Your Find volatility of a stock news are ready. Find volatility of a stock are a trading that is most popular and liked by everyone now. You can Get the Find volatility of a stock files here. Get all royalty-free wallet.

If you’re looking for find volatility of a stock pictures information linked to the find volatility of a stock topic, you have visit the ideal site. Our site always gives you hints for downloading the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

Find Volatility Of A Stock. Its very important for stock trader to know volatility of stocks to choose right stock for trading next day. To start you need to define what constitutes a volatile stock for your own trading. Using the formula SQRT5D13 indicates that the. The formula for daily volatility is computed by finding out the square root of the variance of a daily stock price.

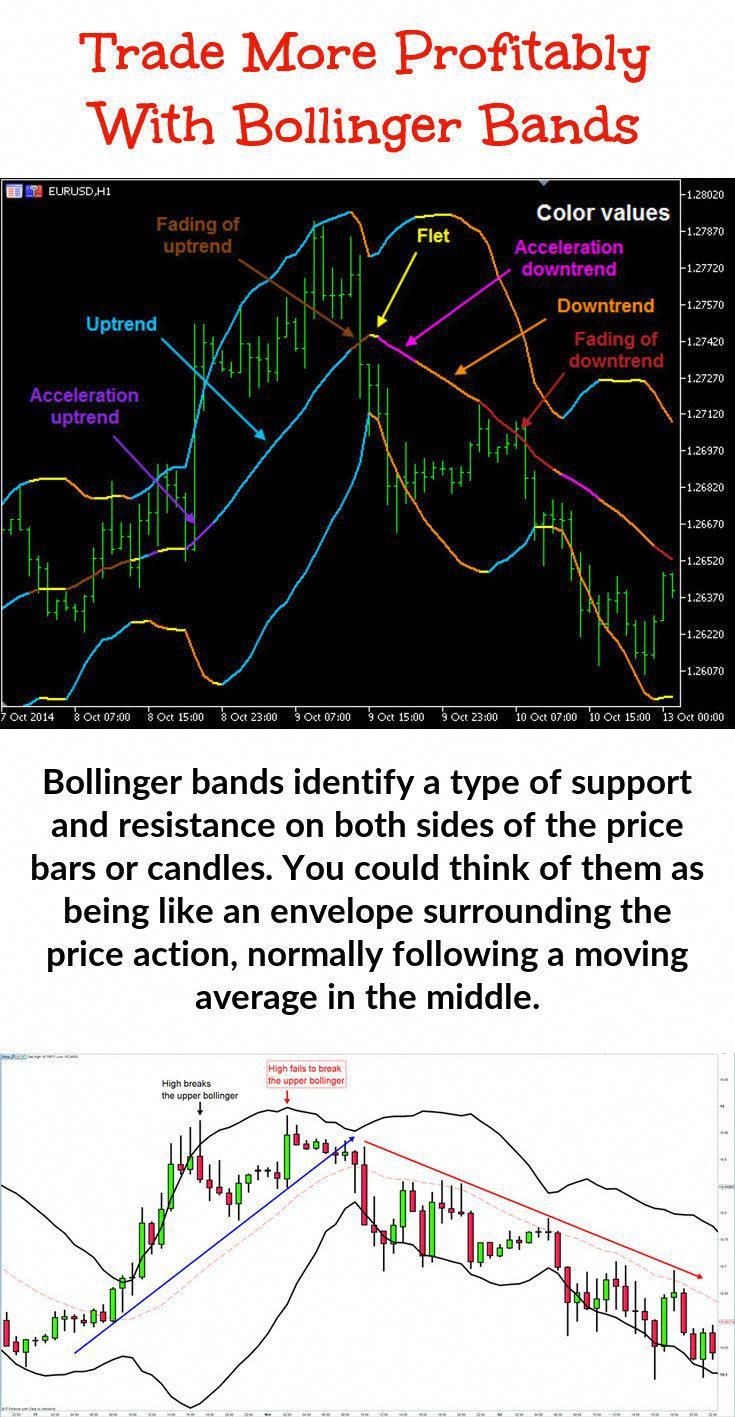

Bollinger Band Trading When Done Correctly Takes Advantage Of The Implied Volatility In Options In Stock Trading Strategies Trading Charts Implied Volatility From pinterest.com

Bollinger Band Trading When Done Correctly Takes Advantage Of The Implied Volatility In Options In Stock Trading Strategies Trading Charts Implied Volatility From pinterest.com

Volatility is found by calculating the annualized standard deviation of daily change in price. Define Your Volatility Threshold. Looking at this information for an individual stock will provide another clue about whether or not you should be buying or selling contracts based on IV as well as how long you might expect to remain in a trade. To check the volatility of a stock or other financial instrument search for it on TradingView using the name or ticker. Calculate the daily log change LNtt-1 create a. That is values above 10 indicate the stock is expected to move proportionally higher for each 1.

If the price almost never changes it has low volatility.

Once the chart is open you will need to add the Average True Range indicator or Historical Volatility indicator. To start you need to define what constitutes a volatile stock for your own trading. In cell C23 enter STDV C3C22 to calculate the standard deviation for the past 20 days. Think of this as stocks that have very volatile implied volatility. The Volatility Skew Finder is only available to registered members. Stock and ETF Implied Volatility Screener.

Source: pinterest.com

Source: pinterest.com

It is crucial to have the ability to filter specific criteria like. Think of this as stocks that have very volatile implied volatility. To check the volatility of a stock or other financial instrument search for it on TradingView using the name or ticker. To start you need to define what constitutes a volatile stock for your own trading. Using a stock screener like Scanz is one of the best ways to find volatile stocks.

Source: pinterest.com

Source: pinterest.com

The stock beta of 10 means that you are expecting a stock to move 1 for every 1 the broad market moves. The formula for daily volatility is computed by finding out the square root of the variance of a daily stock price. How to Find Volatile Stocks. The Volatility Skew Finder can find stocks with greater volatilities in the calls vs. That is values above 10 indicate the stock is expected to move proportionally higher for each 1.

Source: pinterest.com

Source: pinterest.com

If the percieved volatilityimplied volatility is rising it means the market expectation is positive. Looking at this information for an individual stock will provide another clue about whether or not you should be buying or selling contracts based on IV as well as how long you might expect to remain in a trade. A stocks volatility is the variation in its price over a period of time. A stock whose value fluctuates by 30 in a single day would be considered volatile by. This stock volatility calculator can also help you to shortlist stocks for day trading.

Source: id.pinterest.com

Source: id.pinterest.com

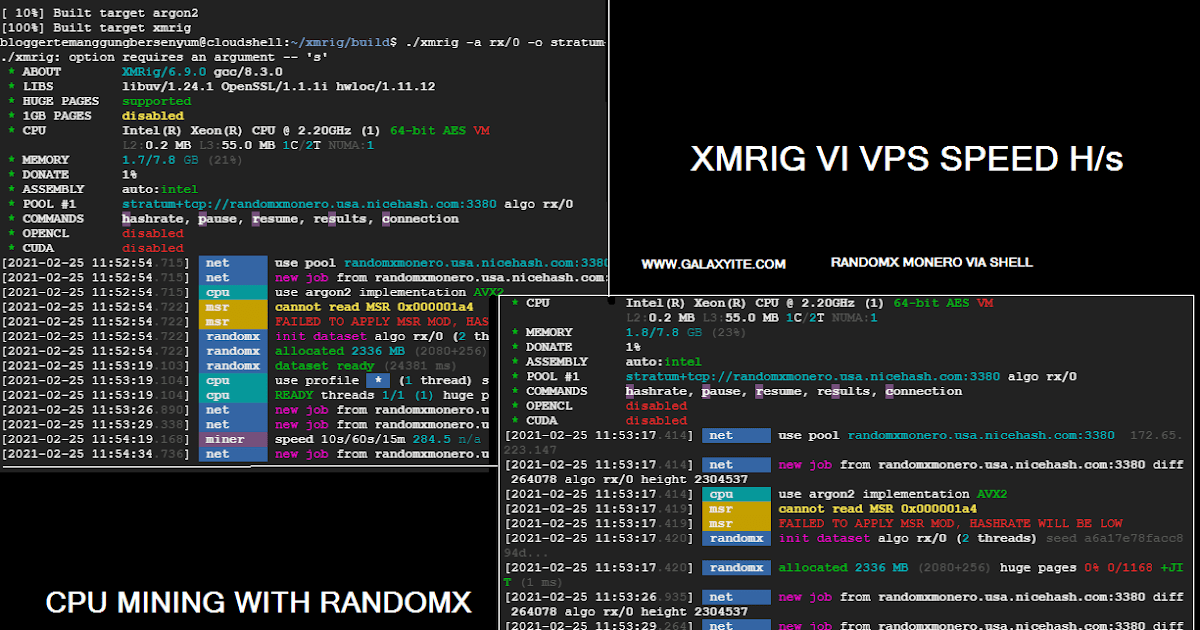

Calls which is bearish. There is another volatility number called percieved volatility which is calculated as approximately Max - tdays price Max todays price 2. I can only tell you how we calculate volatility on a financial asset or commodity. Theta measures the change in the price of an option for a one-day decrease in its time to expiration. Standard deviation is the most common way to measure market volatility and traders can use Bollinger Bands to analyze standard deviation.

Source: pinterest.com

Source: pinterest.com

The Volatility Skew Finder is only available to registered members. This is the volatility during this time. If the price almost never changes it has low volatility. Enter each amount into the appropriate cell in column C. Finding Volatility Skew Stocks with disparities in call and put volatilities can be identified using the Volatility Skew Finder.

Source: pinterest.com

Source: pinterest.com

If the price of a stock moves up and down rapidly over short time periods it has high volatility. You can also calculate weekly volatility by multiplying the daily volatility by square root of the number of trading days in a week which is 5. Think of this as stocks that have very volatile implied volatility. Volatility is found by calculating the annualized standard deviation of daily change in price. See a list of Highest Implied Volatility using the Yahoo Finance screener.

Source: pinterest.com

Source: pinterest.com

The Advanced Stock Screener section of StockTA offers a good mix of technical indicators including those for volatility on US and Canadian Stocks. The formula for daily volatility is computed by finding out the square root of the variance of a daily stock price. Lets take a closer look at how the process works. The volatility can be calculated either using the standard deviation or the variance of the security or stock. This stock volatility calculator can also help you to shortlist stocks for day trading.

Source: pinterest.com

Source: pinterest.com

The formula for daily volatility is computed by finding out the square root of the variance of a daily stock price. Scan for The Most Volatile Stocks. If the price almost never changes it has low volatility. For example for daily periods these would be the closing price on that day. A stocks volatility is the variation in its price over a period of time.

Source: pinterest.com

Source: pinterest.com

That is values above 10 indicate the stock is expected to move proportionally higher for each 1. Using the formula SQRT5D13 indicates that the. The stock beta of 10 means that you are expecting a stock to move 1 for every 1 the broad market moves. When applied to the stock market implied volatility generally increases in bearish markets when investors believe equity prices will decline over time. Theta measures the change in the price of an option for a one-day decrease in its time to expiration.

Source: in.pinterest.com

Source: in.pinterest.com

For example for daily periods these would be the closing price on that day. It is crucial to have the ability to filter specific criteria like. If the percieved volatilityimplied volatility is rising it means the market expectation is positive. Finding Volatility Skew Stocks with disparities in call and put volatilities can be identified using the Volatility Skew Finder. What is option theta.

Source: pinterest.com

Source: pinterest.com

Define Your Volatility Threshold. The volatility can be calculated either using the standard deviation or the variance of the security or stock. Its very important for stock trader to know volatility of stocks to choose right stock for trading next day. You can also do some research in the middle of the trading session to find the stocks that are moving the most that day. Maximum drawdown is another way to.

Source: pinterest.com

Source: pinterest.com

To check the volatility of a stock or other financial instrument search for it on TradingView using the name or ticker. You can also do some research in the middle of the trading session to find the stocks that are moving the most that day. You can find regularly volatile stocks by using a stock screener such as StockFetcher to help you search. This stock volatility calculator can also help you to shortlist stocks for day trading. That is values above 10 indicate the stock is expected to move proportionally higher for each 1.

Source: pinterest.com

Source: pinterest.com

Using a stock screener like Scanz is one of the best ways to find volatile stocks. When applied to the stock market implied volatility generally increases in bearish markets when investors believe equity prices will decline over time. This is similar to the VVIX index which measures the volatility of the Volatility Index. Enter each amount into the appropriate cell in column C. For example one stock may have a tendency to swing wildly higher and lower while another stock may move in much steadier.

Source: pinterest.com

Source: pinterest.com

Define Your Volatility Threshold. This stock volatility calculator can also help you to shortlist stocks for day trading. Enter each amount into the appropriate cell in column C. You can find regularly volatile stocks by using a stock screener such as StockFetcher to help you search. What is option theta.

Source: fi.pinterest.com

Source: fi.pinterest.com

Its very important for stock trader to know volatility of stocks to choose right stock for trading next day. To start you need to define what constitutes a volatile stock for your own trading. To calculate the annualized historical volatility enter SQRT 252C23 in cell C24. That is values above 10 indicate the stock is expected to move proportionally higher for each 1. Standard deviation is the most common way to measure market volatility and traders can use Bollinger Bands to analyze standard deviation.

Source: id.pinterest.com

Source: id.pinterest.com

That is values above 10 indicate the stock is expected to move proportionally higher for each 1. In answer to your question How do you compute the volatility or standard deviation of a stock I notice you have thermodynamics as a topic area. To check the volatility of a stock or other financial instrument search for it on TradingView using the name or ticker. To start you need to define what constitutes a volatile stock for your own trading. Looking at this information for an individual stock will provide another clue about whether or not you should be buying or selling contracts based on IV as well as how long you might expect to remain in a trade.

Source: id.pinterest.com

Source: id.pinterest.com

Lets take a closer look at how the process works. You can find regularly volatile stocks by using a stock screener such as StockFetcher to help you search. In answer to your question How do you compute the volatility or standard deviation of a stock I notice you have thermodynamics as a topic area. Think of this as stocks that have very volatile implied volatility. You can also calculate weekly volatility by multiplying the daily volatility by square root of the number of trading days in a week which is 5.

Source: pinterest.com

Source: pinterest.com

You can also do some research in the middle of the trading session to find the stocks that are moving the most that day. The volatility can be calculated either using the standard deviation or the variance of the security or stock. Maximum drawdown is another way to. Finding Volatility Skew Stocks with disparities in call and put volatilities can be identified using the Volatility Skew Finder. Calculate the daily log change LNtt-1 create a.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title find volatility of a stock by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.