Your Emerging market crisis trading are ready in this website. Emerging market crisis are a news that is most popular and liked by everyone now. You can News the Emerging market crisis files here. Get all free wallet.

If you’re looking for emerging market crisis pictures information connected with to the emerging market crisis topic, you have come to the ideal site. Our website always provides you with hints for viewing the maximum quality video and image content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

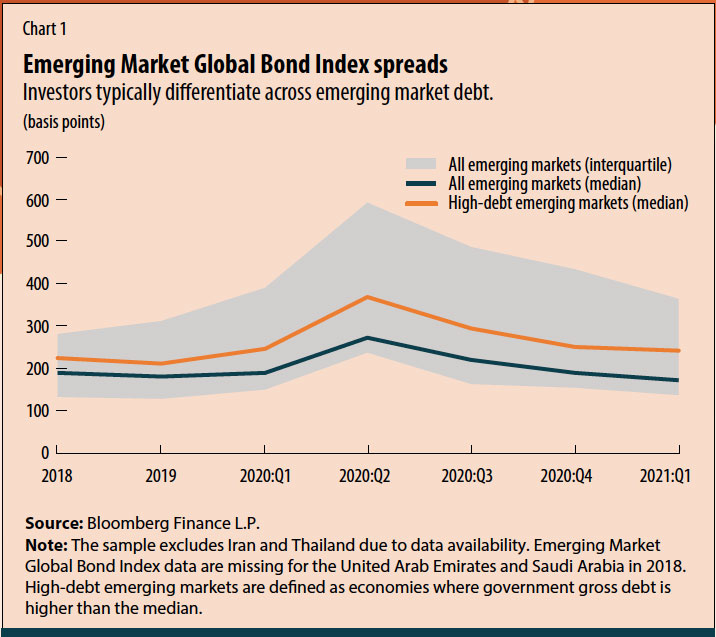

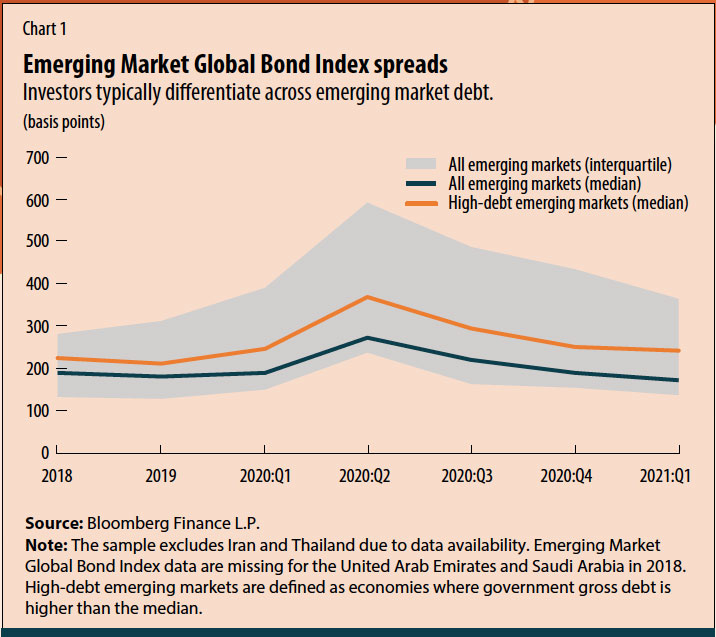

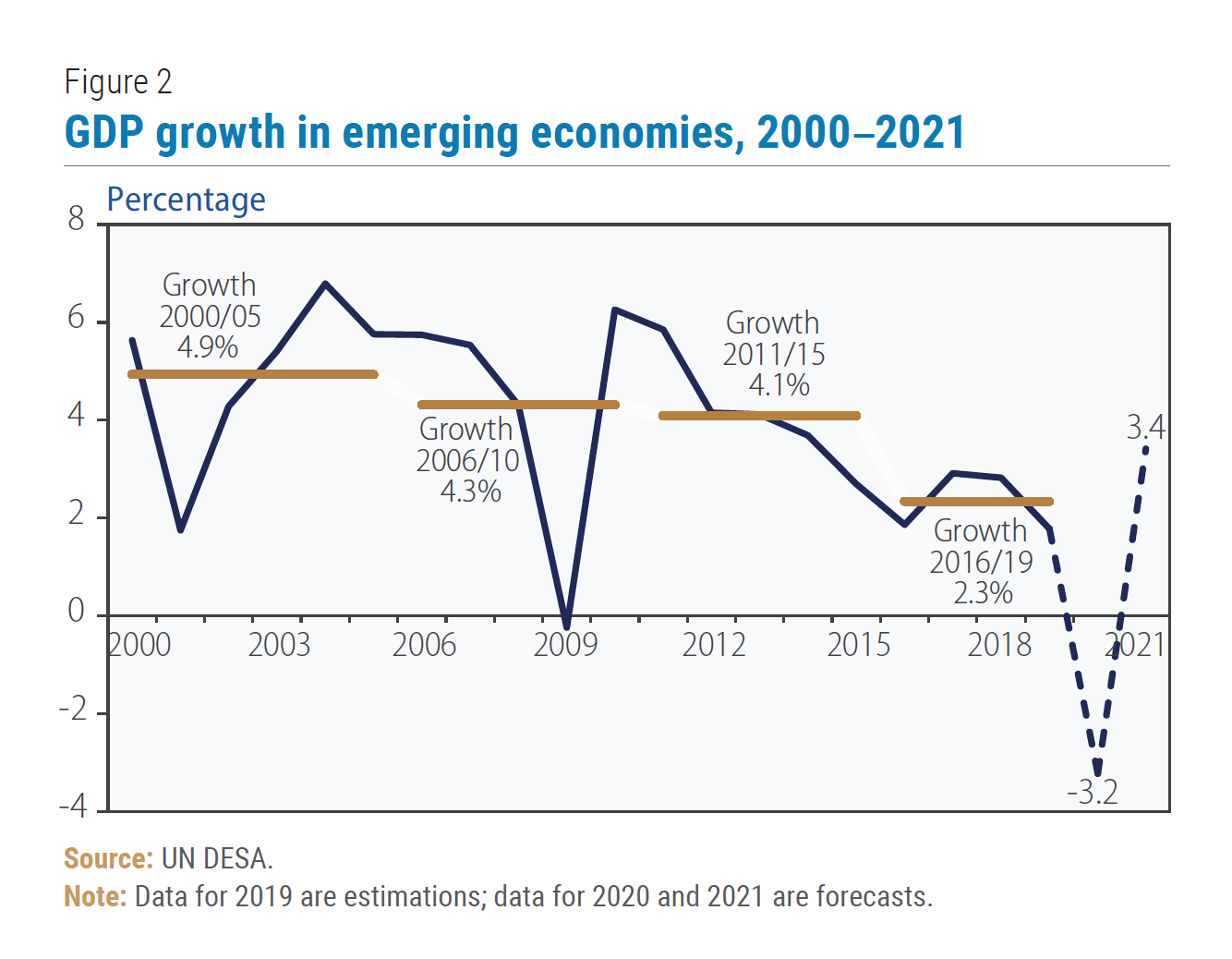

Emerging Market Crisis. Lessons of the Asian crisis. When global crises unfold foreign investors typically pull out capital from emerging markets either in defense or to deploy invest that capital into their home countries during unfolding domestic crises. Using a sample of around 50 emerging market economies the impact of the crisis is measured along several dimensions including the actual decline in quarterly growth the decline in stock markets the rise in sovereign spreads and the decline in credit growth. China is a major trade destination for emerging markets which is why an energy crunch in the country coupled with a burgeoning debt crisis in its real estate sector has hurt sentiment in recent.

Miles To Go The Future Of Emerging Markets Imf F D From imf.org

Miles To Go The Future Of Emerging Markets Imf F D From imf.org

Emerging markets are mostly based in South East Asia excluding Japan and Latin America. When global crises unfold foreign investors typically pull out capital from emerging markets either in defense or to deploy invest that capital into their home countries during unfolding domestic crises. The risk sensitivity of capital flows in and out of emerging markets compounds the impact of COVID-19. Heterogeneous experience across EMs. COVID-19 has yet to hit most emerging-market economies EMEs to the extent it has affected the European Union and the United States. 000 2251.

Emerging markets are thus starved for liquidity which further amplifies the drawdowns that were initially set in motion by the global crisis.

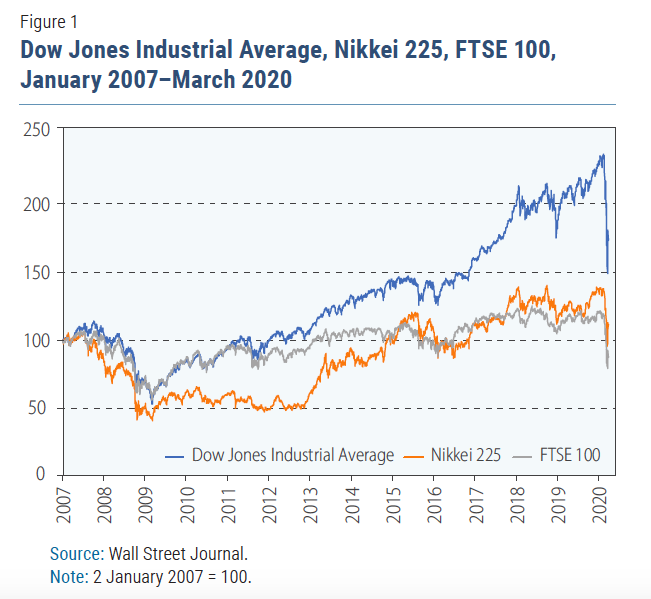

Using a sample of around 50 emerging market economies the impact of the crisis is measured along several dimensions including the actual decline in quarterly growth the decline in stock markets the rise in sovereign spreads and the decline in credit growth. The world should be ready for an emerging market debt crisis as the global economy emerges from the coronavirus pandemic and interest rates rise drawing capital away from vulnerable countries. China India Brazil Mexico. Despite overly optimistic views from promoters like the World Bank 100 invested in EM equities in 1989 would be worth 1450 today compared to nearly 2000 if invested in the SP 500. Although policymakers in emerging markets can take certain stepssuch as reducing expectations of bailouts and improving transparency in government decision making and the operation of the banking and corporate sectorsto help investors make informed choices volatile capital flows are not peculiar to emerging markets and it is unrealistic to think that they will ever be. Rudi Dornbusch the late MIT economist famously said that when it came to emerging market economies crises take a lot longer to happen than you think they will.

Source: imf.org

Source: imf.org

Among all the emerging currencies the Turkish lira has been the hardest hit apart from the Argentinian peso by the sell-off that. As per the International Monetary Fund IMF emerging markets and developing economies will likely see slower growth in 2015 for the fifth consecutive year with deep recession in Brazil and Russia. The world should be ready for an emerging market debt crisis as the global economy emerges from the coronavirus pandemic and interest rates rise drawing capital away from vulnerable countries. Emerging markets crisis. We analyzed historical crisis occurrence and found that on average there are 43 crises unfolding at any given time in our target EM markets.

Source: focus-economics.com

Source: focus-economics.com

Emerging markets are defined as economies which are making the transition from a low income developing economy to a high income developed economy. The Effects of Productivity Shocks Financial Shocks and Monetary Policy on Exchange Rates. Emerging-market currencies got a glimpse of the Treasury-led turbulence last week when they posted the biggest loss since July 9 as the two-year yield jumped. However when they do happen they do so faster than you thought they could. COVID-19 has yet to hit most emerging-market economies EMEs to the extent it has affected the European Union and the United States.

Source: imf.org

Source: imf.org

In the large emerging markets of the world economythe likes of Brazil Argentina sub-Saharan Africa India Thailand and. Key emerging markets include. As does whether the external debt is held by. Lessons of the Asian crisis. Emerging-market currencies got a glimpse of the Treasury-led turbulence last week when they posted the biggest loss since July 9 as the two-year yield jumped.

Source: ft.com

Source: ft.com

Nov 22 Reuters - Emerging market shares fell for a fourth straight session on Monday as rising COVID-19 cases in Europe and some hawkish comments from the. In the large emerging markets of the world economythe likes of Brazil Argentina sub-Saharan Africa India Thailand and. Rudi Dornbusch the late MIT economist famously said that when it came to emerging market economies crises take a lot longer to happen than you think they will. Lessons of the Asian crisis. Despite overly optimistic views from promoters like the World Bank 100 invested in EM equities in 1989 would be worth 1450 today compared to nearly 2000 if invested in the SP 500.

Source: voxeu.org

Source: voxeu.org

The risk sensitivity of capital flows in and out of emerging markets compounds the impact of COVID-19. When global crises unfold foreign investors typically pull out capital from emerging markets either in defense or to deploy invest that capital into their home countries during unfolding domestic crises. Among all the emerging currencies the Turkish lira has been the hardest hit apart from the Argentinian peso by the sell-off that. As does whether the external debt is held by. The Turkish crisis.

Source: pinterest.com

Source: pinterest.com

The latest data from the Institute of International Finance shows that debt in emerging markets including China increased from 9 trillion in 2002 to 21 trillion in 2007 and finally to 63. The pain could deepen if key economic data including Chinas industrial production and South African consumer prices confirm forecasts for a worsening macro picture. When global crises unfold foreign investors typically pull out capital from emerging markets either in defense or to deploy invest that capital into their home countries during unfolding domestic crises. Key emerging markets include. China India Brazil Mexico.

Source: imf.org

Source: imf.org

Emerging markets are thus starved for liquidity which further amplifies the drawdowns that were initially set in motion by the global crisis. The issues relating to world GDP growth was the sharpest at 42 per cent during global economic crises and its impact on emerging market the third quarter of 2008 to the second quarter of 2009. China India Brazil Mexico. Emerging markets crisis. Emerging-market currencies are close to erasing their gains for the year as geopolitical risks in Eastern Europe rising Covid-19 cases and a stronger dollar quash investor appetite for risk.

Source: un.org

Source: un.org

An Application of the Currency Crisis Model and Implications for Emerging Market Crises Emerging Markets Finance and Trade Taylor Francis Journals vol. China India Brazil Mexico. Using a sample of around 50 emerging market economies the impact of the crisis is measured along several dimensions including the actual decline in quarterly growth the decline in stock markets the rise in sovereign spreads and the decline in credit growth. In the West it was the virus that triggered the financial crisis. Emerging markets are thus starved for liquidity which further amplifies the drawdowns that were initially set in motion by the global crisis.

Source: pinterest.com

Source: pinterest.com

Emerging markets are thus starved for liquidity which further amplifies the drawdowns that were initially set in motion by the global crisis. We wanted to ensure that on average we are always invested in a no-crisis instrument to diversify EM risk and therefore propose a maximum equal-weighted portfolio allocation of 15 to a single country in crisis with the remainder allocated to 10Y. The Effects of Productivity Shocks Financial Shocks and Monetary Policy on Exchange Rates. The latest data from the Institute of International Finance shows that debt in emerging markets including China increased from 9 trillion in 2002 to 21 trillion in 2007 and finally to 63. Emerging markets are defined as economies which are making the transition from a low income developing economy to a high income developed economy.

Source: un.org

Source: un.org

However when they do happen they do so faster than you thought they could. Nevertheless the incipient global recession and widespread market contagion have already resulted in substantial deterioration in EME macroeconomic and financial indicators. Despite overly optimistic views from promoters like the World Bank 100 invested in EM equities in 1989 would be worth 1450 today compared to nearly 2000 if invested in the SP 500. The risk sensitivity of capital flows in and out of emerging markets compounds the impact of COVID-19. We analyzed historical crisis occurrence and found that on average there are 43 crises unfolding at any given time in our target EM markets.

Source: blogs.imf.org

Source: blogs.imf.org

Emerging-market currencies are close to erasing their gains for the year as geopolitical risks in Eastern Europe rising Covid-19 cases and a stronger dollar quash investor appetite for risk. The latest data from the Institute of International Finance shows that debt in emerging markets including China increased from 9 trillion in 2002 to 21 trillion in 2007 and finally to 63. When global crises unfold foreign investors typically pull out capital from emerging markets either in defense or to deploy invest that capital into their home countries during unfolding domestic crises. Emerging markets history of high volatility and low returns has hardly been attractive for investors. Emerging markets crisis.

Source: ecb.europa.eu

Source: ecb.europa.eu

Emerging markets are thus starved for liquidity which further amplifies the drawdowns that were initially set in motion by the global crisis. Emerging Markets Crisis Investing. Emerging markets are mostly based in South East Asia excluding Japan and Latin America. We wanted to ensure that on average we are always invested in a no-crisis instrument to diversify EM risk and therefore propose a maximum equal-weighted portfolio allocation of 15 to a single country in crisis with the remainder allocated to 10Y. The Turkish crisis.

Source: ar.pinterest.com

Source: ar.pinterest.com

China is a major trade destination for emerging markets which is why an energy crunch in the country coupled with a burgeoning debt crisis in its real estate sector has hurt sentiment in recent. The Effects of Productivity Shocks Financial Shocks and Monetary Policy on Exchange Rates. Nevertheless the incipient global recession and widespread market contagion have already resulted in substantial deterioration in EME macroeconomic and financial indicators. In the large emerging markets of the world economythe likes of Brazil Argentina sub-Saharan Africa India Thailand and. When global crises unfold foreign investors typically pull out capital from emerging markets either in defense or to deploy invest that capital into their home countries during unfolding domestic crises.

Source: elibrary.imf.org

Source: elibrary.imf.org

However when they do happen they do so faster than you thought they could. China is a major trade destination for emerging markets which is why an energy crunch in the country coupled with a burgeoning debt crisis in its real estate sector has hurt sentiment in recent. The world should be ready for an emerging market debt crisis as the global economy emerges from the coronavirus pandemic and interest rates rise drawing capital away from vulnerable countries. To account for initial conditions and pre-crisis. Heterogeneous experience across EMs.

Source: voxeu.org

Source: voxeu.org

Emerging-market currencies got a glimpse of the Treasury-led turbulence last week when they posted the biggest loss since July 9 as the two-year yield jumped. Emerging markets crisis. Lessons of the Asian crisis. Heterogeneous experience across EMs. We analyzed historical crisis occurrence and found that on average there are 43 crises unfolding at any given time in our target EM markets.

Source: focus-economics.com

Source: focus-economics.com

The Turkish crisis. Emerging-market currencies got a glimpse of the Treasury-led turbulence last week when they posted the biggest loss since July 9 as the two-year yield jumped. In the West it was the virus that triggered the financial crisis. Emerging markets like the BRICS countries have been hit hard by the coronavirus pandemic. Key emerging markets include.

Source: voxeu.org

Source: voxeu.org

Nevertheless the incipient global recession and widespread market contagion have already resulted in substantial deterioration in EME macroeconomic and financial indicators. Although policymakers in emerging markets can take certain stepssuch as reducing expectations of bailouts and improving transparency in government decision making and the operation of the banking and corporate sectorsto help investors make informed choices volatile capital flows are not peculiar to emerging markets and it is unrealistic to think that they will ever be. When global crises unfold foreign investors typically pull out capital from emerging markets either in defense or to deploy invest that capital into their home countries during unfolding domestic crises. The world should be ready for an emerging market debt crisis as the global economy emerges from the coronavirus pandemic and interest rates rise drawing capital away from vulnerable countries. The combination of a health crisis capital flow reversal a demand and supply shock and exchange rate crisis has created severe implications for emerging markets.

Source: bworldonline.com

Source: bworldonline.com

The combination of a health crisis capital flow reversal a demand and supply shock and exchange rate crisis has created severe implications for emerging markets. The pain could deepen if key economic data including Chinas industrial production and South African consumer prices confirm forecasts for a worsening macro picture. China is a major trade destination for emerging markets which is why an energy crunch in the country coupled with a burgeoning debt crisis in its real estate sector has hurt sentiment in recent. The combination of a health crisis capital flow reversal a demand and supply shock and exchange rate crisis has created severe implications for emerging markets. Using a sample of around 50 emerging market economies the impact of the crisis is measured along several dimensions including the actual decline in quarterly growth the decline in stock markets the rise in sovereign spreads and the decline in credit growth.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title emerging market crisis by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.