Your Highest option volatility coin are obtainable. Highest option volatility are a coin that is most popular and liked by everyone today. You can Find and Download the Highest option volatility files here. News all free news.

If you’re looking for highest option volatility pictures information connected with to the highest option volatility keyword, you have visit the ideal blog. Our website frequently provides you with suggestions for viewing the highest quality video and picture content, please kindly surf and find more informative video articles and images that fit your interests.

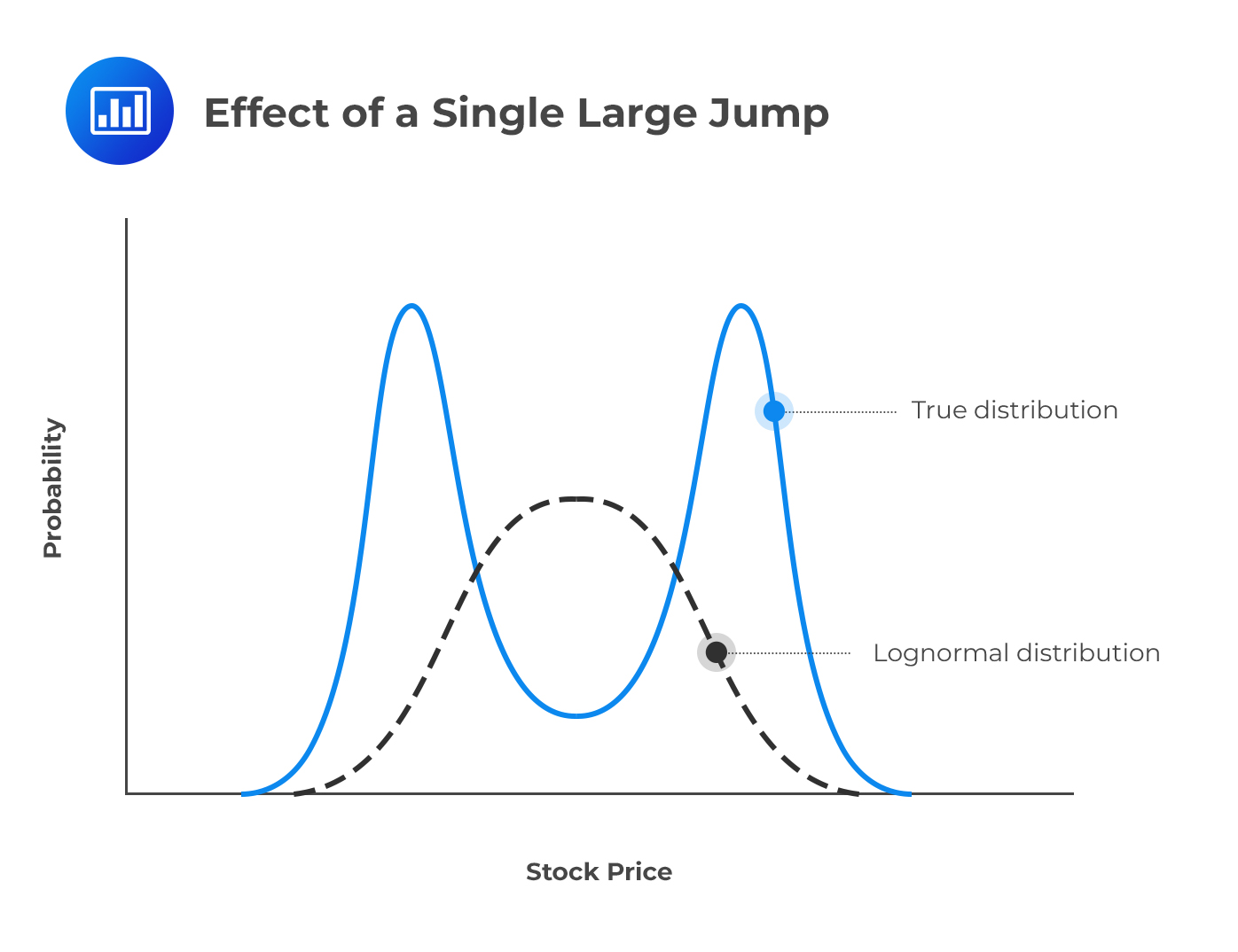

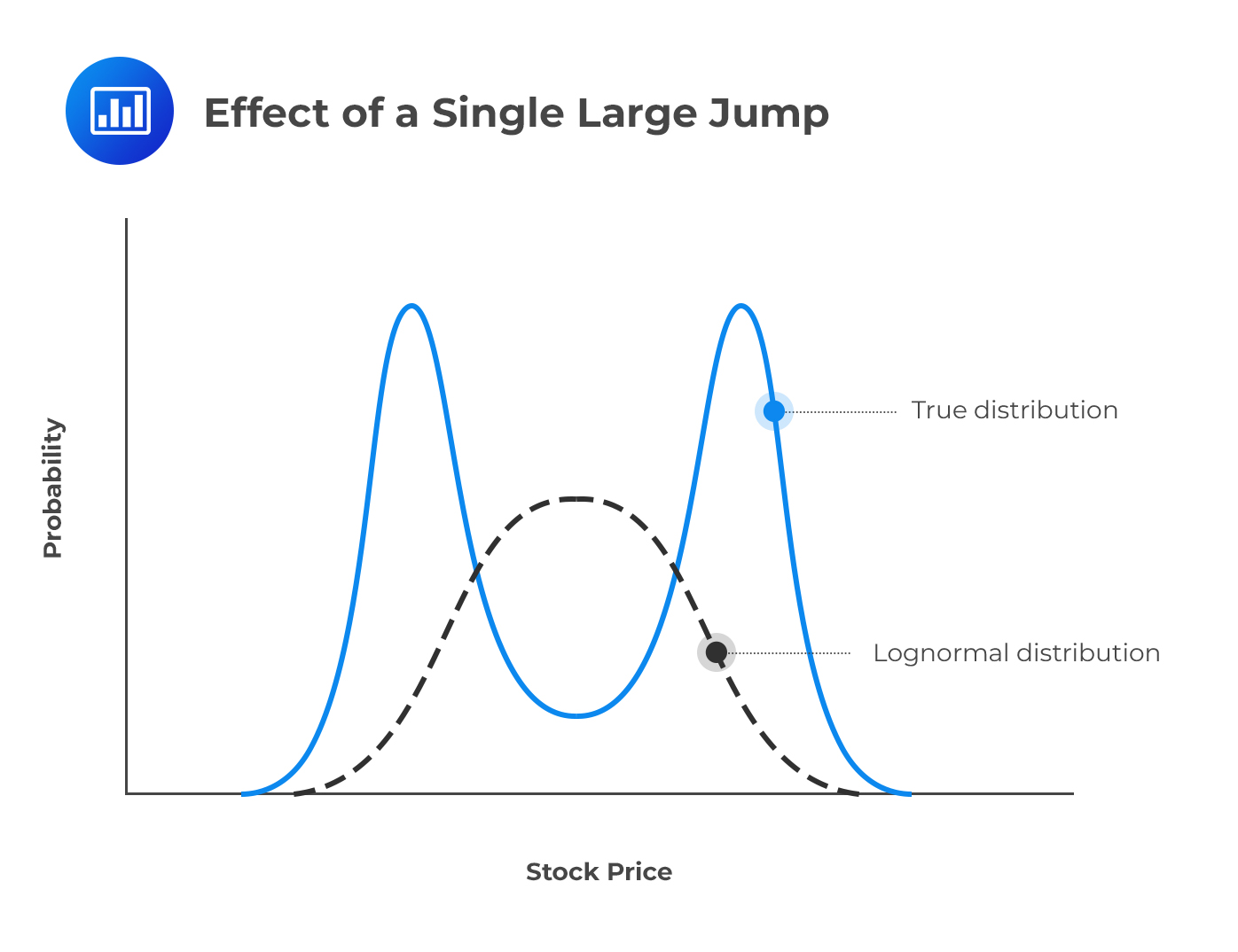

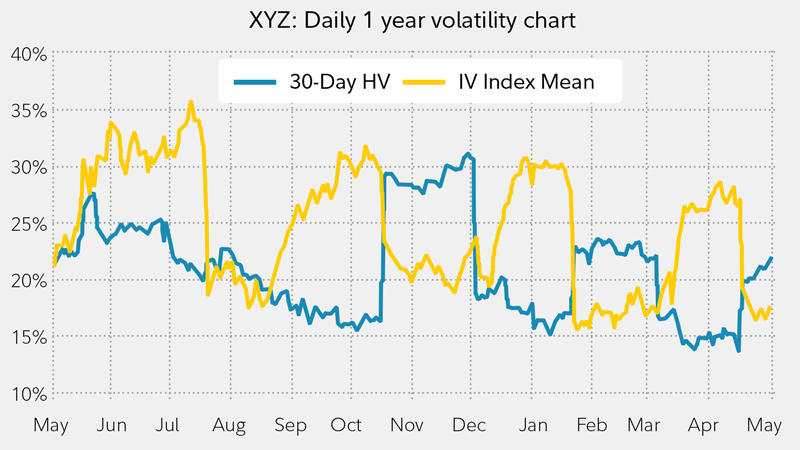

Highest Option Volatility. As of 27th June 2021 the image also reflects its current price Market Capitalization etc. Implied volatility rises when the demand for an option increases and when the markets expectations for the underlying stock is positive. As the likelihood of the share price deviating further from the strike prices increases the option contract typically increases in value. High IV strategies are trades that we use most commonly in high volatility environments.

Volatility Smiles Frm Part 2 Study Notes Analystprep From analystprep.com

Volatility Smiles Frm Part 2 Study Notes Analystprep From analystprep.com

Even though the options price is higher at the second measurement it is still considered cheaper based on volatility. A high or low percent change typically indicates the market is expecting a greater movement in the stocks price. You will see higher-priced option premiums on options with high volatility. Bitcoin 50-day realized volatility. US Canadian European and Asian equities stocks indices and funds futures and options back to 2000. Besides Bitcoin there are many other excellent trading options as well and changes related to volatility are frequent all the time.

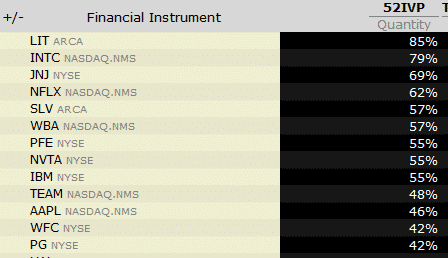

The above list displays 22 high volatile stocks with high beta.

The implied volatility of the option is determined to be 180. Here are the cryptocurrencies with the highest volatility in. As of 27th June 2021 the image also reflects its current price Market Capitalization etc. This is often due to an upcoming or impending event such as an earnings announcement analyst conference presentation or SEC filing. This means that option sellers have an edge because they are selling these too expensive options. High IV strategies are trades that we use most commonly in high volatility environments.

Source: optionstradingiq.com

Source: optionstradingiq.com

Options prices volumes and OI implied volatilities and Greeks volatility surfaces by delta and by moneyness Implied Volatility Index and other data. They offer a whole variety of options for scanning volatility including a Volatility Ranker and a Spread Scanner that looks deeply into implied volatility data to identify spreads that take advantage of higher or lower than usual IV. If options prices tend to be high in times of high implied volatility and implied volatility usually has been higher than actual volatility that means that options have been overpriced most of the time. The above data displays a 74 average 50-day volatility over the past two years. A competing service thats worth looking into is Market Chameleon.

Source: investopedia.com

Source: investopedia.com

Bitcoin 50-day realized volatility. Besides Bitcoin there are many other excellent trading options as well and changes related to volatility are frequent all the time. For this reason we always sell implied volatility. This means that option sellers have an edge because they are selling these too expensive options. The Highest Implied Volatility Options option screen shows the highest implied volatility options in descending order both calls and puts.

Source: analystprep.com

Source: analystprep.com

The percent change represents the shift in implied volatility from the previous sessions close. You will see higher-priced option premiums on options with high volatility and cheaper premiums with low volatility. During quieter periods traders tend to over-leverage which then causes larger liquidations during sudden price moves. Besides Bitcoin there are many other excellent trading options as well and changes related to volatility are frequent all the time. According to the volatility index VIX 2020 has been the most volatile trading year to date.

Source: medium.com

Source: medium.com

The best example is BTC which is a leader and has the highest volume. You will see higher-priced option premiums on options with high volatility and cheaper premiums with low volatility. Volatility can benefit investors from every point of view. Learn the best volatility trading strategies for the options market. Our favorite strategy is the iron condor followed by short strangles and straddles.

Implied volatility rises when the demand for an option increases and when the markets expectations for the underlying stock is positive. For this reason we always sell implied volatility. Options with elevated implied volatility are an indication that investors are anticipating the underlying equity to experience higher than normal price swings relative to its historical range. A competing service thats worth looking into is Market Chameleon. Highest Implied Volatility Options Screen.

Source: dailyfx.com

Source: dailyfx.com

As the likelihood of the share price deviating further from the strike prices increases the option contract typically increases in value. Add Filter filter_optionsfilter_options_selected_2help_text Applied Filters. US Canadian European and Asian equities stocks indices and funds futures and options back to 2000. Our favorite strategy is the iron condor followed by short strangles and straddles. The Highest Implied Volatility Options option screen shows the highest implied volatility options in descending order both calls and puts.

Source: dailyfx.com

Source: dailyfx.com

If options prices tend to be high in times of high implied volatility and implied volatility usually has been higher than actual volatility that means that options have been overpriced most of the time. Conversely as the markets expectations decrease or demand for an option diminishes implied. You will see higher-priced option premiums on options with high volatility and cheaper premiums with low volatility. Options that have high levels of implied volatility will result in high-priced option premiums. A short time later the option is trading at 210 with the underlying at 4334 yielding an implied volatility of 172.

Source: investopedia.com

Source: investopedia.com

The above list displays 22 high volatile stocks with high beta. Even though the options price is higher at the second measurement it is still considered cheaper based on volatility. 26 rows Top Mutual Funds. You will see higher-priced option premiums on options with high volatility and cheaper premiums with low volatility. This means that option sellers have an edge because they are selling these too expensive options.

As of 27th June 2021 the image also reflects its current price Market Capitalization etc. Here are the cryptocurrencies with the highest volatility in. The high volatility will keep your option price elevated and it will quickly drop as volatility begins to drop. Options that have high levels of implied volatility will result in high-priced option premiums. During quieter periods traders tend to over-leverage which then causes larger liquidations during sudden price moves.

Source: tradestation.com

Source: tradestation.com

What is IV Rank. This means that option sellers have an edge because they are selling these too expensive options. The implied volatility of the option is determined to be 180. When implied volatility is high we like to collect creditsell premium and hope for a contraction in volatility. You will see higher-priced option premiums on options with high volatility and cheaper premiums with low volatility.

Source: powercycletrading.com

Source: powercycletrading.com

Implied volatility rises when the demand for an option increases and when the markets expectations for the underlying stock is positive. That is why option premium selling works. On the other hand implied volatility decreases with a lesser demand and when the underlying stock has a negative outlook. A short time later the option is trading at 210 with the underlying at 4334 yielding an implied volatility of 172. High IV strategies are trades that we use most commonly in high volatility environments.

Source: investopedia.com

Source: investopedia.com

As the likelihood of the share price deviating further from the strike prices increases the option contract typically increases in value. The Highest Increase in Implied Volatility option screen shows options that have shown a significant increase in implied volatility since the previous trading session. As of 27th June 2021 the image also reflects its current price Market Capitalization etc. If options prices tend to be high in times of high implied volatility and implied volatility usually has been higher than actual volatility that means that options have been overpriced most of the time. In the Stock Market it performs well.

Source: investopedia.com

Source: investopedia.com

The above data displays a 74 average 50-day volatility over the past two years. As of 27th June 2021 the image also reflects its current price Market Capitalization etc. The implied volatility of the option is determined to be 180. The best example is BTC which is a leader and has the highest volume. A competing service thats worth looking into is Market Chameleon.

Source: optionistics.com

Source: optionistics.com

This means that option sellers have an edge because they are selling these too expensive options. You will see higher-priced option premiums on options with high volatility and cheaper premiums with low volatility. That is partially due to realized volatility being a backward-looking indicator. Bitcoin 50-day realized volatility. Volatility can benefit investors from every point of view.

IV rank or implied volatility rank is a metric used to identify a securitys implied volatility compared to its IV history and is an important metric for day tradersIf I were to tell you that a stocks implied volatility is 50 you might think that is high until I told you it was a biotech penny stock that regularly makes 100 moves in a week. A competing service thats worth looking into is Market Chameleon. The percent change represents the shift in implied volatility from the previous sessions close. High IV strategies are trades that we use most commonly in high volatility environments. Add Filter filter_optionsfilter_options_selected_2help_text Applied Filters.

When implied volatility is high we like to collect creditsell premium and hope for a contraction in volatility. Short calls and puts have their place and can be very effective but should only be run by more experienced option traders. A high or low percent change typically indicates the market is expecting a greater movement in the stocks price. Our favorite strategy is the iron condor followed by short strangles and straddles. Options prices volumes and OI implied volatilities and Greeks volatility surfaces by delta and by moneyness Implied Volatility Index and other data.

Source: fidelity.com

Source: fidelity.com

When implied volatility is high we like to collect creditsell premium and hope for a contraction in volatility. 26 rows Top Mutual Funds. Conversely as the markets expectations decrease or demand for an option diminishes implied. The above data displays a 74 average 50-day volatility over the past two years. On the other hand implied volatility decreases with a lesser demand and when the underlying stock has a negative outlook.

What is IV Rank. On the other hand implied volatility decreases with a lesser demand and when the underlying stock has a negative outlook. Historically implied volatility has outperformed realized implied volatility in the markets. During quieter periods traders tend to over-leverage which then causes larger liquidations during sudden price moves. Options prices volumes and OI implied volatilities and Greeks volatility surfaces by delta and by moneyness Implied Volatility Index and other data.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title highest option volatility by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.