Your Individual stock volatility coin are ready. Individual stock volatility are a trading that is most popular and liked by everyone today. You can Get the Individual stock volatility files here. Find and Download all royalty-free exchange.

If you’re searching for individual stock volatility pictures information linked to the individual stock volatility interest, you have pay a visit to the right site. Our website frequently gives you hints for viewing the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and images that match your interests.

Individual Stock Volatility. Volatility can be measured by comparing current or expected returns against the stock or markets mean average and typically represents a large positive or negative change. While theres no trend toward increased volatility at the market level there is a significant trend of increasing idiosyncratic volatility at the individual firm level. Just like equity markets individual stocks can also experience volatility. While VIX measures SP 500 volatility the average true range indicator developed by J.

Investor Types And Stock Return Volatility Sciencedirect From sciencedirect.com

Investor Types And Stock Return Volatility Sciencedirect From sciencedirect.com

Maheu Search for more papers by this author. The primary reason behind this is in a bullish market investors expect prices to increase over time and therefore IV goes down. Think of this as stocks that have very volatile implied volatility. To help prevent this we suggest that investors consider a stocks beta a common measure of stock volatility when purchasing a stock. Welles Wilder Jr is a technical chart indicator that can be applied to any stock exchange-traded fund. According to Constantinides 1984 the individual stock volatility should play a major role in a decision to execute the tax-trading strategy as the profits increase from low to high volatility stocks.

The stock return.

Historical and current market data analysis using online tools. Monetary policy fiscal policy or uncertainty over political events like. Every stock is a part of a larger market. When applied to stock markets a bearish market will show a high implied volatility rate as opposed to a bullish market where implied volatility will be low. Both individual stocks and the SP 500 generally move around over the course of a day. Welles Wilder Jr is a technical chart indicator that can be applied to any stock exchange-traded fund.

Source: investopedia.com

Source: investopedia.com

But when it comes to broader market volatility a variety of causes can trigger bigger swings in share prices. Stock trend analysis using. McCurdy Maheu is from the Department of Economics University of Toronto and McCurdy is from the Joseph L. But when it comes to broader market volatility a variety of causes can trigger bigger swings in share prices. Maheu Search for more papers by this author.

Source: investopedia.com

Source: investopedia.com

When it comes to individual stocks events tied to the companys performance such as earnings or a product announcement can drive volatility in its shares. Volatility of Single Stocks. AnsThere is a strong relationship between the average returns and AnsDiversification is the elimination of risk by combining multiple assets historical volatility of portfolios but this relationship breaks down when looking at average returns and historical volatility of individual stocks. But when it comes to broader market volatility a variety of causes can trigger bigger swings in share prices. Volatility can be measured by comparing current or expected returns against the stock or markets mean average and typically represents a large positive or negative change.

Source: ft.com

Source: ft.com

The stock return. Stock volatility refers to the potential for a given stock to experience a drastic decrease or increase in value within a predetermined period of timeInvestors evaluate the volatility of stock before making a decision to purchase a new stock offering buy additional shares of a stock. Just like equity markets individual stocks can also experience volatility. On theoretical grounds it is possible that the volatility of individual stocks has increased while the volatility of the market as a whole has remained stable. Implied and realized historical volatility correlation implied volatility skew and volatility surface.

Source: lynalden.com

Source: lynalden.com

Typically a stock. Volatility is the up-and-down change in the price or value of an individual stock or the overall market during a given period of time. McCurdy Maheu is from the Department of Economics University of Toronto and McCurdy is from the Joseph L. Implied and realized historical volatility correlation implied volatility skew and volatility surface. Individual stocks tend to have highly volatile prices and the returns you might receive on any single stock may vary wildly.

Source: sciencedirect.com

Source: sciencedirect.com

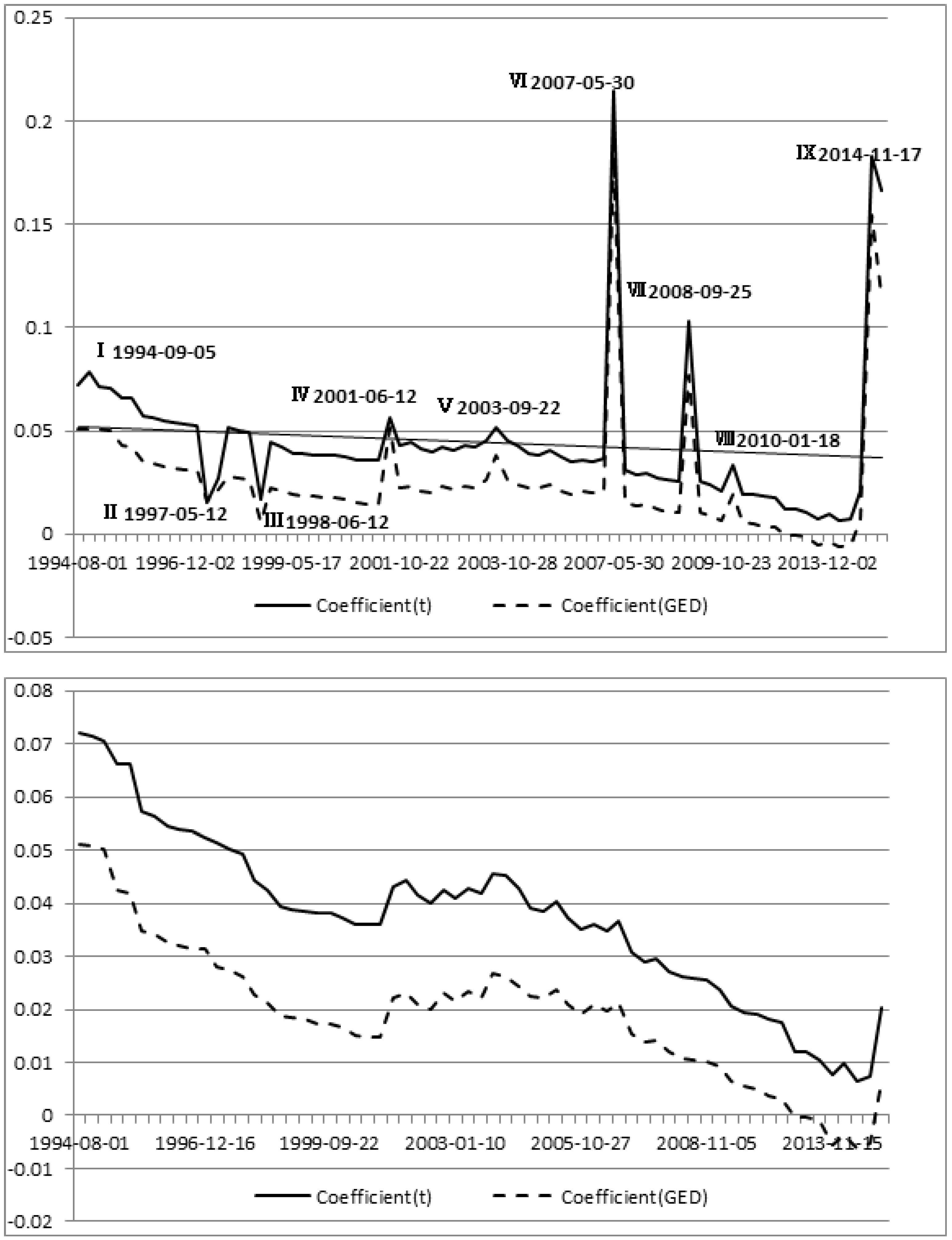

News Arrival Jump Dynamics and Volatility Components for Individual Stock Returns. 103 rows Stock volatility refers to the changes in the value of that stock. In this study we show that the volatility of individual stocks has indeed increased over the decades of the 1980s and 1990s. Individual stock volatility sorts and abnormal trading. AnsThere is a strong relationship between the average returns and AnsDiversification is the elimination of risk by combining multiple assets historical volatility of portfolios but this relationship breaks down when looking at average returns and historical volatility of individual stocks.

Source: researchgate.net

Source: researchgate.net

VIX Futures Premium help. The stock return. Think of this as stocks that have very volatile implied volatility. Implied and realized historical volatility correlation implied volatility skew and volatility surface. Implied volatility for US equity and futures markets.

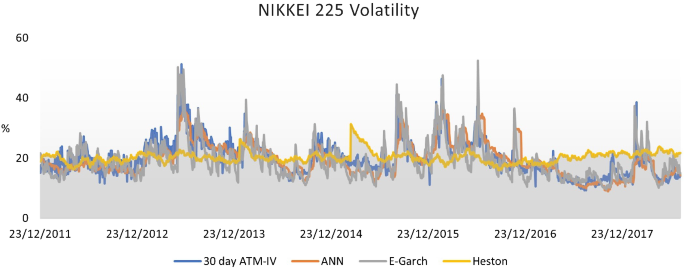

Source: mdpi.com

Source: mdpi.com

Typically a stock. Maheu Search for more papers by this author. You want to pay attention to the prices at the close of each day over the course of a certain period of time to determine if the market or an individual stock is acting volatile. Stock trend analysis using. In this study we show that the volatility of individual stocks has indeed increased over the decades of the 1980s and 1990s.

Source: qontigo.com

Source: qontigo.com

Individual stocks become more volatile over the 19762000 period during which quarterly accounting data are available at the firm level. Individual Stocks Have Become More Volatile. VIX Futures Premium help. But when it comes to broader market volatility a variety of causes can trigger bigger swings in share prices. The total volatility for individual stocks and for.

Source: investopedia.com

Source: investopedia.com

Volatility is the up-and-down change in the price or value of an individual stock or the overall market during a given period of time. IVX Monitor service provides current readings of intraday. Things like index funds the SP 500 and NASDAQ are all examples of larger markets made up of several individual stocks. Rotman School of Management University of Toronto and is an Associated Fellow of. Pan 2002 based on index options higher volatility smirks in individual options should reflect a greater risk of large negative price jumps2 For our sample pe-riod of 19962005 stocks with steeper volatility smirks underperform those with flatter smirks by 1090 per year on a risk-adjusted basis using the Fama and French 1996 3.

Source: exploitinvesting.com

Source: exploitinvesting.com

Volatility can be measured by comparing current or expected returns against the stock or markets mean average and typically represents a large positive or negative change. IVX Monitor service provides current readings of intraday. The primary reason behind this is in a bullish market investors expect prices to increase over time and therefore IV goes down. In this study we show that the volatility of individual stocks has indeed increased over the decades of the 1980s and 1990s. A stock that maintains a relatively stable price has low volatility.

Source: wikihow.com

Source: wikihow.com

Malcolm Tatum Stock volatility is when stock dramatically increases or decreases within a period of time. Individual stocks become more volatile over the 19762000 period during which quarterly accounting data are available at the firm level. A stock with a price that fluctuates wildlyhits new highs and lows or moves erraticallyis considered highly volatile. Maheu Search for more papers by this author. Implied volatility for US equity and futures markets.

Source: lynalden.com

Source: lynalden.com

Individual Stocks Have Become More Volatile. News Arrival Jump Dynamics and Volatility Components for Individual Stock Returns. A stock that maintains a relatively stable price has low volatility. But on the flip side buying at the wrong time can spell disaster. When it comes to individual stocks events tied to the companys performance such as earnings or a product announcement can drive volatility in its shares.

Source: link.springer.com

Source: link.springer.com

Typically a stock. On theoretical grounds it is possible that the volatility of individual stocks has increased while the volatility of the market as a whole has remained stable. Monetary policy fiscal policy or uncertainty over political events like. On average corporate earnings have deteriorated and their volatilities have increased over the sample period. The total volatility for individual stocks and for.

Source: timothysykes.com

Source: timothysykes.com

Volatility can be measured by comparing current or expected returns against the stock or markets mean average and typically represents a large positive or negative change. Every stock is a part of a larger market. The stock return. If you invest in the right stock you. Maheu Search for more papers by this author.

Source: ruleoneinvesting.com

Source: ruleoneinvesting.com

On average corporate earnings have deteriorated and their volatilities have increased over the sample period. Typically a stock. When it comes to individual stocks events tied to the companys performance such as earnings or a product announcement can drive volatility in its shares. Both individual stocks and the SP 500 generally move around over the course of a day. VIX Futures Premium help.

Source: investopedia.com

Source: investopedia.com

McCurdy Maheu is from the Department of Economics University of Toronto and McCurdy is from the Joseph L. Individual Stocks Have Become More Volatile. But on the flip side buying at the wrong time can spell disaster. Malcolm Tatum Stock volatility is when stock dramatically increases or decreases within a period of time. To help prevent this we suggest that investors consider a stocks beta a common measure of stock volatility when purchasing a stock.

Unsurprisingly this highly volatile stock presented a huge opportunity for gains. A stock with a price that fluctuates wildlyhits new highs and lows or moves erraticallyis considered highly volatile. Individual stock volatility sorts and abnormal trading. The total volatility for individual stocks and for. Every stock is a part of a larger market.

Source: link.springer.com

Source: link.springer.com

Implied and realized historical volatility correlation implied volatility skew and volatility surface. We double sort stocks based on the stocks return rank and the prior month. VIX Futures Premium help. Looking at this information for an individual stock will provide another clue about whether or not you should be buying or selling contracts based on IV as well as how long you might expect. Stock market volatility is a measure of how much the stock markets overall value fluctuates up and down.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title individual stock volatility by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.