Your Forex implied volatility mining are ready. Forex implied volatility are a wallet that is most popular and liked by everyone this time. You can Download the Forex implied volatility files here. Get all free trading.

If you’re searching for forex implied volatility pictures information related to the forex implied volatility interest, you have come to the ideal blog. Our site frequently provides you with suggestions for downloading the highest quality video and picture content, please kindly surf and locate more informative video content and graphics that match your interests.

Forex Implied Volatility. Foreign exchange currency implied volatility refers to the constant movement and changes in exchange rates in the worlds global foreign exchange market. IV will fall when investors are super-confident options are seen as being undervalued and likely to rise in price. Implied volatility rank or IVR represents a ranking system that compares is implied volatility is high or low in a specific asset based on the past year of IV data. USING IMPLIED VOLATILITY TO TRADE COMMODITIES STOCKS INDICIES In addition to forex implied volatility gauges can be incorporated into trading strategiesfor commodities stocks and indices.

Cci And Bollinger Bands Reversal Trading Is Forex System That Trade On Reversal Forexisgreat Whatisoptiontrading Trading Forex Band From pinterest.com

Cci And Bollinger Bands Reversal Trading Is Forex System That Trade On Reversal Forexisgreat Whatisoptiontrading Trading Forex Band From pinterest.com

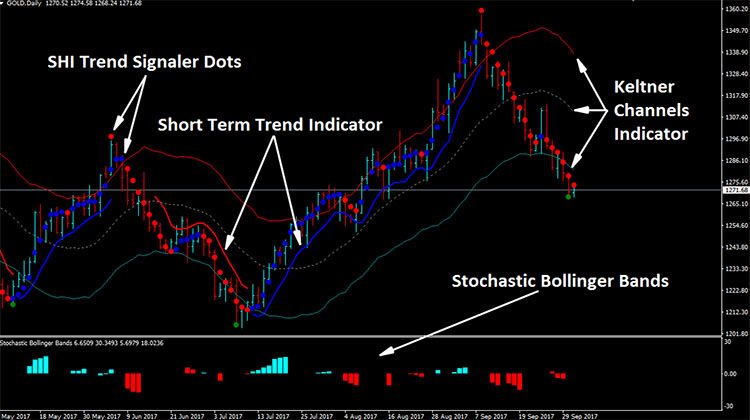

As IV is a factor in option pricing models with all other things being equal as in strike price duration etc the higher the IV the higher the price of the option. Implied volatility is a term that refers to a certain measurement that establishes the likelihood a particular market is to change over time. Implied volatility is a projection it may deviate from actual future volatility. To better understand we should split it. As mentioned above measures of implied volatility can. This Volatility Indicator can also be used with any forex trading strategy or trading indicator.

To better understand we should split it.

Importance of IV Rank. Implied Volatility - Implied Volatility can help traders determine if options are fairly valued undervalued or overvalued. Largely owed to the inherent mean-reverting characteristic of major currency pairs implied volatility trading ranges typically serve as robust forex signals. Implied volatility can also help you measure sentiment. For example this EURGBP analysis that defined a 24-hour implied volatility trading range for EURGBP provided an illustrated example of how these technical barriers can help traders identify possible inflection points and trading opportunities. Implied Volatility IV tends to rise when traders are worried about risk or are becoming very fearful options are seen as being overvalued.

Source: pinterest.com

Source: pinterest.com

This Volatility Indicator can also be used with any forex trading strategy or trading indicator. Implied volatility is a term that refers to a certain measurement that establishes the likelihood a particular market is to change over time. Foreign exchange currency implied volatility refers to the constant movement and changes in exchange rates in the worlds global foreign exchange market. Implied volatility can also help you measure sentiment. The term structures of implied volatilities provide indications of the markets near- and long-term uncertainty about future short- and long-term swap rates.

Source: pinterest.com

Source: pinterest.com

Get insights that every beginner should know to successfully trade the forex market. USING IMPLIED VOLATILITY TO TRADE COMMODITIES STOCKS INDICIES. It can therefore help traders make decisions about option pricing and whether it is a good time to buy or sell options. Implied volatilityIV or vol in essence is the expected change in price over a given period and is a useful if not slightly peculiar indicator. Implied volatility rank or IVR represents a ranking system that compares is implied volatility is high or low in a specific asset based on the past year of IV data.

Source: id.pinterest.com

Source: id.pinterest.com

Implied Volatility IV tends to rise when traders are worried about risk or are becoming very fearful options are seen as being overvalued. Implied volatility is a term that refers to a certain measurement that establishes the likelihood a particular market is to change over time. What is Forex Implied Volatility Data. An FX implied volatility surface sample data is shown below. Importance of IV Rank.

Source: pinterest.com

Source: pinterest.com

Implied volatilityIV or vol in essence is the expected change in price over a given period and is a useful if not slightly peculiar indicator. A risk reversal refers to the difference between the volatility of the call option and the put option at the same moneyness level while a butterfly spread is the difference between the average volatility of the call and put options with the same moneyness level and ATM volatility. Implied volatilityIV or vol in essence is the expected change in price over a given period and is a useful if not slightly peculiar indicator. The Volatility Indicator is basically to know the. For example this EURGBP analysis that defined a 24-hour implied volatility trading range for EURGBP provided an illustrated example of how these technical barriers can help traders identify possible inflection points and trading opportunities.

Source: pinterest.com

Source: pinterest.com

Foreign exchange currency implied volatility refers to the constant movement and changes in exchange rates in the worlds global foreign exchange market. Options implied volatility as mentioned in the previous posts is the expected volatility of the stock in the time of the options life. Implied volatilityIV or vol in essence is the expected change in price over a given period and is a useful if not slightly peculiar indicator. Get insights that every beginner should know to successfully trade the forex market. Forex Volatility Charts Live - Today This Week This Month USD EUR JPY GBP CHF CAD AUD NZD.

Source: pinterest.com

Source: pinterest.com

As mentioned above measures of implied volatility can. Implied Volatility IV is being used extensively in the Option world to project the Expected Move for the underlying instrument. USING IMPLIED VOLATILITY TO TRADE COMMODITIES STOCKS INDICIES. News Analysis at your fingertips. As IV is a factor in option pricing models with all other things being equal as in strike price duration etc the higher the IV the higher the price of the option.

Source: pinterest.com

Source: pinterest.com

In addition to forex implied volatility gauges can be incorporated into trading strategies for commodities stocks and indices. Implied volatility rank or IVR represents a ranking system that compares is implied volatility is high or low in a specific asset based on the past year of IV data. The term structures of implied volatilities provide indications of the markets near- and long-term uncertainty about future short- and long-term swap rates. Implied volatility implies the ex pected volatility of a stock over the life of the option. Forex volatility charts tell you which currency is most volatile relative to each other.

Source: pinterest.com

Source: pinterest.com

Implied volatility rank or IVR represents a ranking system that compares is implied volatility is high or low in a specific asset based on the past year of IV data. As this can be used with any type of currency pair so this can also be used as a combination with other trading indicators and the trading strategies to give better trading results. The Volatility Indicator is basically to know the. Implied Volatility IV tends to rise when traders are worried about risk or are becoming very fearful options are seen as being overvalued. Implied Volatility IV is being used extensively in the Option world to project the Expected Move for the underlying instrument.

Source: pinterest.com

Source: pinterest.com

To better understand we should split it. VIX is used as a proxy for SPYs IV for 30 days. USING IMPLIED VOLATILITY TO TRADE COMMODITIES STOCKS INDICIES In addition to forex implied volatility gauges can be incorporated into trading strategiesfor commodities stocks and indices. Options Market Overview Options Strategy Indexes Unusual Options Activity IV Rank and IV Percentile Most Active Options Unusual Options Volume Highest Implied Volatility Change in Volatility Options Volume Leaders Change in Open Interest Options Price History Options Screener. The Volatility Indicator is basically to know the.

Source: pinterest.com

Source: pinterest.com

Ad Learn how to trade Forex with our ultimate and updated beginners guide. This indicator is meaningful only for SPY but can be used in any other instrument which has a. Forex Volatility Charts Live - Today This Week This Month USD EUR JPY GBP CHF CAD AUD NZD. USING IMPLIED VOLATILITY TO TRADE COMMODITIES STOCKS INDICIES. Implied volatility implies the ex pected volatility of a stock over the life of the option.

Source: pinterest.com

Source: pinterest.com

As IV is a factor in option pricing models with all other things being equal as in strike price duration etc the higher the IV the higher the price of the option. VIX is used as a proxy for SPYs IV for 30 days. Importance of IV Rank. Largely owed to the inherent mean-reverting characteristic of major currency pairs implied volatility trading ranges typically serve as robust forex signals. Implied Volatility - Implied Volatility can help traders determine if options are fairly valued undervalued or overvalued.

Source: pinterest.com

Source: pinterest.com

It can therefore help traders make decisions about option pricing and whether it is a good time to buy or sell options. In addition to forex implied volatility gauges can be incorporated into trading strategies for commodities stocks and indices. Implied volatility is a term that refers to a certain measurement that establishes the likelihood a particular market is to change over time. Implied volatility can also help you measure sentiment. For example this EURGBP analysis that defined a 24-hour implied volatility trading range for EURGBP provided an illustrated example of how these technical barriers can help traders identify possible inflection points and trading opportunities.

Source: pinterest.com

Source: pinterest.com

Importance of IV Rank. Implied volatility rank or IVR represents a ranking system that compares is implied volatility is high or low in a specific asset based on the past year of IV data. Foreign exchange currency implied volatility refers to the constant movement and changes in exchange rates in the worlds global foreign exchange market. Forex volatility charts tell you which currency is most volatile relative to each other. Ad Learn how to trade Forex with our ultimate and updated beginners guide.

Source: hu.pinterest.com

Source: hu.pinterest.com

Largely owed to the inherent mean-reverting characteristic of major currency pairs implied volatility trading ranges typically serve as robust forex signals. It can therefore help traders make decisions about option pricing and whether it is a good time to buy or sell options. The Volatility Indicator can be used with any forex currency pair. In addition to forex implied volatility gauges can be incorporated into trading strategies for commodities stocks and indices. To better understand we should split it.

Source: pinterest.com

Source: pinterest.com

Implied volatility for currency crosses will generally be higher than the implied volatility of the majors. Options Market Overview Options Strategy Indexes Unusual Options Activity IV Rank and IV Percentile Most Active Options Unusual Options Volume Highest Implied Volatility Change in Volatility Options Volume Leaders Change in Open Interest Options Price History Options Screener. Implied volatility is a projection it may deviate from actual future volatility. Implied volatility rank or IVR represents a ranking system that compares is implied volatility is high or low in a specific asset based on the past year of IV data. To better understand we should split it.

Source: pinterest.com

Source: pinterest.com

As this can be used with any type of currency pair so this can also be used as a combination with other trading indicators and the trading strategies to give better trading results. So a security with a high volatility will be one that has a price that is going up and down quite frequently while a stock with low volatility will have a price that is fluctuating much more slowly. As mentioned above measures of implied volatility can. As IV is a factor in option pricing models with all other things being equal as in strike price duration etc the higher the IV the higher the price of the option. Implied Volatility IV tends to rise when traders are worried about risk or are becoming very fearful options are seen as being overvalued.

Source: pinterest.com

Source: pinterest.com

USING IMPLIED VOLATILITY TO TRADE COMMODITIES STOCKS INDICIES. An FX implied volatility surface sample data is shown below. Implied volatility can also help you measure sentiment. Implied volatility implies the ex pected volatility of a stock over the life of the option. What is Forex Implied Volatility Data.

Source: pinterest.com

Source: pinterest.com

Implied volatility implies the ex pected volatility of a stock over the life of the option. The term structures of implied volatilities provide indications of the markets near- and long-term uncertainty about future short- and long-term swap rates. Largely owed to the inherent mean-reverting characteristic of major currency pairs implied volatility trading ranges typically serve as robust forex signals. As this can be used with any type of currency pair so this can also be used as a combination with other trading indicators and the trading strategies to give better trading results. Implied volatility for currency crosses will generally be higher than the implied volatility of the majors.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title forex implied volatility by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.