Your Exchange rate volatility index trading are available in this site. Exchange rate volatility index are a exchange that is most popular and liked by everyone now. You can Get the Exchange rate volatility index files here. Get all free trading.

If you’re looking for exchange rate volatility index images information connected with to the exchange rate volatility index keyword, you have come to the right blog. Our site always gives you hints for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

Exchange Rate Volatility Index. An emerging economy the macroeconomics variables ie. The exchange rate volatility risk was also relatively low for the majority of EU 10 frontier markets since 200405 when seven countries became members of Exchange Rate Mechanism ERM II and agreed to peg their currencies to the euro with the further aim of becoming eurozone members and adopting the euro as their currency. It is calculated and disseminated on a real-time basis by the CBOE and is often referred to as. The IDRUSD volatility during January-March 2018 was the lowest compared to the currencies of high-risk countries fragile five and in the ASEAN region.

How To Measure Volatility In Forex Babypips Com From babypips.com

How To Measure Volatility In Forex Babypips Com From babypips.com

It is calculated and disseminated on a real-time basis by the CBOE and is often referred to as. Price Index ASPI of Colombo Stock Exchange CSE and the daily exchange rate values of US Dollar Euro and British Pound for a period of six years from 05 January 2010 to 31 December 2015. Implied volatility for currency crosses will generally be higher than the implied volatility of the majors. Exchange rate volatility refers to the tendency for foreign currencies to appreciate or depreciate in value thus affecting the profitability of foreign exchange trades. Is 15 Mexican pesos is 13 Turkish lira is 88 Russian ruble is 14 South. An emerging economy the macroeconomics variables ie.

According to Yakub et al.

Rupiah volatility is around 8 while Brazilian real volatility. The literature has applied various kinds of variables for exchange rate volatility volatility. The industrial production index IPI of the EA-11 countries the IPI for Mexico the nominal exchange rate between the two currencies the consumer price index CPI in. It is calculated and disseminated on a real-time basis by the CBOE and is often referred to as. From the stuff in our shopping carts to the cars in our driveways to the gadgets in our. Exchange rate volatility refers to the tendency for foreign currencies to appreciate or depreciate in value thus affecting the profitability of foreign exchange trades.

Source: daytrading.com

Source: daytrading.com

The literature has applied various kinds of variables for exchange rate volatility volatility. So when looking at changes in the value of an exchange rate over time the volatility would also refer to a change in the exchange rate. VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange s CBOE Volatility Index a popular measure of the stock market s expectation of volatility based on SP 500 index options. Price Index ASPI of Colombo Stock Exchange CSE and the daily exchange rate values of US Dollar Euro and British Pound for a period of six years from 05 January 2010 to 31 December 2015. They called the stock market volatility index the Sigma Index and explained that it would be updated frequently and used as an underlying asset for futures and options.

Source: beanfxtrader.com

Source: beanfxtrader.com

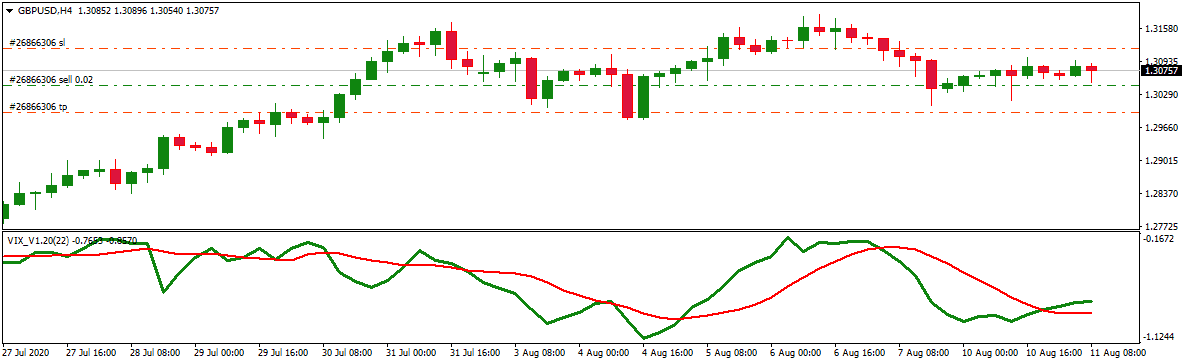

Addition to the exchange rate volatility the variables included in the analysis are. Methodologically we employ the Foreign Exchange Volatility Index FXVIX as a measure of FX volatility. The volatility is the measurement of the amount that these. As a result there is more uncertainty in the relationship between foreign exchange markets and international stock markets. They called the stock market volatility index the Sigma Index and explained that it would be updated frequently and used as an underlying asset for futures and options.

Source: dailyfx.com

Source: dailyfx.com

There are many circumstances when exchange rate volatility comes into play including business dealings between parties in two. 2019 exchange rate volatility refers to appreciation or depreciation of domestic currency. Countries fragile five and in the ASEAN region. The industrial production index IPI of the EA-11 countries the IPI for Mexico the nominal exchange rate between the two currencies the consumer price index CPI in. Why should you care about the volatility of foreign exchange rates.

Source: babypips.com

Source: babypips.com

Exchange-rate volatility on their trade flows. And individual stocks can experience much higher volatility than the Index. Exchange rate volatility refers to the erratic fluctuations in exchange rates. The daily market values. So when looking at changes in the value of an exchange rate over time the volatility would also refer to a change in the exchange rate.

Source: fxssi.com

Source: fxssi.com

Exchange-rate volatility on their trade flows. We find that while exchange rate. The exchange rate volatility risk was also relatively low for the majority of EU 10 frontier markets since 200405 when seven countries became members of Exchange Rate Mechanism ERM II and agreed to peg their currencies to the euro with the further aim of becoming eurozone members and adopting the euro as their currency. They proposed the creation of certain volatility indices that would track volatility in the stock market interest rate and foreign exchange market. Exchange rate volatility refers to the tendency for foreign currencies to appreciate or depreciate in value thus affecting the profitability of foreign exchange trades.

Source: forexcracked.com

Source: forexcracked.com

So when looking at changes in the value of an exchange rate over time the volatility would also refer to a change in the exchange rate. It is calculated and disseminated on a real-time basis by the CBOE and is often referred to as. Is 15 Mexican pesos is 13 Turkish lira is 88 Russian ruble is 14 South. According to Yakub et al. 2019 exchange rate volatility refers to appreciation or depreciation of domestic currency.

Source: offbeatforex.com

Source: offbeatforex.com

A measure of exchange rate volatility ERVt is included to capture both the absolute domestic-money-demand depressing effects of volatility and any substitution away from domestic assets demand to foreign assets demands due to a rise in volatility. The volatility is the measurement of the amount that these rates change and the frequency of those changes. Implied volatility for currency crosses will generally be higher than the implied volatility of the majors. The volatility on the SP 500 index averages around 14 and has seen spikes as high at 48. Why should you care about the volatility of foreign exchange rates.

Source: forexcracked.com

Source: forexcracked.com

According to Yakub et al. In this paper following Rose 2000 we primarily use a widely-used indicator the real exchange rate volatility which is constructed as the standard deviation of the first-difference. The industrial production index IPI of the EA-11 countries the IPI for Mexico the nominal exchange rate between the two currencies the consumer price index CPI in. CBOE Volatility Index VIX 20042020. Exchange-rate volatility on their trade flows.

Source: forexpops.com

Source: forexpops.com

VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange s CBOE Volatility Index a popular measure of the stock market s expectation of volatility based on SP 500 index options. The volatility on the SP 500 index averages around 14 and has seen spikes as high at 48. Rupiah volatility is around 8 while Brazilian real volatility is 15 Mexican pesos is 13 Turkish lira is 88 Russian ruble is 14 South Korean won is 9 Malaysian ringgit is 93. Of exchange rate volatility on stock market return volatility in Sri Lanka. The most volatile forex pairs are exotic currency pairs which can have volatility numbers that are as extreme as some individual stocks.

Source: tradingview.com

Source: tradingview.com

They called the stock market volatility index the Sigma Index and explained that it would be updated frequently and used as an underlying asset for futures and options. The daily market values. 2019 exchange rate volatility refers to appreciation or depreciation of domestic currency. Exchange rate volatility represents short-term fluctuations of nominal real exchange rates about their longer-term trends while currency misalignment refers to a significant deviation of the actual real exchange rate RER from its equilibrium level Frenkel and Goldstein 1991. In order to distinguish the distinct impact of the real exchange-rate volatility on their exports and imports both in the short-run and long-run we use the bounds-testing approach.

Source: motivation.africa

Source: motivation.africa

Generally variability of RERs reflects variability of nominal exchange rates. In this paper following Rose 2000 we primarily use a widely-used indicator the real exchange rate volatility which is constructed as the standard deviation of the first-difference. Exchange rate volatility refers to the erratic fluctuations in exchange rates. We find that while exchange rate. VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange s CBOE Volatility Index a popular measure of the stock market s expectation of volatility based on SP 500 index options.

Source: forexcracked.com

Source: forexcracked.com

Of exchange rate volatility on stock market return volatility in Sri Lanka. A measure of exchange rate volatility ERVt is included to capture both the absolute domestic-money-demand depressing effects of volatility and any substitution away from domestic assets demand to foreign assets demands due to a rise in volatility. From the stuff in our shopping carts to the cars in our driveways to the gadgets in our. Theoretical analyses of the relationship between higher exchange-rate volatility and international trade transactions have been conducted by Hooper and. The volatility is the measurement of the amount that these rates change and the frequency of those changes.

Source: en.wikipedia.org

Source: en.wikipedia.org

A measure of exchange rate volatility ERVt is included to capture both the absolute domestic-money-demand depressing effects of volatility and any substitution away from domestic assets demand to foreign assets demands due to a rise in volatility. The IDRUSD volatility during January-March 2018 was the lowest compared to the currencies of high-risk countries fragile five and in the ASEAN region. Generally variability of RERs reflects variability of nominal exchange rates. Why should you care about the volatility of foreign exchange rates. According to Yakub et al.

Source: bonustrade.app

Source: bonustrade.app

VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange s CBOE Volatility Index a popular measure of the stock market s expectation of volatility based on SP 500 index options. Implied volatility for currency crosses will generally be higher than the implied volatility of the majors. An emerging economy the macroeconomics variables ie. The volatility of exchange rates is the source of exchange rates risk and has certain implications on the volume of international trade consequently on the balance of payments. In order to distinguish the distinct impact of the real exchange-rate volatility on their exports and imports both in the short-run and long-run we use the bounds-testing approach.

Source: forex.in.rs

Source: forex.in.rs

2019 exchange rate volatility refers to appreciation or depreciation of domestic currency. According to Yakub et al. Generally variability of RERs reflects variability of nominal exchange rates. There are many circumstances when exchange rate volatility comes into play including business dealings between parties in two. Exchange rate volatility represents short-term fluctuations of nominal real exchange rates about their longer-term trends while currency misalignment refers to a significant deviation of the actual real exchange rate RER from its equilibrium level Frenkel and Goldstein 1991.

Source: pinterest.com

Source: pinterest.com

Methodologically we employ the Foreign Exchange Volatility Index FXVIX as a measure of FX volatility. Theoretical analyses of the relationship between higher exchange-rate volatility and international trade transactions have been conducted by Hooper and. Exchange rate volatility refers to the tendency for foreign currencies to appreciate or depreciate in value thus affecting the profitability of foreign exchange trades. They called the stock market volatility index the Sigma Index and explained that it would be updated frequently and used as an underlying asset for futures and options. We find that while exchange rate.

Source: dailyfx.com

Source: dailyfx.com

So when looking at changes in the value of an exchange rate over time the volatility would also refer to a change in the exchange rate. We find that while exchange rate. From the stuff in our shopping carts to the cars in our driveways to the gadgets in our. Countries fragile five and in the ASEAN region. The volatility is the measurement of the amount that these.

Source: dailyfx.com

Source: dailyfx.com

Generally variability of RERs reflects variability of nominal exchange rates. They called the stock market volatility index the Sigma Index and explained that it would be updated frequently and used as an underlying asset for futures and options. Countries fragile five and in the ASEAN region. VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange s CBOE Volatility Index a popular measure of the stock market s expectation of volatility based on SP 500 index options. The literature has applied various kinds of variables for exchange rate volatility volatility.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title exchange rate volatility index by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.