Your Market chameleon volatility exchange are ready. Market chameleon volatility are a coin that is most popular and liked by everyone this time. You can Find and Download the Market chameleon volatility files here. Get all royalty-free bitcoin.

If you’re searching for market chameleon volatility pictures information related to the market chameleon volatility keyword, you have visit the ideal site. Our website always provides you with hints for downloading the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that match your interests.

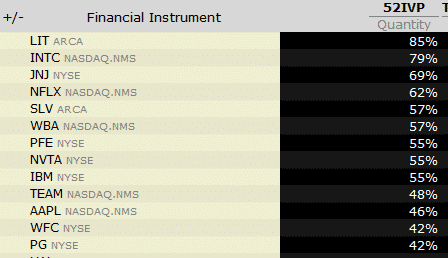

Market Chameleon Volatility. As Market Chameleon summarizes Put options are a convenient way for investors to protect against investment losses in the event that an existing held equity position may be exhibiting increased volatility or risk of downward movement. Market Chameleon is a platform built for stock traders and options traders. Interpreting the two Implied Volatility rows on the options tab of Market Chameleon. The platform also has an interest scanner that displays stocks with high moderate or low implied volatility for the current trading day.

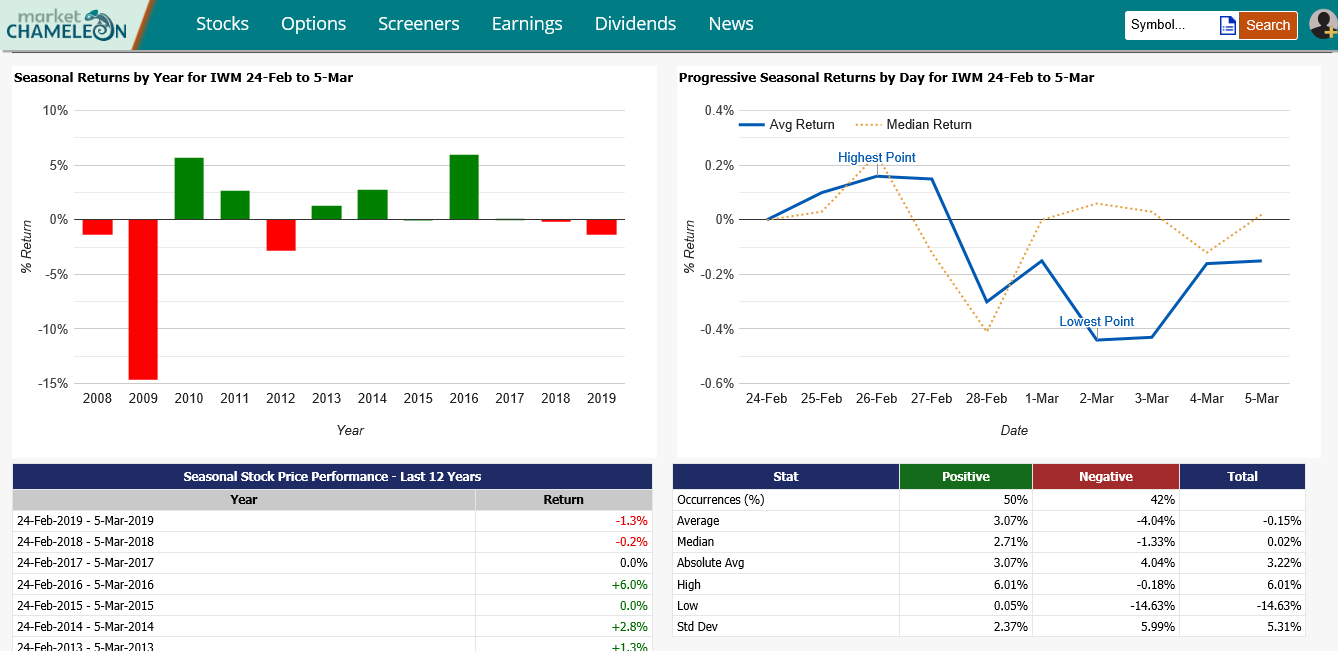

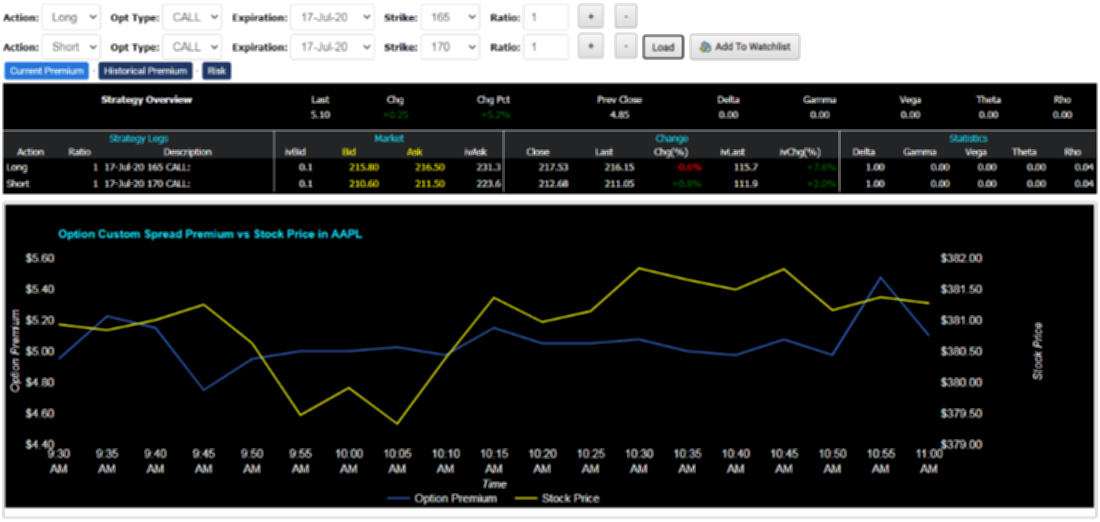

Advanced Stock Chart Learn Stock Trading From marketchameleon.com

Advanced Stock Chart Learn Stock Trading From marketchameleon.com

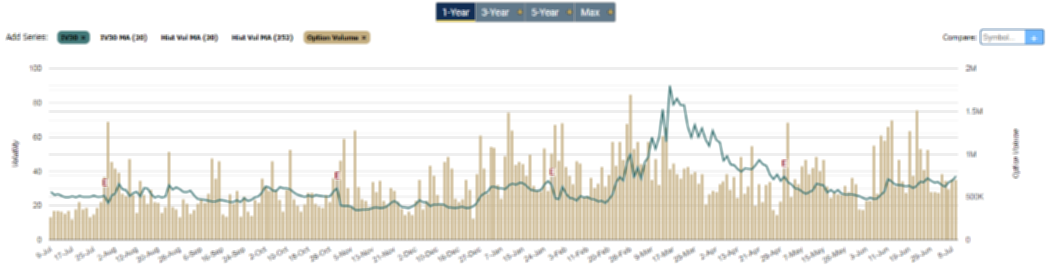

The way an options price reacts to changes in volatility is called vega. Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other. Think or Swim has it as part of the platform. Accessibility is always at the forefront which is why it offers newsletters and simple screeners through a free starter tier. In this webinar we go into detail on trading volatility VOL using options straddlesYou can follow along with the data at. ATMP Historical Stock Volatility 20-Day Rolling Volatility for Open-High-Low-Close OHLC Close-to-Close CC Open-to-Close OC and Close-to-Open CO This is a sample chart image.

Interpreting the two Implied Volatility rows on the options tab of Market Chameleon.

Special guest Jay Soloff of Options Floor Trader and Coffee Condors will join Market Chameleon founder Dmitry Pargamanik to talk about market volatility. Simple to use and low cost Chameleon is a unique chemical detector. The way an options price reacts to changes in volatility is called vega. The platform also has an interest scanner that displays stocks with high moderate or low implied volatility for the current trading day. This is given as a number between zero and one indicating the amount the price of an option will change for every 1 change in implied volatility of the option. A competing service thats worth looking into is Market Chameleon.

Source: investopedia.com

Source: investopedia.com

Think of this as stocks that have very volatile implied volatility. This is given as a number between zero and one indicating the amount the price of an option will change for every 1 change in implied volatility of the option. Download historical options trading and volatility data upcoming earnings and dividend events and daily stock market activity. Beta values that describe volatility or systemic risk remain comparably high for most China-themed exchange-traded funds. A competing service thats worth looking into is Market Chameleon.

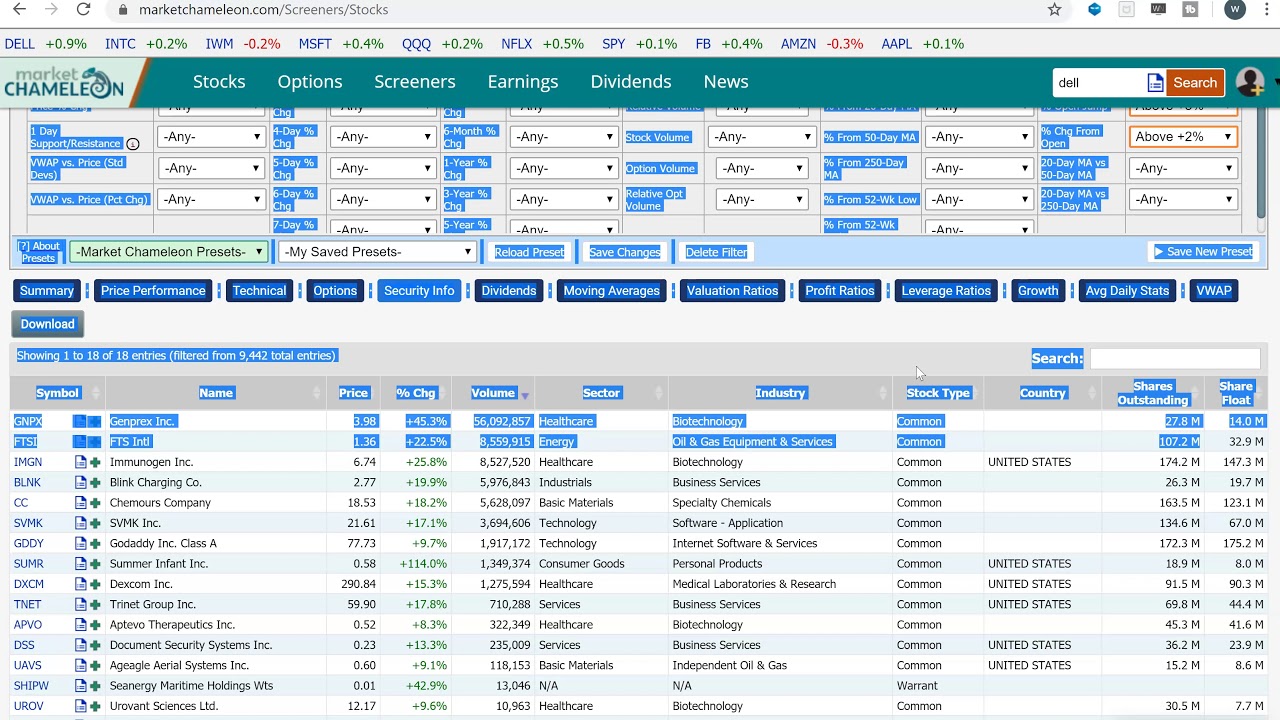

Source: marketchameleon.com

Source: marketchameleon.com

The following charts enable you to view the volatility skew for each option expiration listed for GFS comparing against other. The way an options price reacts to changes in volatility is called vega. So an option with a vega of 05 will see its price rise 050 if volatility of the option rises by 1. TastyWorks has it as part of the platform. Accessibility is always at the forefront which is why it offers newsletters and simple screeners through a free starter tier.

Source: optionstradingiq.com

Source: optionstradingiq.com

The strike price may be set by reference to the spot price market price of the underlying security or commodity on the day. Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other. I think its near the break even price. The Chameleon chemical detection armband is much more convenient. TastyWorks has it as part of the platform.

Source: marketchameleon.com

Source: marketchameleon.com

Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other. Fund Leaders Laggards. This is similar to the VVIX index which measures the volatility of the Volatility Index. The strike price may be set by reference to the spot price market price of the underlying security or commodity on the day. So an option with a vega of 05 will see its price rise 050 if volatility of the option rises by 1.

Source: marketchameleon.com

Source: marketchameleon.com

Simple to use and low cost Chameleon is a unique chemical detector. It means that the market expects the stock to be some percent away from its current price by the time the option expires. BarChart and Optionistics also may have it for a price. Skewの売りと買いの差 や インプライドボラティリティ を無料アカウント登録のみで確認できる. The following charts enable you to view the volatility skew for each option expiration listed for JJM comparing against other.

Source: marketchameleon.com

Source: marketchameleon.com

So an option with a vega of 05 will see its price rise 050 if volatility of the option rises by 1. The following charts enable you to view the volatility skew for each option expiration listed for GFS comparing against other. The volatility skew shows you the difference in implied volatility IV between out-of-the-money options at-the-money options and in-the-money options. A relative highlight here is their scanner that looks for IV Movers. Accessibility is always at the forefront which is why it offers newsletters and simple screeners through a free starter tier.

Source: daytradingz.com

Source: daytradingz.com

Fund Leaders Laggards. Simple to use and low cost Chameleon is a unique chemical detector. Market Chameleon is a web-based trading research site designed to take some of the guesswork out of stock and option analysis. GLD support price is 16664 and resistance is 16952 based on 1 day standard deviation move. This is given as a number between zero and one indicating the amount the price of an option will change for every 1 change in implied volatility of the option.

Source: marketchameleon.com

Source: marketchameleon.com

Special guest Jay Soloff of Options Floor Trader and Coffee Condors will join Market Chameleon founder Dmitry Pargamanik to talk about market volatility. The following charts enable you to view the volatility skew for each option expiration listed for GFS comparing against other. Interpreting the two Implied Volatility rows on the options tab of Market Chameleon. Special guest Jay Soloff of Options Floor Trader and Coffee Condors will join Market Chameleon founder Dmitry Pargamanik to talk about market volatility. Think of this as stocks that have very volatile implied volatility.

Source: marketchameleon.com

Source: marketchameleon.com

This is similar to the VVIX index which measures the volatility of the Volatility Index. The way an options price reacts to changes in volatility is called vega. Market Chameleon is a platform built for stock traders and options traders. As Market Chameleon summarizes Put options are a convenient way for investors to protect against investment losses in the event that an existing held equity position may be exhibiting increased volatility or risk of downward movement. TastyWorks has it as part of the platform.

Source: marketchameleon.com

Source: marketchameleon.com

Beta values that describe volatility or systemic risk remain comparably high for most China-themed exchange-traded funds. If there is a Black Swan or similar event market plunge IV is. Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other. Skewの売りと買いの差 や インプライドボラティリティ を無料アカウント登録のみで確認できる. Market Chameleons Implied Volatility Movers Report shows how the current implied volatility for a symbols particular option expiration has changed since the previous day.

Source: in.pinterest.com

Source: in.pinterest.com

ATMP Historical Stock Volatility 20-Day Rolling Volatility for Open-High-Low-Close OHLC Close-to-Close CC Open-to-Close OC and Close-to-Open CO This is a sample chart image. You can pay for it at Market Chameleon. If there is a Black Swan or similar event market plunge IV is. In webull youll see implied volatility whenever you buy a putcall. Calculating the at-the-money implied volatility ATM IV is based on the strikes nearest to the at-the-money spot price and the change represents the difference from the.

Source: marketchameleon.com

Source: marketchameleon.com

Special guest Jay Soloff of Options Floor Trader and Coffee Condors will join Market Chameleon founder Dmitry Pargamanik to talk about market volatility. Currently the stocks implied volatilitythe expected post-earnings move calculated from the implied at-the-money straddle of the expiration. The platform also has an interest scanner that displays stocks with high moderate or low implied volatility for the current trading day. So an option with a vega of 05 will see its price rise 050 if volatility of the option rises by 1. Calculating the at-the-money implied volatility ATM IV is based on the strikes nearest to the at-the-money spot price and the change represents the difference from the.

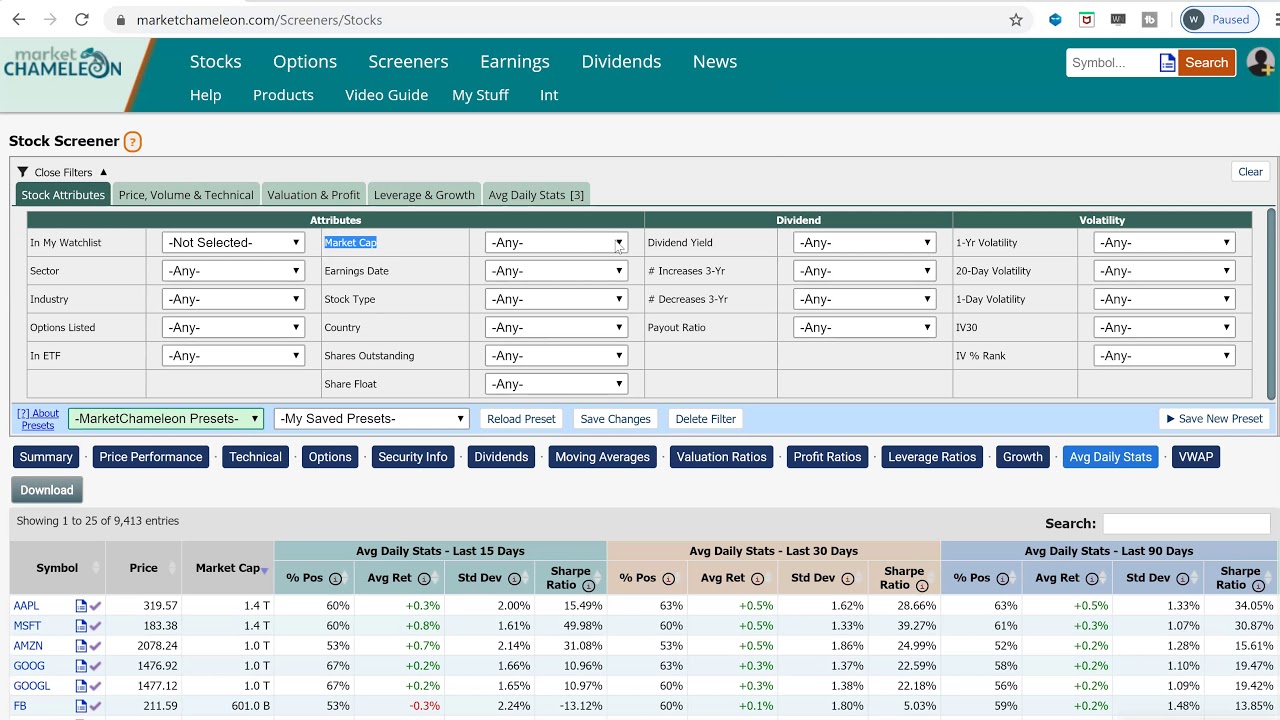

Source: daytradereview.com

Source: daytradereview.com

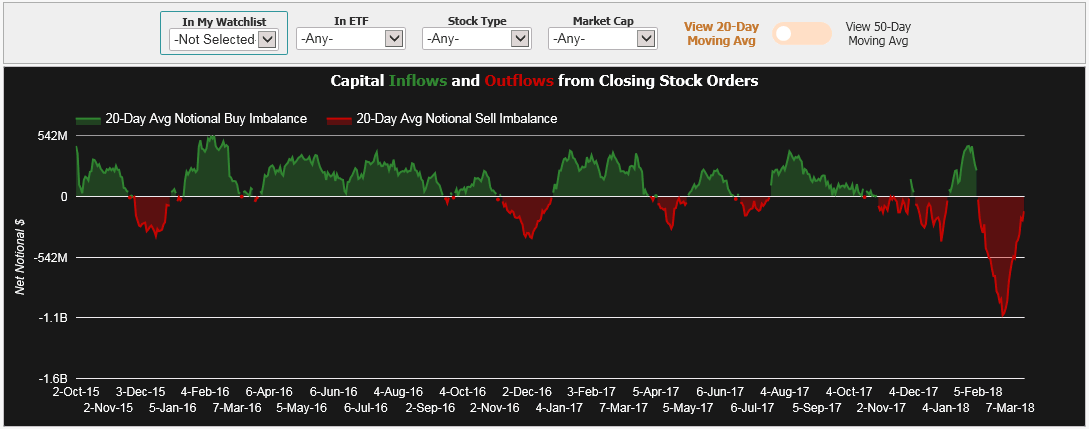

When the market declines rapidly implied volatility IV tends to increase rapidly. Market Chameleons Implied Volatility Movers Report shows how the current implied volatility for a symbols particular option expiration has changed since the previous day. Think of this as stocks that have very volatile implied volatility. If there is a Black Swan or similar event market plunge IV is. Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other.

Source: marketchameleon.com

Source: marketchameleon.com

This means that using the most recent 20 day stock volatility and applying a one standard deviation move around the stocks closing price stastically there is a 67 probability that GLD stock will trade within this expected range on the day. Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other. Market Chameleon Total Access Subscription gives users access exclusive content and analysis as well as the ability to download data directly from our website. The platform offers various tools to identify potential trading opportunities. As Market Chameleon summarizes Put options are a convenient way for investors to protect against investment losses in the event that an existing held equity position may be exhibiting increased volatility or risk of downward movement.

Source: mobile.twitter.com

Source: mobile.twitter.com

Market Chameleon Total Access Subscription gives users access exclusive content and analysis as well as the ability to download data directly from our website. The Chameleon chemical detection armband is much more convenient. Calculating the at-the-money implied volatility ATM IV is based on the strikes nearest to the at-the-money spot price and the change represents the difference from the. In webull youll see implied volatility whenever you buy a putcall. When the market declines rapidly implied volatility IV tends to increase rapidly.

Source: marketchameleon.com

Source: marketchameleon.com

This is similar to the VVIX index which measures the volatility of the Volatility Index. In webull youll see implied volatility whenever you buy a putcall. This is similar to the VVIX index which measures the volatility of the Volatility Index. Calculating the at-the-money implied volatility ATM IV is based on the strikes nearest to the at-the-money spot price and the change represents the difference from the. Market Chameleons Implied Volatility Movers Report shows how the current implied volatility for a symbols particular option expiration has changed since the previous day.

Source: youtube.com

Source: youtube.com

Currently the stocks implied volatilitythe expected post-earnings move calculated from the implied at-the-money straddle of the expiration. Special guest Jay Soloff of Options Floor Trader and Coffee Condors will join Market Chameleon founder Dmitry Pargamanik to talk about market volatility. Download historical options trading and volatility data upcoming earnings and dividend events and daily stock market activity. When the market declines rapidly implied volatility IV tends to increase rapidly. GLD support price is 16664 and resistance is 16952 based on 1 day standard deviation move.

Source: marketchameleon.com

Source: marketchameleon.com

Beta values that describe volatility or systemic risk remain comparably high for most China-themed exchange-traded funds. The following charts enable you to view the volatility skew for each option expiration listed for GFS comparing against other. Fund Leaders Laggards. In webull youll see implied volatility whenever you buy a putcall. Simple to use and low cost Chameleon is a unique chemical detector.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title market chameleon volatility by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.