Your Fx option volatility bitcoin are available. Fx option volatility are a coin that is most popular and liked by everyone today. You can News the Fx option volatility files here. Find and Download all royalty-free mining.

If you’re looking for fx option volatility pictures information linked to the fx option volatility topic, you have visit the right blog. Our website always gives you suggestions for viewing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

Fx Option Volatility. In general callput options are quoted with respect to their Black-Scholes volatility. A long low IV-short high IV strategy produces large average returns after transaction costs. An implied volatility is the volatility implied by the market price of an option based on the Black-Scholes option pricing model. Furthermore FX option brokers estimate the implied volatility and other price-influencing parameters to offer efficient quotes on their markets.

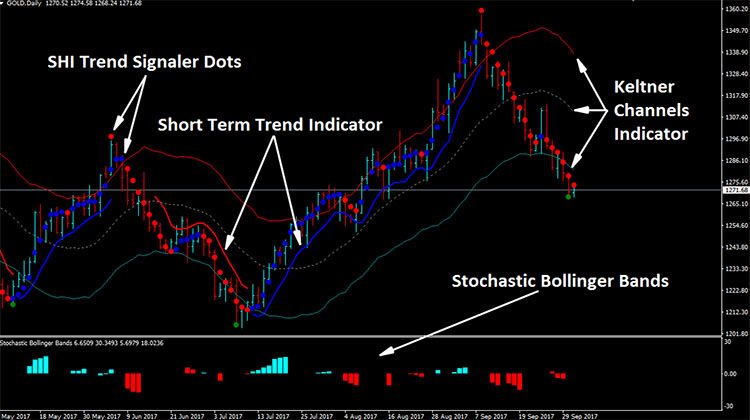

Bollinger Bands With Stochastic Histogram Reversal Strategy Technical Analysis Charts Trading Forex From pinterest.com

Bollinger Bands With Stochastic Histogram Reversal Strategy Technical Analysis Charts Trading Forex From pinterest.com

The volatility smile is the crucial input into pricing and risk management procedures since it is used to price vanilla as well as exotic option books. FX Options for Low Volatility Markets In the case study examples that follow we will uncover the best strategies for taking advantage of these types of low volatility environments examining the benefits risks and mechanics of each option type. FX Volatility Convention. The fairness of the pricing model behind the currency options quotes is decisive for the acceptance and success of the market. Long straddle positions in currencies with low high IVs perform well poorly. We can also invert the relation and calculate which so-called implied volatility should be used to result in a certain price.

The fairness of the pricing model behind the currency options quotes is decisive for the acceptance and success of the market.

An increase in volatility will increase the prices of all the options on an asset and a decrease in volatility causes all the options to decrease in value. CMIS 2013132903 April 10 2014 Quantitative Risk Group Commercial In Confidence. We assume that readers have at least some knowledge to these terms and what they refer to. In general callput options are quoted with respect to their Black-Scholes volatility. Volatility is a key component of the options pricing model. A long low IV-short high IV strategy produces large average returns after transaction costs.

Source: pinterest.com

Source: pinterest.com

FX Option Pricing with Stochastic-Local Volatility Model Zili Zhu Oscar Yu Tian Geoffrey Lee Xiaolin Luo Bowie Owens and Thomas Lo Report Number. In general callput options are quoted with respect to their Black-Scholes volatility. The process to built the surface is basically the following. The volatility smile is the crucial input into pricing and risk management procedures since it is used to price vanilla as well as exotic option books. The options chain example above shows a one-month option price that is closest to the money 106 has implied volatility of 773.

Source: pinterest.com

Source: pinterest.com

We assume that readers have at least some knowledge to these terms and what they refer to. Furthermore FX option brokers estimate the implied volatility and other price-influencing parameters to offer efficient quotes on their markets. An implied volatility is the volatility implied by the market price of an option based on the Black-Scholes option pricing model. Volatility smile Foreign Exchange FX European vanilla options are valued with the well-known Black Scholes model. The only unobserved input to this model is the volatility.

Source: pinterest.com

Source: pinterest.com

The process to built the surface is basically the following. An implied volatility is the volatility implied by the market price of an option based on the Black-Scholes option pricing model. Implied volatility gauges actual volatility expectations and is a key determinant of FX option premium - its significantly higher with limited setbacks and. We assume that readers have at least some knowledge to these terms and what they refer to. The options chain example above shows a one-month option price that is closest to the money 106 has implied volatility of 773.

Source: id.pinterest.com

Source: id.pinterest.com

The lowest volatility levels in the past five years. FX Options Volatility Surface. One-month volatility on the lira has shot up north of 41 meaning straddles on that expiry are pricing in a decline in the currency to as much as 136818 per dollarThree-month volatility on a closing basis is at the highest since 2018 factoring in the possibility of a slump to 148364 per dollar. Risk reversal is the di erence between the volatility of the call price and the put price with the same moneyness levels. Deterministic interest rates an option on the FX spot with a strike 𝐾𝐾 can be priced in Black -Scholes model.

Source: pinterest.com

Source: pinterest.com

Deterministic interest rates an option on the FX spot with a strike 𝐾𝐾 can be priced in Black -Scholes model. Furthermore FX option brokers estimate the implied volatility and other price-influencing parameters to offer efficient quotes on their markets. We assume that readers have at least some knowledge to these terms and what they refer to. We will be using simplified model using at the money risk reversal and strangle volatilities quotations for the purpose. In the money for a put option this is when the current price is less than the strike price and would thus generate a profit were it exercised.

Source: pinterest.com

Source: pinterest.com

Pricing information for EDI FX Option Volatility Data for valuations portfolio analytics and risk management daily updates is available by getting in contact with Exchange Data International. Volatility trading is trading the expected future volatility of an underlying instrument. A long low IV-short high IV strategy produces large average returns after transaction costs. An implied volatility is the volatility implied by the market price of an option based on the Black-Scholes option pricing model. Connect with Exchange Data International to get a quote and arrange.

Source: pinterest.com

Source: pinterest.com

G10 FX option implied volatility warns against complacency - standing firm by longer term highs despite a relatively quiet session before major US. In the FX market we define the risk reversal volatility as sigma_25-RR sigma_25-Call - sigma_25-Put Question. FX Options for Low Volatility Markets In the case study examples that follow we will uncover the best strategies for taking advantage of these types of low volatility environments examining the benefits risks and mechanics of each option type. Answer 1 of 6. We can also invert the relation and calculate which so-called implied volatility should be used to result in a certain price.

Source: pinterest.com

Source: pinterest.com

Provides price transparency between the OTC and CME options markets. The volatility smile is the crucial input into pricing and risk management procedures since it is used to price vanilla as well as exotic option books. Calibration of the FX Heston Model FX Option Volatility Surface Risk Reversal. G10 FX option implied volatility warns against complacency - standing firm by longer term highs despite a relatively quiet session before major US. Furthermore FX option brokers estimate the implied volatility and other price-influencing parameters to offer efficient quotes on their markets.

Source: pinterest.com

Source: pinterest.com

Provides price transparency between the OTC and CME options markets. We can also invert the relation and calculate which so-called implied volatility should be used to result in a certain price. An FX volatility surface is a three-dimensional plot of the implied volatility as a function of term and Delta and smile. Instead of trading directly on the stock price or futures and trying to predict the market direction the volatility trading strategies seek to gauge how much the stock price will move regardless of the current trends and price action. Volatility smile Foreign Exchange FX European vanilla options are valued with the well-known Black Scholes model.

Source: pinterest.com

Source: pinterest.com

In the FX OTC derivative market the volatility smile is not directly observable as opposed to the equity markets where strike-price or strike-volatility pairs can be. Deterministic interest rates an option on the FX spot with a strike 𝐾𝐾 can be priced in Black -Scholes model. The lowest volatility levels in the past five years. In general callput options are quoted with respect to their Black-Scholes volatility. Calibration of the FX Heston Model FX Option Volatility Surface Risk Reversal.

Source: pinterest.com

Source: pinterest.com

An increase in volatility will increase the prices of all the options on an asset and a decrease in volatility causes all the options to decrease in value. FX Options for Low Volatility Markets In the case study examples that follow we will uncover the best strategies for taking advantage of these types of low volatility environments examining the benefits risks and mechanics of each option type. Change of numéraire the implied volatility of an FX option depends on the numéraire of the purchaser again because of the non-linearity of. Long straddle positions in currencies with low high IVs perform well poorly. The volatility smile is the crucial input into pricing and risk management procedures since it is used to price vanilla as well as exotic option books.

Source: pinterest.com

Source: pinterest.com

As far as our. Furthermore FX option brokers estimate the implied volatility and other price-influencing parameters to offer efficient quotes on their markets. We can also invert the relation and calculate which so-called implied volatility should be used to result in a certain price. One-month volatility on the lira has shot up north of 41 meaning straddles on that expiry are pricing in a decline in the currency to as much as 136818 per dollarThree-month volatility on a closing basis is at the highest since 2018 factoring in the possibility of a slump to 148364 per dollar. In the FX market we define the risk reversal volatility as sigma_25-RR sigma_25-Call - sigma_25-Put Question.

Source: pinterest.com

Source: pinterest.com

We will be using simplified model using at the money risk reversal and strangle volatilities quotations for the purpose. Provides price transparency between the OTC and CME options markets. FX Options Volatility Surface. We will be using simplified model using at the money risk reversal and strangle volatilities quotations for the purpose. Is this the value to input in a Black-Scholes formula to get the price of a risk reversal option More precisely is any one of these equations holds.

Source: pinterest.com

Source: pinterest.com

Pricing information for EDI FX Option Volatility Data for valuations portfolio analytics and risk management daily updates is available by getting in contact with Exchange Data International. G10 FX option implied volatility warns against complacency - standing firm by longer term highs despite a relatively quiet session before major US. We will be using simplified model using at the money risk reversal and strangle volatilities quotations for the purpose. A simple options calculator will allow you to input a price and find the fx option volatility of a specific currency instrument. Volatility smile Foreign Exchange FX European vanilla options are valued with the well-known Black Scholes model.

Source: pinterest.com

Source: pinterest.com

An FX volatility surface is a three-dimensional plot of the implied volatility as a function of term and Delta and smile. A long low IV-short high IV strategy produces large average returns after transaction costs. Change of numéraire the implied volatility of an FX option depends on the numéraire of the purchaser again because of the non-linearity of. Is this the value to input in a Black-Scholes formula to get the price of a risk reversal option More precisely is any one of these equations holds. Collect market quotes for options also spot forwards and interest rates.

Source: pinterest.com

Source: pinterest.com

The fairness of the pricing model behind the currency options quotes is decisive for the acceptance and success of the market. Deterministic interest rates an option on the FX spot with a strike 𝐾𝐾 can be priced in Black -Scholes model. The term structures of implied volatilities. An FX volatility surface is a three-dimensional plot of the implied volatility as a function of term and Delta and smile. Long straddle positions in currencies with low high IVs perform well poorly.

Source: pinterest.com

Source: pinterest.com

Risk reversal is the di erence between the volatility of the call price and the put price with the same moneyness levels. The process to built the surface is basically the following. In the FX OTC derivative market the volatility smile is not directly observable as opposed to the equity markets where strike-price or strike-volatility pairs can be. Volatility smile Foreign Exchange FX European vanilla options are valued with the well-known Black Scholes model. As far as our.

Source: pinterest.com

Source: pinterest.com

We can also invert the relation and calculate which so-called implied volatility should be used to result in a certain price. We will be using simplified model using at the money risk reversal and strangle volatilities quotations for the purpose. An increase in volatility will increase the prices of all the options on an asset and a decrease in volatility causes all the options to decrease in value. Is this the value to input in a Black-Scholes formula to get the price of a risk reversal option More precisely is any one of these equations holds. Implied volatility gauges actual volatility expectations and is a key determinant of FX option premium - its significantly higher with limited setbacks and.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fx option volatility by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.