Your Financial volatility meaning bitcoin are ready. Financial volatility meaning are a bitcoin that is most popular and liked by everyone now. You can Download the Financial volatility meaning files here. Download all royalty-free news.

If you’re looking for financial volatility meaning images information connected with to the financial volatility meaning topic, you have visit the right blog. Our website frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

Financial Volatility Meaning. Volatility stands for the risk of change in the price of a security. You can describe and measure volatility of a stock how much the stock tends to move using other statistics for example dailyweeklymonthly range or average true range. A tendency to erupt in violence or anger. That way you know youll be ready no matter what happens next.

The Impact Of Sentiment And Attention Measures On Stock Market Volatility Sciencedirect From sciencedirect.com

The Impact Of Sentiment And Attention Measures On Stock Market Volatility Sciencedirect From sciencedirect.com

Volatility is one of the factors that investors in the financial markets analyse when making trading decisions. In finance volatility is a measurement of the fluctuations of the price of a security. Volatility is an arithmetic measure of the spread of the returns from investment in an asset. For example because the stock prices of small newer companies tend to rise and fall more sharply over short periods of time than stock of established blue-chip companies small caps are described as more volatile. Volatility is key in determining option prices. You can describe and measure volatility of a stock how much the stock tends to move using other statistics for example dailyweeklymonthly range or average true range.

It is essentially an analysis of the changes in the value of a security.

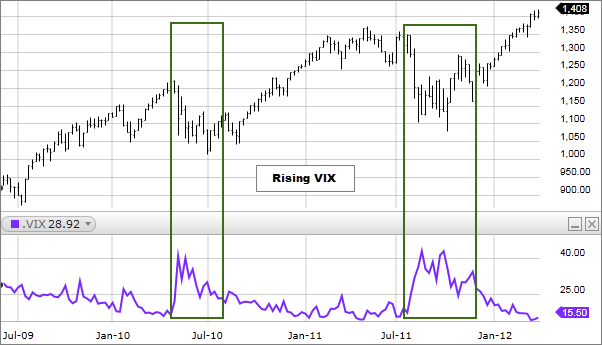

Volatility is indeed one of the most important risk indicators that is available to. High volatility equals greater uncertainty about what the value will be tomorrow or next month or next year. In simpler terms it is the gauge of how fast. Volatility in financial parlance usually refers to how much an assets value fluctuates from its general trend. Analysts look at volatility in a market an index and specific securities. Volatility is a statistical tool that is used for measuring the dispersion of returns realized by an investor for a particular security index.

Source: investopedia.com

Source: investopedia.com

There are two key approaches to volatility each with its pros and cons. Its the range and speed of price movements. Volatility in financial parlance usually refers to how much an assets value fluctuates from its general trend. Volatility is also a signal of risk. In finance volatility is a measurement of the fluctuations of the price of a security.

Source: fidelity.com

Source: fidelity.com

Usually the higher the volatility of an asset the higher the risk associated with that particular asset. The term volatility indicates how much and how quickly the value of an investment market or market sector changes. And market volatility can simply offer you opportunities to buy low sell high and realize all your financial dreams. Volatility indicates the pricing behavior of the security and helps estimate the fluctuations that may happen in a short period of time. Volatility is not always standard deviation.

Source: investopedia.com

Source: investopedia.com

It indicates how much an assets values fluctuate above or below the mean price. In the non-financial world volatility describes a tendency toward rapid unpredictable change. If the prices of a security fluctuate rapidly in a short time span it is termed to have high volatility. In addition market volatility. Volatility is one of the factors that investors in the financial markets analyse when making trading decisions.

Source: capital.com

Source: capital.com

When applied to the financial markets the definition isnt much different just a bit more. A tendency to erupt in violence or anger. The volatility of the main financial prices - main exchange rates main interest rate futures main stock indexes - is often understood or perceived as a measure of risk. The term volatility indicates how much and how quickly the value of an investment market or market sector changes. Where have you heard about volatility.

Source: ruleoneinvesting.com

Source: ruleoneinvesting.com

You can describe and measure volatility of a stock how much the stock tends to move using other statistics for example dailyweeklymonthly range or average true range. The term receives a lot of attention during periods of economic turbulence. A higher volatility means that a securitys value can. It indicates the risk associated with the changing price of the security and is measured by calculating the standard deviation of the annualized returns over a given period of time. THE RELATIONSHIP BETWEEN STOCK MARKET RETURN AND CONDITIONAL VARIANCE VOLATILITY IN THE NIGERIAN STOCK MARKET FROM 1999-2016.

Source: ruleoneinvesting.com

Source: ruleoneinvesting.com

Volatility in financial parlance usually refers to how much an assets value fluctuates from its general trend. THE RELATIONSHIP BETWEEN STOCK MARKET RETURN AND CONDITIONAL VARIANCE VOLATILITY IN THE NIGERIAN STOCK MARKET FROM 1999-2016. In finance volatility is the degree of variation of a trading price series over time as measured by the standard deviation of returns. A tendency to erupt in violence or anger. Volatility often refers to the amount of uncertainty or risk related to the size of changes in a securitys value.

Source: babypips.com

Source: babypips.com

You can describe and measure volatility of a stock how much the stock tends to move using other statistics for example dailyweeklymonthly range or average true range. For example because the stock prices of small newer companies tend to rise and fall more sharply over short periods of time than stock of established blue-chip companies small caps are described as more volatile. Volatility is one of the factors that investors in the financial markets analyse when making trading decisions. Volatility is measured by calculating standard deviation beta or volatility index. It indicates how much an assets values fluctuate above or below the mean price.

Source: pinterest.com

Source: pinterest.com

Knowing a volatile person means not knowing well what he or she will do next. The term receives a lot of attention during periods of economic turbulence. By looking at volatility you can try to gauge risk. Volatility is measured by calculating standard deviation beta or volatility index. For financial instruments like stocks volatility is a statistical measure of the degree of variation in their trading price observed over a period of time.

Source: investopedia.com

Source: investopedia.com

Historical volatility is the measure of past price variation while implied volatility is the perception of what it will be in the future. Implied volatility determines the prices for call and put options. A tendency to change quickly and unpredictably. The term implied volatility describes the estimated volatility of an asset and it is a common feature of options trading. 22 Interpreting volatility.

Source: lynalden.com

Source: lynalden.com

In addition market volatility. Volatility in financial parlance usually refers to how much an assets value fluctuates from its general trend. Volatility is the purest measure of risk in financial markets and consequently has become the expected price of uncertainty. Inaccurate volatility estimates can leave financial institutions bereft of capital for operations and investment. When applied to the financial markets the definition isnt much different just a bit more.

Source: investopedia.com

Source: investopedia.com

This article contains the current opinions of the author but not necessarily those of Acorns. Beta coefficients option pricing models and standard deviations of returns are examples of techniques to quantify volatility. In simpler terms it is the gauge of how fast. The term implied volatility describes the estimated volatility of an asset and it is a common feature of options trading. This article contains the current opinions of the author but not necessarily those of Acorns.

Source: sciencedirect.com

Source: sciencedirect.com

Volatility is one of the factors that investors in the financial markets analyse when making trading decisions. It indicates how much an assets values fluctuate above or below the mean price. There are two types of volatility implied forward-looking and historical volatility also known as statistical volatility. Implied volatility determines the prices for call and put options. By looking at volatility you can try to gauge risk.

Source: capital.com

Source: capital.com

For example because the stock prices of small newer companies tend to rise and fall more sharply over short periods of time than stock of established blue-chip companies small caps are described as more volatile. The term receives a lot of attention during periods of economic turbulence. And market volatility can simply offer you opportunities to buy low sell high and realize all your financial dreams. If the prices of a security fluctuate rapidly in a short time span it is termed to have high volatility. It indicates how much an assets values fluctuate above or below the mean price.

Source: investopedia.com

Source: investopedia.com

Inaccurate volatility estimates can leave financial institutions bereft of capital for operations and investment. It indicates the risk associated with the changing price of the security and is measured by calculating the standard deviation of the annualized returns over a given period of time. Investing involves risk including loss of principal. Volatility is the purest measure of risk in financial markets and consequently has become the expected price of uncertainty. A measurement of historic volatility looks at a securitys past market prices.

Source: investopedia.com

Source: investopedia.com

Historical volatility is the measure of past price variation while implied volatility is the perception of what it will be in the future. The volatility of the main financial prices - main exchange rates main interest rate futures main stock indexes - is often understood or perceived as a measure of risk. There are two key approaches to volatility each with its pros and cons. Beta coefficients option pricing models and standard deviations of returns are examples of techniques to quantify volatility. The term implied volatility describes the estimated volatility of an asset and it is a common feature of options trading.

Source: investopedia.com

Source: investopedia.com

Beta coefficients option pricing models and standard deviations of returns are examples of techniques to quantify volatility. Volatility stands for the risk of change in the price of a security. There are two key approaches to volatility each with its pros and cons. A measurement of historic volatility looks at a securitys past market prices. The meanings of both volatility and standard deviation reach far beyond the area where the two represent the same thing.

Source: capital.com

Source: capital.com

When applied to the financial markets the definition isnt much different just a bit more. Knowing a volatile person means not knowing well what he or she will do next. In addition market volatility. A tendency to change quickly and unpredictably. It is one of the most key measures in quantifying risk.

Noun the quality or state of being volatile. Volatility is an arithmetic measure of the spread of the returns from investment in an asset. Volatility often refers to the amount of uncertainty or risk related to the size of changes in a securitys value. Where have you heard about volatility. Implied volatility determines the prices for call and put options.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title financial volatility meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.