Your Fixed income volatility index exchange are available. Fixed income volatility index are a mining that is most popular and liked by everyone now. You can News the Fixed income volatility index files here. Get all royalty-free bitcoin.

If you’re looking for fixed income volatility index images information related to the fixed income volatility index topic, you have visit the right blog. Our website always provides you with suggestions for viewing the highest quality video and picture content, please kindly surf and locate more enlightening video articles and images that fit your interests.

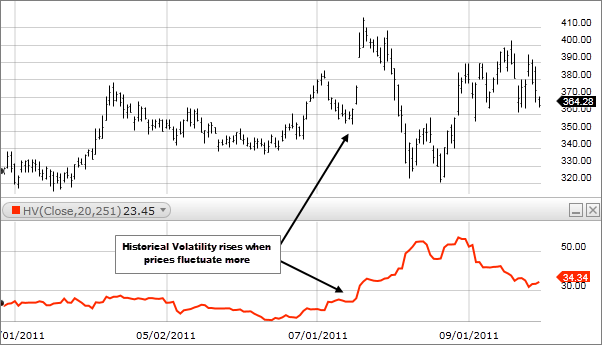

Fixed Income Volatility Index. Since the early 2010s Antonios startup QUASaR Quantitative Strategies and Research has teamed up with. A method of quoting option contracts whereby bids and asks are quoted according to their implied volatilities rather than prices. The iShares Minimum Volatility Funds may experience more than minimum volatility as there is no guarantee that the underlying indexs strategy of seeking to lower volatility will be successful. That said we expect risky assets to perform well as volatility.

Cvol For Interest Rates Understanding Volatility In Price And Yield Terms Cme Group From cmegroup.com

Cvol For Interest Rates Understanding Volatility In Price And Yield Terms Cme Group From cmegroup.com

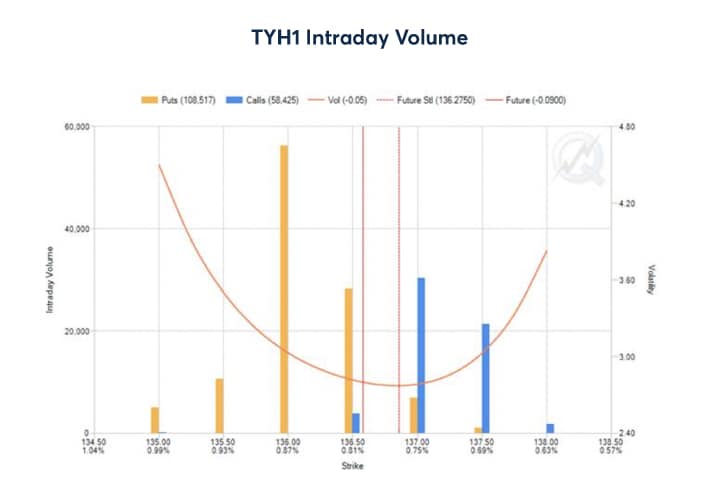

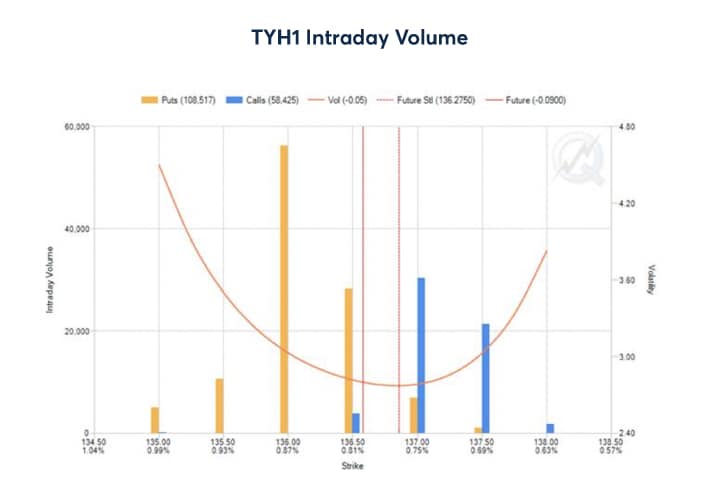

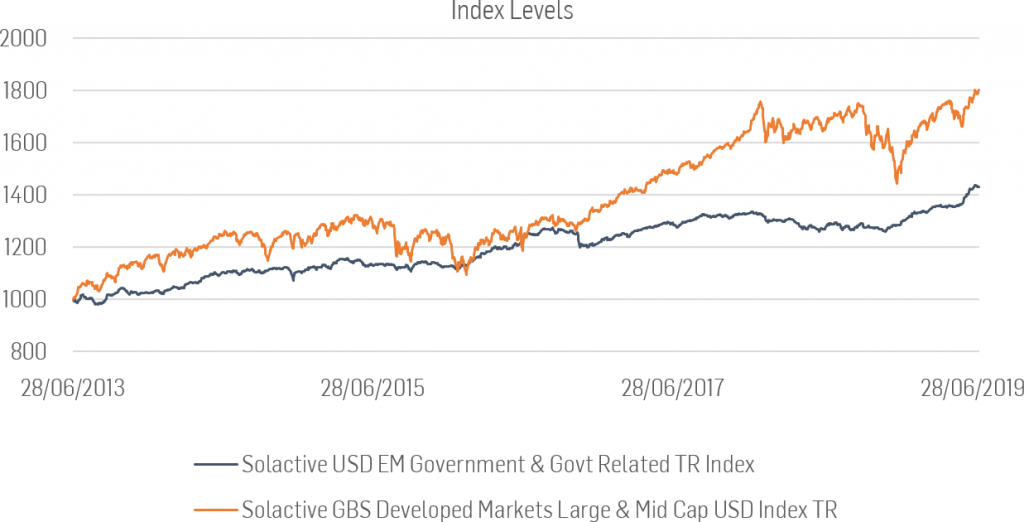

Youre no longer limited to monitoring key interest rates see whats happening across fixed income markets throughout the day. Until recently however the fixed income market did not have suitable volatility measures that could address the markets term and credit structure. Corporate and foreign debentures and secured notes that. A method of quoting option contracts whereby bids and asks are quoted according to their implied volatilities rather than prices. ICE Data Indices is the second largest fixed income index provider by assets under management globally with more. MSCI brings to market Fixed Income Factor ESG and Climate Indexes helping investors gain better insights in a fully transparent and targeted manner.

It also seeks to profit from a steepening of the yield curve whether that occurs via rising long-term interest rates or falling short term interest rates which are historically associated with large equity market declines.

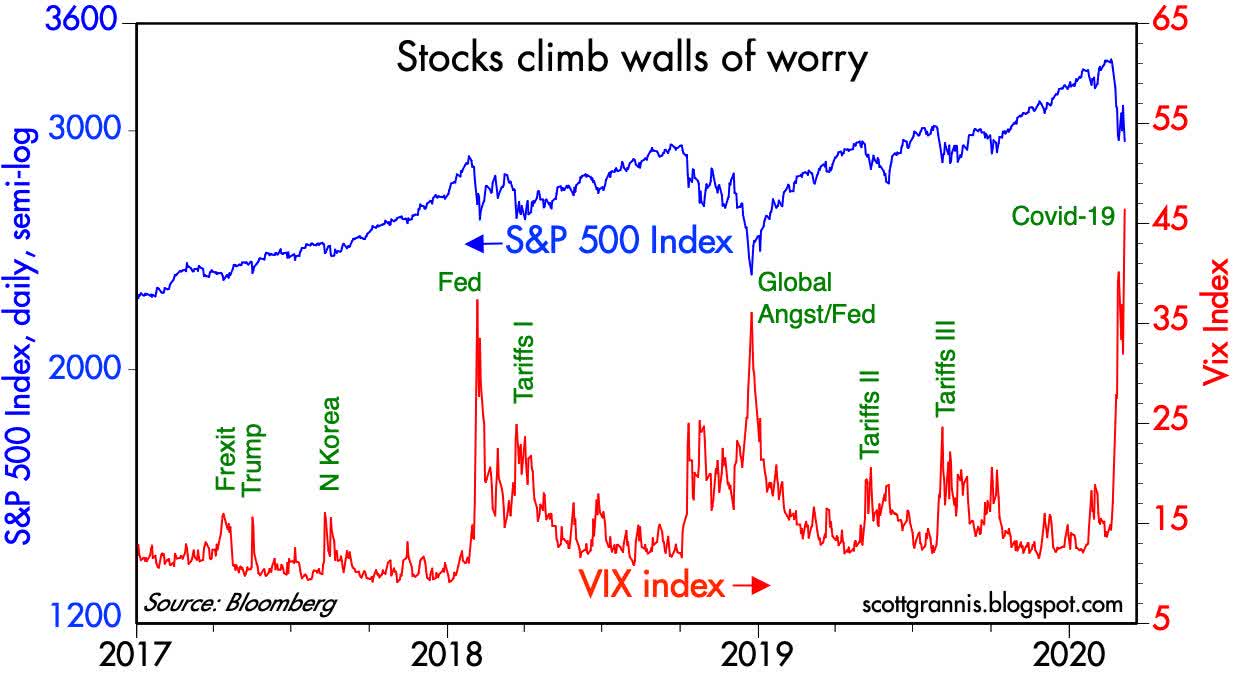

Companies selected by the index provider may not exhibit positive or favorable ESG characteristics. The divide in the Vix index of stock volatility and the Move gauge tracking fixed income has been driven by the disparate performance of the two asset classes over the past month. Youre no longer limited to monitoring key interest rates see whats happening across fixed income markets throughout the day. The iShares Minimum Volatility Funds may experience more than minimum volatility as there is no guarantee that the underlying indexs strategy of seeking to lower volatility will be successful. California Munis View California Munis ETFs Barclays Capital California 1-7 Year Non-AMT Municipal Bond Index. 4 We do not believe that economic fundamentals justify the high level of market volatility we are currently seeing.

Source: cmegroup.com

Source: cmegroup.com

Until recently however the fixed income market did not have suitable volatility measures that could. Citi indices needs some FI non-linearity concerns support staff size vs peers. Fixed income instruments with the highest trading volume are selected. Government agencies quasi-federal corporations corporate or foreign debt guaranteed by the US. MSCI Fixed Income Indexes leverage 50 years of extensive risk and.

Source: ft.com

Source: ft.com

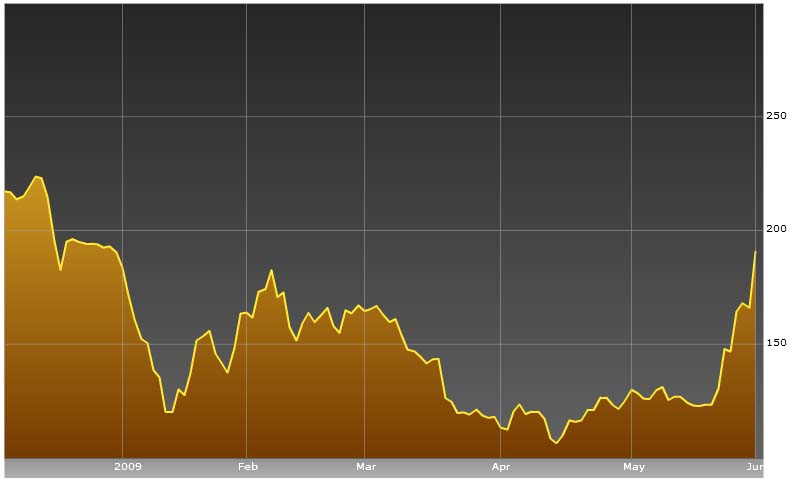

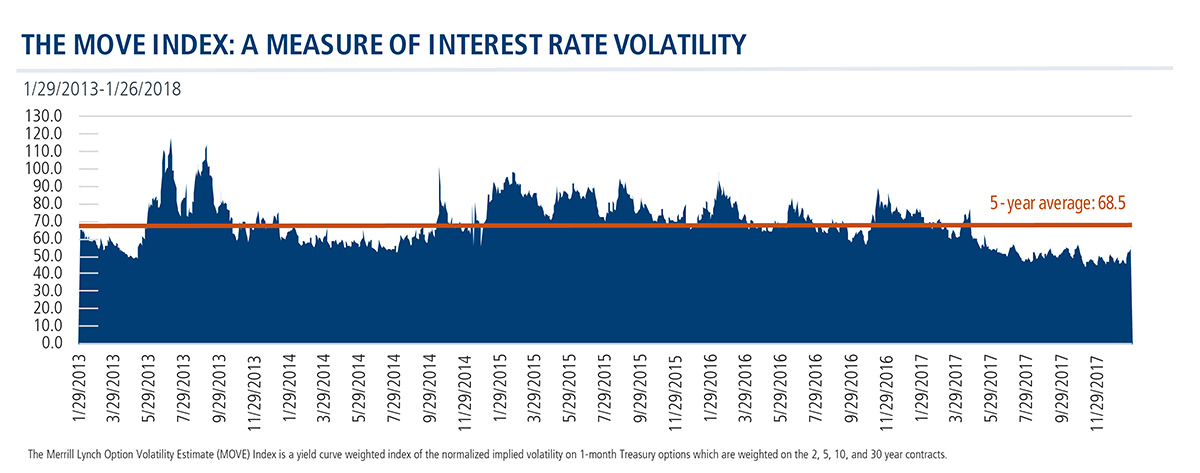

Barclays Capital California Competitive Intermediate Municipal 1-17 year. MSCI USA Minimum Volatility Extended ESG Reduced Carbon Target Index. Managing higher volatility has become much tougher with interest rates at such low levels since any change will lead to greater convexity according to three panellists speaking at Investment Magazines Fixed Income and Credit Forum. Track Fixed Income market volatility The ICE BofA MOVE Index which tracks fixed income market volatility is being upgraded from end-of-day to near-real-time pricing so you can better track US. The VIX index maintained by Chicago Board Options Exchange Cboe is a measure of expected volatility in the US equity market.

Source: fidelity.com

Source: fidelity.com

California Munis View California Munis ETFs Barclays Capital California 1-7 Year Non-AMT Municipal Bond Index. Given the volatility of fixed income given how low rates are and how small changes can mean very large changes in valuation this has enormous. 2 BlackRock as of 1142021. In terms of economic fundamentals Invesco Fixed Income believes that growth should continue to be strong fueled by easy monetary and fiscal policy and that inflation is unlikely to accelerate in the next couple of months. Since the early 2010s Antonios startup QUASaR Quantitative Strategies and Research has teamed up with.

Source: fidelity.com

Source: fidelity.com

The equity market has long had the VIX Index as a measure of its volatility and a benchmark for tracking future uncertainty in US. Citi indices needs some FI non-linearity concerns support staff size vs peers. Lehman lacked its current capabilities non-PCA. 4 We do not believe that economic fundamentals justify the high level of market volatility we are currently seeing. GovernmentCredit 1-7 Years ex BBB Index is a market-value weighted index that tracks the total return results of fixed-rate publicly placed dollar-denominated obligations issued by the US.

Source: investopedia.com

Source: investopedia.com

It also seeks to profit from a steepening of the yield curve whether that occurs via rising long-term interest rates or falling short term interest rates which are historically associated with large equity market declines. Fixed income risk models 2002 Inhouse model historical simple covariance matrix linear. Based on USMVs AUM of 293B. Barclays Capital California 2-Plus Year Municipal Bond Index. The VIX index maintained by Chicago Board Options Exchange Cboe is a measure of expected volatility in the US equity market.

Source: researchgate.net

Source: researchgate.net

Since the early 2010s Antonios startup QUASaR Quantitative Strategies and Research has teamed up with. It also seeks to profit from a steepening of the yield curve whether that occurs via rising long-term interest rates or falling short term interest rates which are historically associated with large equity market declines. 4 We do not believe that economic fundamentals justify the high level of market volatility we are currently seeing. Government agencies quasi-federal corporations corporate or foreign debt guaranteed by the US. Barclays Capital California 2-Plus Year Municipal Bond Index.

Source: seekingalpha.com

Source: seekingalpha.com

MSCI brings to market Fixed Income Factor ESG and Climate Indexes helping investors gain better insights in a fully transparent and targeted manner. There are fixed-income option-implied volatility indexes for US Treasury futures but the European fixed income market lacks such index. MOVE and the accompanying fixed income volatility indices will become part of ICE Data Indices comprehensive family of more than 5000 global fixed income equity commodity and currency indices that leverage ICE Data Services pricing reference data and analytics solutions. Until recently however the fixed income market did not have suitable volatility measures that could address the markets term and credit structure. The iShares Minimum Volatility Funds may experience more than minimum volatility as there is no guarantee that the underlying indexs strategy of seeking to lower volatility will be successful.

Source:

Source:

Since the early 2010s Antonios startup QUASaR Quantitative Strategies and Research has teamed up with. Lehman lacked its current capabilities non-PCA. In this project a model-free fixed income market volatility index calculation formula based on a solid mathematical proof is proposed. The MOVE and accompanying fixed income volatility indices will become part of the ICE Data Indices for more than 5000 global fixed income equity commodity and currency indices that use ICE Data Services pricing reference data and analytics solutions officials add. MSCI USA Minimum Volatility Extended ESG Reduced Carbon Target Index.

Source: cmegroup.com

Source: cmegroup.com

Barclays Capital California 1-Year Municipal Bond Index. Fixed income volatility throughout the day. MSCI brings to market Fixed Income Factor ESG and Climate Indexes helping investors gain better insights in a fully transparent and targeted manner. MSCI Fixed Income Indexes leverage 50 years of extensive risk and. There are fixed-income option-implied volatility indexes for US Treasury futures but the European fixed income market lacks such index.

Source: raymondjames.com

Source: raymondjames.com

IBoxx MSCI ESG Advanced USD Liquid Investment Grade. 2 BlackRock as of 1142021. MSCI USA Minimum Volatility Extended ESG Reduced Carbon Target Index. Barclays Capital California 2-Plus Year Municipal Bond Index. Lehman lacked its current capabilities non-PCA.

Source: blackrock.com

Source: blackrock.com

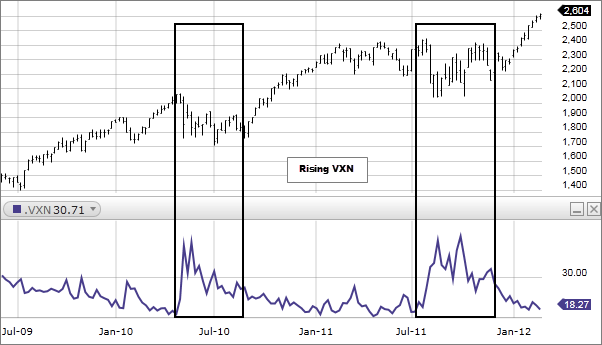

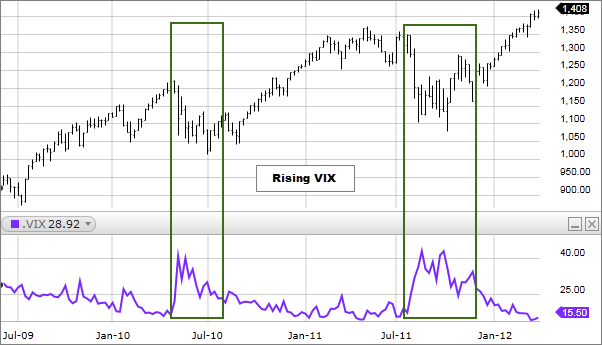

The divide in the Vix index of stock volatility and the Move gauge tracking fixed income has been driven by the disparate performance of the two asset classes over the past month. Since the early 2010s Antonios startup QUASaR Quantitative Strategies and Research has teamed up with. Fixed income risk models 2002 Inhouse model historical simple covariance matrix linear. US exchange group ICE has confirmed it will publish some of its key fixed income and volatility indices in real-time rather than at the end of the trading day. The Price of Fixed Income Market Volatility - October 2013 Introduction CBOE interest rate volatility indexes Some of the interest rate volatility indexes in this book are currently being implemented by the Chicago Board Options Exchange CBOE Behavior of two recently launched indexes of fixed income volatility that parallel the equity VIX.

Source: ro.pinterest.com

Source: ro.pinterest.com

In terms of economic fundamentals Invesco Fixed Income believes that growth should continue to be strong fueled by easy monetary and fiscal policy and that inflation is unlikely to accelerate in the next couple of months. The VIX index maintained by Chicago Board Options Exchange Cboe is a measure of expected volatility in the US equity market. The equity market has long had the VIX Index as a measure of its volatility and a benchmark for tracking future uncertainty in US. Fixed income risk models 2002 Inhouse model historical simple covariance matrix linear. MOVE and the accompanying fixed income volatility indices will become part of ICE Data Indices comprehensive family of more than 5000 global fixed income equity commodity and currency indices that leverage ICE Data Services pricing reference data and analytics solutions.

Source: cmegroup.com

Source: cmegroup.com

The first indices now being published in real-time include the ICE BofA US Broad Market Index US Corporate Index US High Yield Index Euro Corporate Index Euro High Yield Index and the MOVE Index. The MOVE and accompanying fixed income volatility indices will become part of the ICE Data Indices for more than 5000 global fixed income equity commodity and currency indices that use ICE Data Services pricing reference data and analytics solutions officials add. Companies selected by the index provider may not exhibit positive or favorable ESG characteristics. Until recently however the fixed income market did not have suitable volatility measures that could. MSCI brings to market Fixed Income Factor ESG and Climate Indexes helping investors gain better insights in a fully transparent and targeted manner.

Source: seekingalpha.com

Source: seekingalpha.com

Since the early 2010s Antonios startup QUASaR Quantitative Strategies and Research has teamed up with. Fixed income markets amount to one of the largest segments of the whole capital market universe. MSCI Fixed Income Indexes leverage 50 years of extensive risk and. MSCI brings to market Fixed Income Factor ESG and Climate Indexes helping investors gain better insights in a fully transparent and targeted manner. Barclays Capital California 2-Plus Year Municipal Bond Index.

Source: researchgate.net

Source: researchgate.net

Barclays Capital California 1-Year Municipal Bond Index. This novel research paper by Jaroslav Baran and Jan Voříšek fills this gap and proposes volatility indexes connected to the euro bond futures using the Cboe TYVIX US Treasury implied volatility index 2018 methodology. Measuring Fixed Income Volatility. Investors today are looking for indexes with targeted exposures to align with their investment objectives. It also seeks to profit from a steepening of the yield curve whether that occurs via rising long-term interest rates or falling short term interest rates which are historically associated with large equity market declines.

Source: fidelity.com

Source: fidelity.com

IVOL is a first-of-its-kind ETF which is designed to hedge the risk of an increase in fixed income volatility andor an increase in inflation expectations. There are fixed-income option-implied volatility indexes for US Treasury futures but the European fixed income market lacks such index. Fixed income volatility throughout the day. Good software design for access and downloads. The VIX index maintained by Chicago Board Options Exchange Cboe is a measure of expected volatility in the US equity market.

Source: solactive.com

Source: solactive.com

The iShares Minimum Volatility Funds may experience more than minimum volatility as there is no guarantee that the underlying indexs strategy of seeking to lower volatility will be successful. A method of quoting option contracts whereby bids and asks are quoted according to their implied volatilities rather than prices. Fixed income risks include interest-rate and credit. The Price of Fixed Income Market Volatility - October 2013 Introduction CBOE interest rate volatility indexes Some of the interest rate volatility indexes in this book are currently being implemented by the Chicago Board Options Exchange CBOE Behavior of two recently launched indexes of fixed income volatility that parallel the equity VIX. Fixed income risk models 2002 Inhouse model historical simple covariance matrix linear.

Source: calamos.com

Source: calamos.com

Measuring Fixed Income Volatility. ICE Data Indices is the second largest fixed income index provider by assets under management globally with more. MSCI USA Minimum Volatility Extended ESG Reduced Carbon Target Index. Lehman lacked its current capabilities non-PCA. GovernmentCredit 1-7 Years ex BBB Index is a market-value weighted index that tracks the total return results of fixed-rate publicly placed dollar-denominated obligations issued by the US.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fixed income volatility index by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.