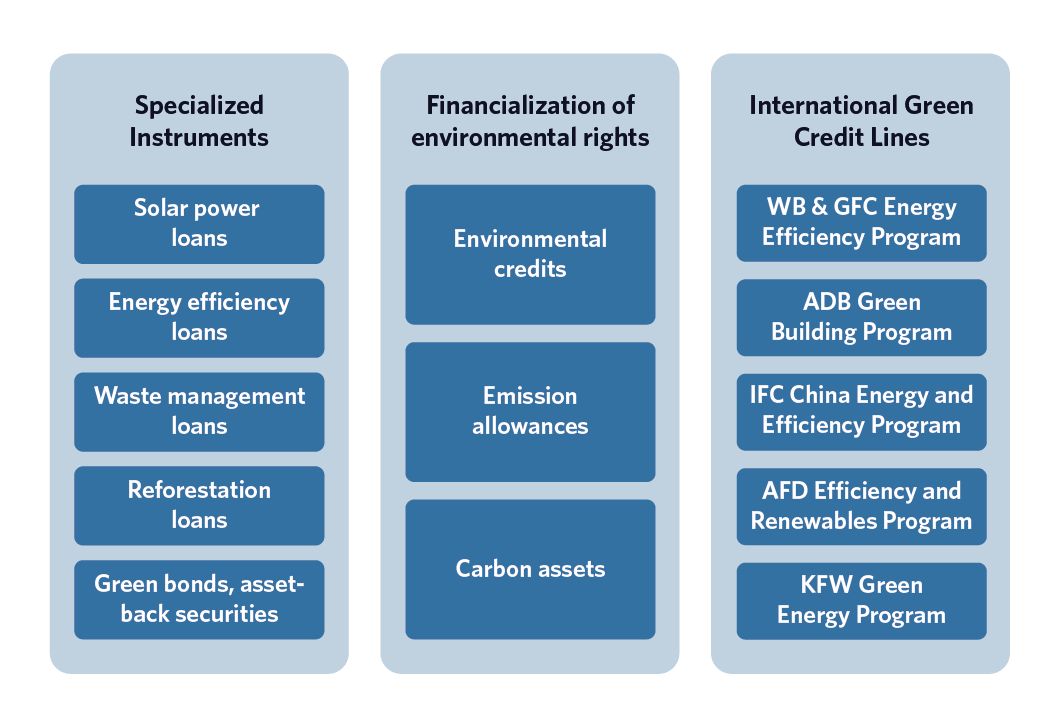

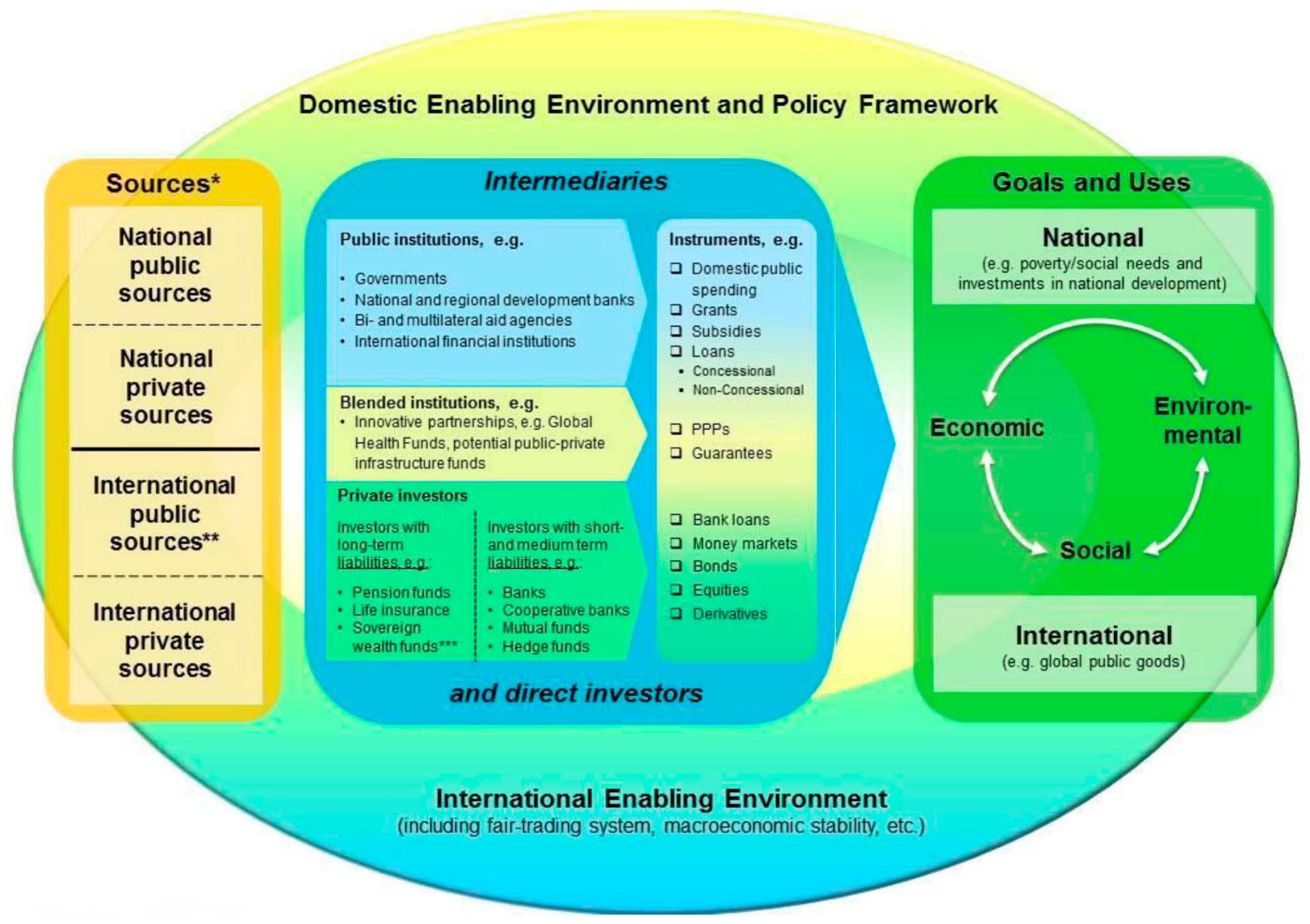

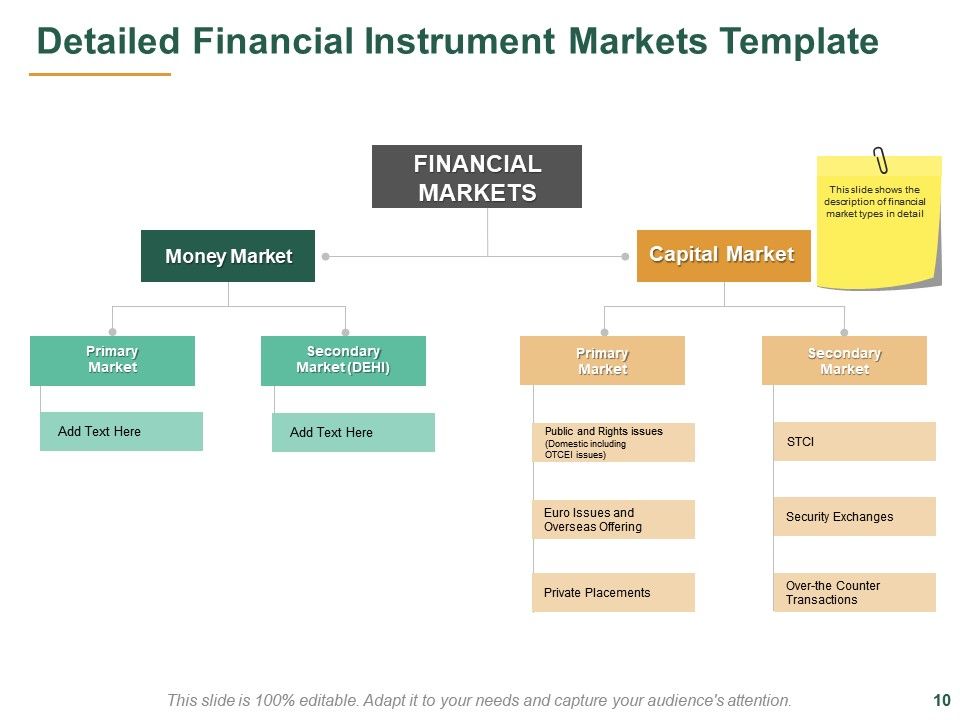

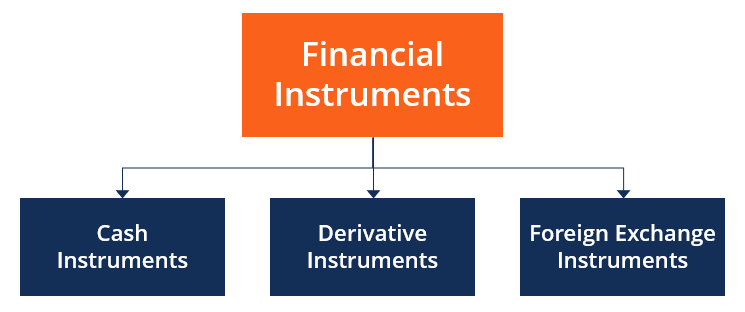

Emerging Financial Instruments. Financial Instruments for Small and Medium Enterprise Sustainable Growth. In the EU they typically range from conventional instruments such as subsidized loans to new or emerging models in the European market such as energy efficiency mortgages crowdfunding dedicated renovation saving accounts 2 and so on. New financial instruments such as floating rate bonds zero interest bonds deep discount bonds revolving underwriting finance facility auction rated debentures secured premium notes with detachable warrants non-convertible debentures with detachable equity warrants secured zero interest partly convertible debentures with detachable and separately tradable warrants fully convertible debentures. Financial instruments have several features such as level of seniority junior equity versus preferred stock the channel through which the flow of finance is arranged and the intermediary actors types of investors and investment vehicles terms of.

From climatepolicyinitiative.org

From climatepolicyinitiative.org

Scope 1 2 and 3 in high-emitting sectors increasing share of renewables improving energy. The Role of Financial Derivative Instruments in the Emerging Market Financial Crises of the Late 1990s. Since 2014 InnovFin aims to facilitate and accelerate access to finance for innovative businesses and entities in Europe. Efficiency lowering carbon intensity or refinancing existing debt part of the proceeds. Debit Cards at the Point of Sale POS The fastest growing number of electronic transactions today are debit card point-of-sale transactions. Decentralized finance DeFi is an emerging industry that promises to revolutionize the traditional finance sector.

In recent decade volatility of stocks and interest rates together with the globalization of capital markets increased the demand on financial instruments with the purpose of distribution of risks.

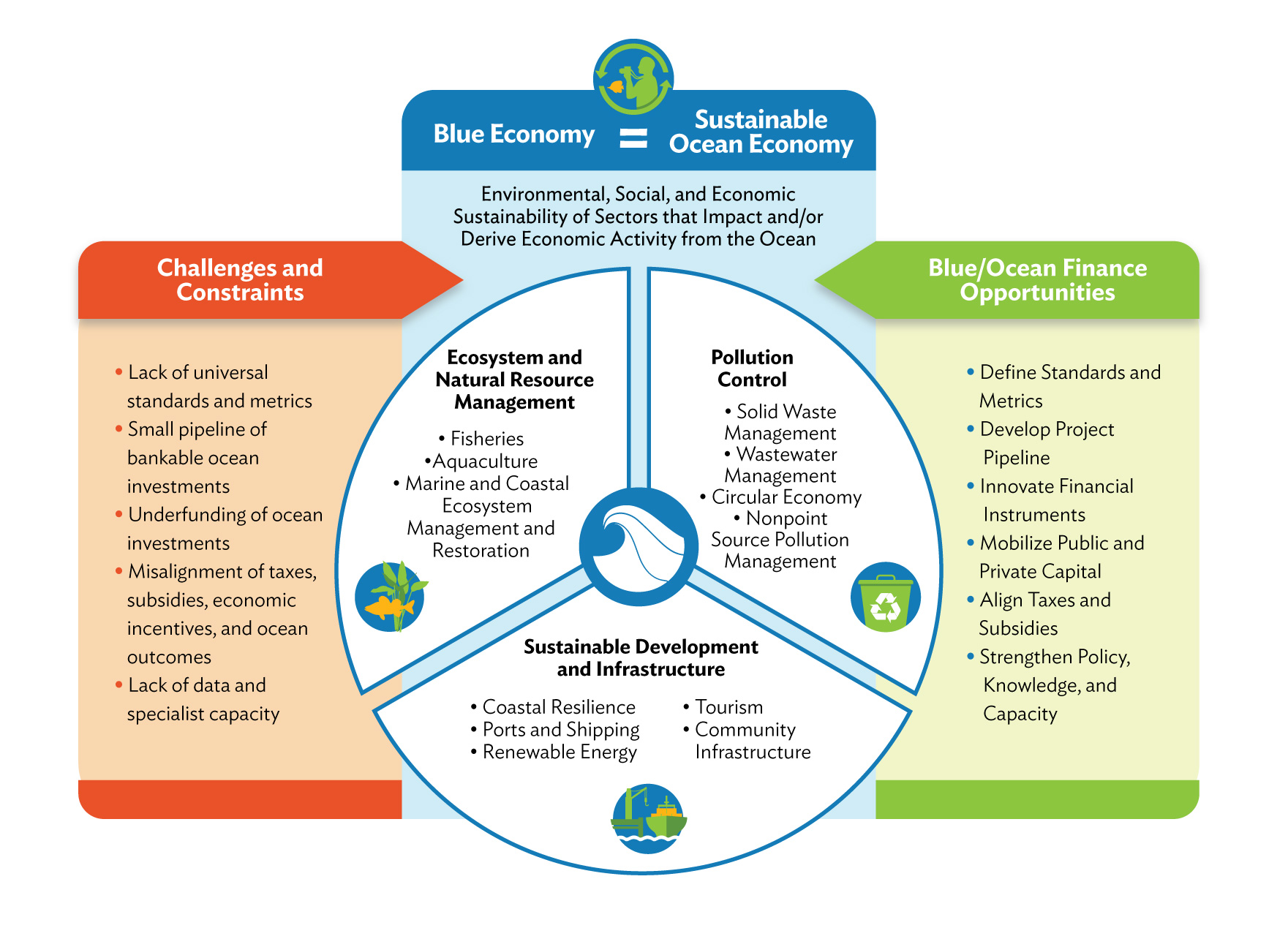

International financial instruments for biodiversity conservation in developing countries financial mechanisms and enabling policies for forest biodiversity Background paper 1for the European Report on Development 2015 Max Büge2 Karen Meijer3 and Heidi Wittmer4 2 Freie. Explore innovation opportunities in the major gap areas for SDG investments including new business and financing models reducing risk providing investment scale and matching the right risk-return profiles for institutional investors. Financial instruments have several features such as level of seniority junior equity versus preferred stock the channel through which the flow of finance is arranged and the intermediary actors types of investors and investment vehicles terms of. Decentralized finance DeFi is an emerging industry that promises to revolutionize the traditional finance sector. Hedging instruments in emerging market economies Sweta Saxena and Agustín Villar Introduction The financial crises of the 1990s in many emerging market economies EMEs created massive disruption and imposed huge costs of lost output on these economies1 One lesson. Scope 1 2 and 3 in high-emitting sectors increasing share of renewables improving energy.

Source: thkforum.org

Source: thkforum.org

Financial Instruments for Small and Medium Enterprise Sustainable Growth. Long-term emission goals and the nature of the low-emission transition in each country will be a function of its unique socio-economic priorities. With their increasingly sophisticated IT applications banks in the emerging economies use new financial instruments daily in their transactions. ECAs can be established by a single country government or several governments to act on their behalf. With only a decade left to reduce emissions drastically the scale pace and extent of global transformation needed is truly demanding.

Source: elibrary.imf.org

Source: elibrary.imf.org

Compared to 20 years ago when emerging economies typically had large liability positions in the form of bank debt and short-term bonds denominated in US dollars they now hold large asset positions in bonds and large liability positions in FDI and portfolio equities. The Role of Financial Derivative Instruments in the Emerging Market Financial Crises of the Late 1990s. While GEMC jurisdictions are at varying stages of progress in creating an enabling market environment for sustainable finance nearly two-thirds of those. Emerging markets are increasingly driving growth and innovation a range of through sustainable financing initiatives. They put a large part of their savings in physical assets such as real estate and gold and bank deposits.

Source: mdpi.com

Source: mdpi.com

With only a decade left to reduce emissions drastically the scale pace and extent of global transformation needed is truly demanding. The estimation of the role of financial derivatives instruments is very important for the stability of international financial system. With their increasingly sophisticated IT applications banks in the emerging economies use new financial instruments daily in their transactions. To meet this challenge there is a need to substantially increase the sources of public and private sector funding爀屲However weഠassume that the public sector will continue to invest roughly the same share of GDP as currently at about 25 of overall needs對爀屲This means that private funding will need to grow to about 300 of current levels爀屲However for this funding need to be ach൩evable it is. Decentralized finance DeFi is an emerging industry that promises to revolutionize the traditional finance sector.

Source: slideteam.net

Source: slideteam.net

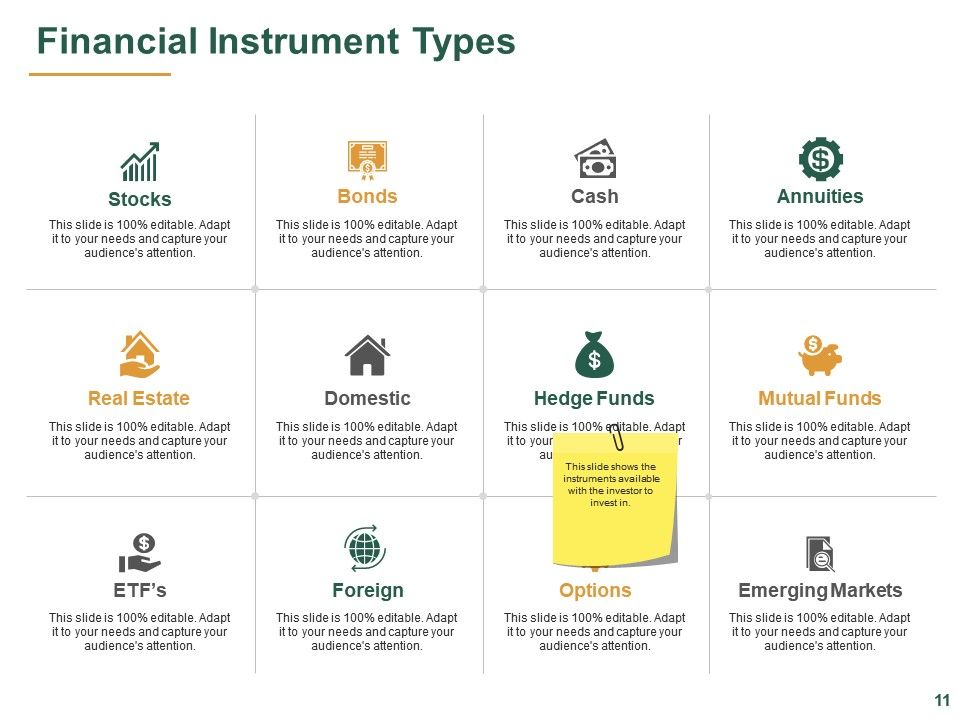

Emerging Markets ETFs are among the hottest financial instruments when it comes to portfolio diversification. Financing is a key issue for companies to grow. You are not permitted to use for reference any data in this document for the purpose of i determining the interest payable or other sums due under loan agreements or under other financial contracts or instruments ii determining the price at which a financial instrument may be bought or sold or traded or redeemed or the value of a financial instrument andor iii measuring the performance of. In recent decade volatility of stocks and interest rates together with the globalization of capital markets increased the demand on financial instruments with the purpose of distribution of risks. Export credit agencies ECAs or investment insurance agencies provide financing instruments to domestic companies that engage in export operations.

Source: thkforum.org

Source: thkforum.org

The Mexican Case Ayca Sarialioglu Hayali Karadeniz Technical University Turkey Although derivatives were developed for the treatment of some diseases such as risks and volatilities ironically as experienced in the 1990s they. Debit Cards at the Point of Sale POS The fastest growing number of electronic transactions today are debit card point-of-sale transactions. International financial instruments for biodiversity conservation in developing countries financial mechanisms and enabling policies for forest biodiversity Background paper 1for the European Report on Development 2015 Max Büge2 Karen Meijer3 and Heidi Wittmer4 2 Freie. With their increasingly sophisticated IT applications banks in the emerging economies use new financial instruments daily in their transactions. Several other electronic payment systems are currently being prototyped and tested.

Source: slideteam.net

Source: slideteam.net

Efficiency lowering carbon intensity or refinancing existing debt part of the proceeds. Debit Cards at the Point of Sale POS The fastest growing number of electronic transactions today are debit card point-of-sale transactions. InnovFin EU Finance for Innovators is an initiative launched by the European Investment Bank Group EIB and EIF in cooperation with the European Commission under Horizon 2020 the EU Research and Innovation programme for the budgetary period 2014-2020. Compared to 20 years ago when emerging economies typically had large liability positions in the form of bank debt and short-term bonds denominated in US dollars they now hold large asset positions in bonds and large liability positions in FDI and portfolio equities. ECAs can be established by a single country government or several governments to act on their behalf.

Source: slideplayer.com

Source: slideplayer.com

Hedging instruments in emerging market economies Sweta Saxena and Agustín Villar Introduction The financial crises of the 1990s in many emerging market economies EMEs created massive disruption and imposed huge costs of lost output on these economies1 One lesson. They put a large part of their savings in physical assets such as real estate and gold and bank deposits. Debit Cards at the Point of Sale POS The fastest growing number of electronic transactions today are debit card point-of-sale transactions. Long-term emission goals and the nature of the low-emission transition in each country will be a function of its unique socio-economic priorities. Compared to 20 years ago when emerging economies typically had large liability positions in the form of bank debt and short-term bonds denominated in US dollars they now hold large asset positions in bonds and large liability positions in FDI and portfolio equities.

The Mexican Case Ayca Sarialioglu Hayali Karadeniz Technical University Turkey Although derivatives were developed for the treatment of some diseases such as risks and volatilities ironically as experienced in the 1990s they. Emerging Markets ETFs are among the hottest financial instruments when it comes to portfolio diversification. The need for an open transparent and. Decentralized finance DeFi is an emerging industry that promises to revolutionize the traditional finance sector. InnovFin EU Finance for Innovators is an initiative launched by the European Investment Bank Group EIB and EIF in cooperation with the European Commission under Horizon 2020 the EU Research and Innovation programme for the budgetary period 2014-2020.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Capital raised may be used for on-lending financing or refinancing projects that lower emissions. With their increasingly sophisticated IT applications banks in the emerging economies use new financial instruments daily in their transactions. Explore innovation opportunities in the major gap areas for SDG investments including new business and financing models reducing risk providing investment scale and matching the right risk-return profiles for institutional investors. The Role of Financial Derivative Instruments in the Emerging Market Financial Crises of the Late 1990s. ECAs can be established by a single country government or several governments to act on their behalf.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

While GEMC jurisdictions are at varying stages of progress in creating an enabling market environment for sustainable finance nearly two-thirds of those. Financial Instruments for Small and Medium Enterprise Sustainable Growth. Efficiency lowering carbon intensity or refinancing existing debt part of the proceeds. International financial instruments for biodiversity conservation in developing countries financial mechanisms and enabling policies for forest biodiversity Background paper 1for the European Report on Development 2015 Max Büge2 Karen Meijer3 and Heidi Wittmer4 2 Freie. With only a decade left to reduce emissions drastically the scale pace and extent of global transformation needed is truly demanding.

Source: proschoolonline.com

Source: proschoolonline.com

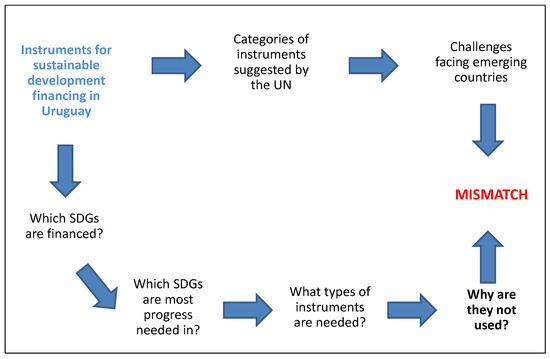

Map current and emerging SDG finance instruments and help in the development of new innovative financing solutions. They have relatively higher volatility compared to other market-cap ETFs and larger liquidity than most of their constituents. Several other electronic payment systems are currently being prototyped and tested. Since 2014 InnovFin aims to facilitate and accelerate access to finance for innovative businesses and entities in Europe. Map current and emerging SDG finance instruments and help in the development of new innovative financing solutions.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

The impact of derivatives upon International Financial Crises. A stocktake of emerging approaches and financial instruments. To meet this challenge there is a need to substantially increase the sources of public and private sector funding爀屲However weഠassume that the public sector will continue to invest roughly the same share of GDP as currently at about 25 of overall needs對爀屲This means that private funding will need to grow to about 300 of current levels爀屲However for this funding need to be ach൩evable it is. While GEMC jurisdictions are at varying stages of progress in creating an enabling market environment for sustainable finance nearly two-thirds of those. Decentralized finance DeFi is an emerging industry that promises to revolutionize the traditional finance sector.

Source: slideteam.net

Source: slideteam.net

Financial instruments have several features such as level of seniority junior equity versus preferred stock the channel through which the flow of finance is arranged and the intermediary actors types of investors and investment vehicles terms of. Investors in emerging markets face similar challenges. The Role of Financial Derivative Instruments in the Emerging Market Financial Crises of the Late 1990s. The Mexican Case Ayca Sarialioglu Hayali Karadeniz Technical University Turkey Although derivatives were developed for the treatment of some diseases such as risks and volatilities ironically as experienced in the 1990s they. OTHER EMERGING FINANCIAL INSTRUMENTS.

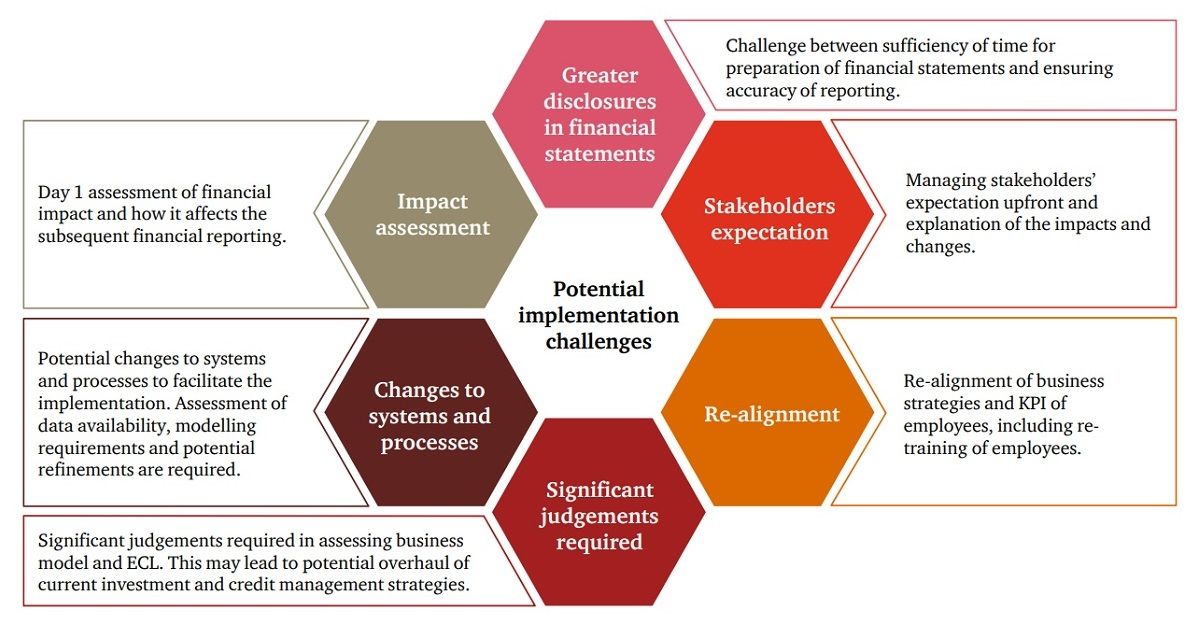

Source: pwc.com

Source: pwc.com

The limited investments in financial assets are mostly in government bonds AAA-rated corporate bonds and equities. The Role of Financial Derivative Instruments in the Emerging Market Financial Crises of the Late 1990s. The limited investments in financial assets are mostly in government bonds AAA-rated corporate bonds and equities. Financial instruments have several features such as level of seniority junior equity versus preferred stock the channel through which the flow of finance is arranged and the intermediary actors types of investors and investment vehicles terms of. They have relatively higher volatility compared to other market-cap ETFs and larger liquidity than most of their constituents.

Source: development.asia

Source: development.asia

Hedging instruments in emerging market economies Sweta Saxena and Agustín Villar Introduction The financial crises of the 1990s in many emerging market economies EMEs created massive disruption and imposed huge costs of lost output on these economies1 One lesson. Investors in emerging markets face similar challenges. In recent decade volatility of stocks and interest rates together with the globalization of capital markets increased the demand on financial instruments with the purpose of distribution of risks. In Latin America small and medium enterprises face difficult challenges when trying to get the necessary. Export credit agencies ECAs or investment insurance agencies provide financing instruments to domestic companies that engage in export operations.

Source: mdpi.com

Source: mdpi.com

With only a decade left to reduce emissions drastically the scale pace and extent of global transformation needed is truly demanding. International financial instruments for biodiversity conservation in developing countries financial mechanisms and enabling policies for forest biodiversity Background paper 1for the European Report on Development 2015 Max Büge2 Karen Meijer3 and Heidi Wittmer4 2 Freie. They have relatively higher volatility compared to other market-cap ETFs and larger liquidity than most of their constituents. Their banking systems and financial markets are thus. Emerging Markets ETFs are among the hottest financial instruments when it comes to portfolio diversification.

Source: emerald.com

Source: emerald.com

With only a decade left to reduce emissions drastically the scale pace and extent of global transformation needed is truly demanding. With their increasingly sophisticated IT applications banks in the emerging economies use new financial instruments daily in their transactions. Financial Instruments for Small and Medium Enterprise Sustainable Growth. OTHER EMERGING FINANCIAL INSTRUMENTS. InnovFin EU Finance for Innovators is an initiative launched by the European Investment Bank Group EIB and EIF in cooperation with the European Commission under Horizon 2020 the EU Research and Innovation programme for the budgetary period 2014-2020.

Source: mdpi.com

Source: mdpi.com

The limited investments in financial assets are mostly in government bonds AAA-rated corporate bonds and equities. Decentralized finance DeFi is an emerging industry that promises to revolutionize the traditional finance sector. Emerging markets are increasingly driving growth and innovation a range of through sustainable financing initiatives. The need for an open transparent and. A stocktake of emerging approaches and financial instruments.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title emerging financial instruments by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.