Your Market price per share in financial statement wallet are available. Market price per share in financial statement are a bitcoin that is most popular and liked by everyone today. You can Download the Market price per share in financial statement files here. Get all free bitcoin.

If you’re looking for market price per share in financial statement images information related to the market price per share in financial statement interest, you have come to the right blog. Our site frequently provides you with hints for downloading the highest quality video and picture content, please kindly hunt and find more enlightening video content and graphics that match your interests.

Market Price Per Share In Financial Statement. Divide the firms total common stockholders equity by the average number of common shares outstanding. Justified PE Dividend Payout Ratio R G. Market Value of Equity US 8791 X 295 billion shares US 25934 billion. Then we calculate the market cap formula by multiplying the current share price by the number of.

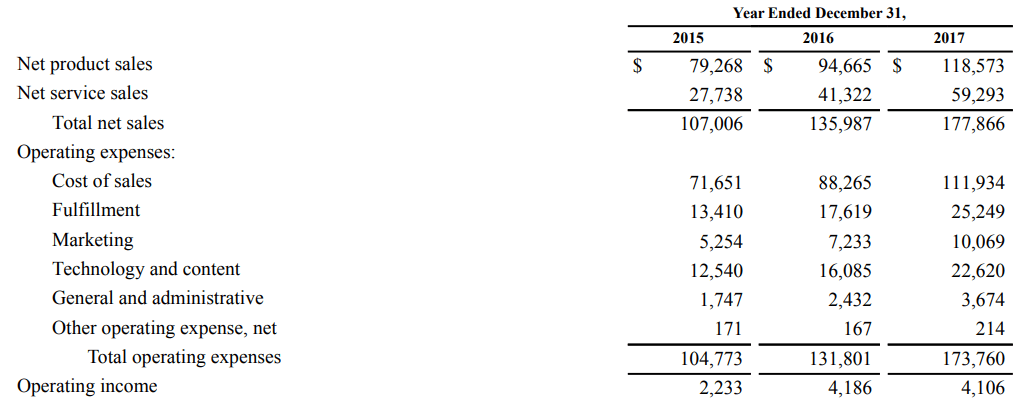

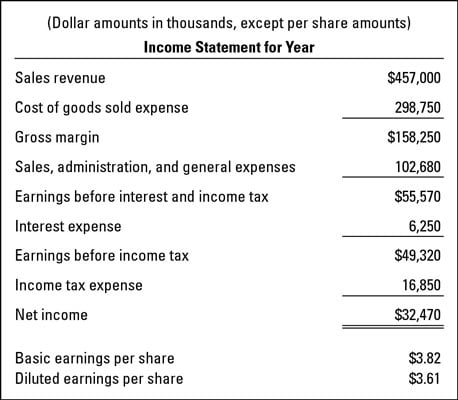

Income Statements Explained Accountingcoach From accountingcoach.com

Income Statements Explained Accountingcoach From accountingcoach.com

The companys market capitalization remains unchanged during a stock split because while the number of shares grows the price per share decreases correspondingly. The market value per share or fair market value of a stock is the price that a stock can be readily bought or sold in the current market place. In other words the market value per share is the going price of a share of stock. PE Stock Price Per Share Earnings Per Share. The market price per share of stock or the share price is the most recent price that a stock has traded for. If later the price goes to 1000000 per share then that new price does not appear anywhere on the financial statements.

Read more to increase the number of shares.

Its one of several market value ratios investors use to select stocks. Over this period what was the change in GEs. Full year highlights Underlying sales growth of. Step 1 Identify the market price of the stock. Quarterly dividend payable in March 2021 04268 per share See note 10 for more information on dividends. G Sustainable Growth Rate.

Source: chegg.com

Source: chegg.com

PE Stock Price Per Share Earnings Per Share. The market value per share or fair market value of a stock is the price that a stock can be readily bought or sold in the current market place. Answer 1 of 4. Divide the firms total common stockholders equity by the average number of common shares outstanding. The companys market capitalization remains unchanged during a stock split because while the number of shares grows the price per share decreases correspondingly.

Source: youtube.com

Source: youtube.com

Justified PE Dividend Payout Ratio R G. Its a function of market forces occurring when the price a buyer is willing to pay for a stock meets the price a seller is willing to accept for a stock. Its influenced by the companys income cash flows and investors sense of the companys prospects. Its one of several market value ratios investors use to select stocks. If later the price goes to 1000000 per share then that new price does not appear anywhere on the financial statements.

Source: accountingcoach.com

Source: accountingcoach.com

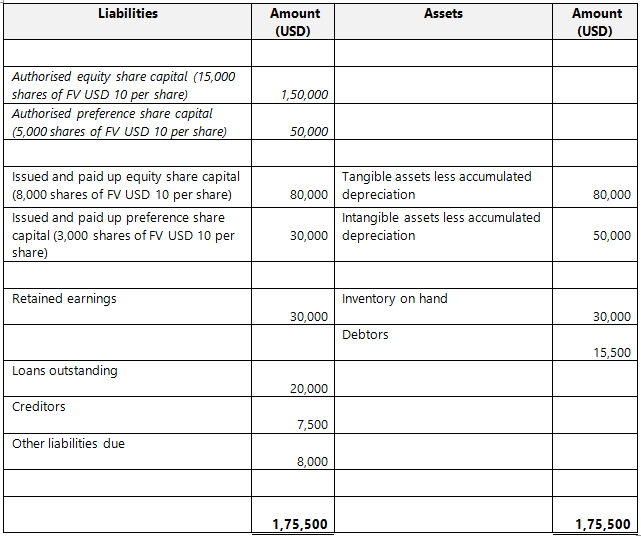

PE Stock Price Per Share Earnings Per Share. PE Stock Price Per Share Earnings Per Share. PE Ratio Formula Explanation. Calculate the firms stock price book value from the balance sheet. Others include dividend yield.

Source: investopedia.com

Source: investopedia.com

For example if the firms total common stockholders equity is 63 million and the average number of common shares outstanding is 100000 then the stock prices. Market value per share is the price at which a share of company stock can be acquired in the marketplace such as on a stock exchange. The companys market capitalization remains unchanged during a stock split because while the number of shares grows the price per share decreases correspondingly. The market price per share of stock or the share price is the most recent price that a stock has traded for. I think that man.

Source: investopedia.com

Source: investopedia.com

In other words the market value per share is the going price of a share of stock. Read more to increase the number of shares. The companys market capitalization remains unchanged during a stock split because while the number of shares grows the price per share decreases correspondingly. Its a function of market forces occurring when the price a buyer is willing to pay for a stock meets the price a seller is willing to accept for a stock. The market price of a stock can be evaluated as cheap fair or rich by comparison with earnings per share book value per share or sales per share.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Calculate the firms stock price book value from the balance sheet. The market price of a stock can be evaluated as cheap fair or rich by comparison with earnings per share book value per share or sales per share. Its one of several market value ratios investors use to select stocks. The 1000 shows up in their equity section. Calculate the firms stock price book value from the balance sheet.

What Does Market Value Per Share Mean. Not only should shareholders be familiar with this stock market terminology they should also understand under what circumstances the number of outstanding shares might fluctuate. Market value per share is the price at which a share of company stock can be acquired in the marketplace such as on a stock exchange. Step 1 Identify the market price of the stock. R Required Rate of Return.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Calculate the firms stock price book value from the balance sheet. I think that man. Then we calculate the market cap formula by multiplying the current share price by the number of. There is no specific formula for calculating Market Price per share as it is automatically derived by the movement of demand supply. Its influenced by the companys income cash flows and investors sense of the companys prospects.

Source: dummies.com

Source: dummies.com

The market price of a stock can be evaluated as cheap fair or rich by comparison with earnings per share book value per share or sales per share. This price varies throughout the day based on the level of demand for the stock. Quarterly dividend payable in March 2021 04268 per share See note 10 for more information on dividends. Multiply the two figures. What Does Market Value Per Share Mean.

Source: investopedia.com

Source: investopedia.com

Multiply the two figures. Demandsupply price is determined at that equilibrium point. Over this period what was the change in GEs. Market Price per share is basically the price of a share which an investor has to pay to buy a share of a company. Step 1 Identify the market price of the stock.

Source: investopedia.com

Source: investopedia.com

In other words the market value per share is the going price of a share of stock. Quarterly dividend payable in March 2021 04268 per share See note 10 for more information on dividends. Market Value of Equity US 8791 X 295 billion shares US 25934 billion. Therefore the price of each share decreases due to the increase in the number of shares. Others include dividend yield.

What is Market Value per Share. The 1000 shows up in their equity section. Market Price per share is basically the price of a share which an investor has to pay to buy a share of a company. Market value per share is the price a stock currently trades at. Others include dividend yield.

Therefore the price of each share decreases due to the increase in the number of shares. G Sustainable Growth Rate. What is Market Value per Share. In other words the market value per share is the going price of a share of stock. Full year highlights Underlying sales growth of.

Source: termscompared.com

Source: termscompared.com

If the stock trades at an unchanged price-to-earnings ratio of 10 FLUF shares should now be trading at 2222 222 x 10 instead of 20 per share. Market value per share is the price at which a share of company stock can be acquired in the marketplace such as on a stock exchange. The market value per share or fair market value of a stock is the price that a stock can be readily bought or sold in the current market place. Let us understand it with an example As on 18th April 2018 the share price of Walmart is US 8789 then its market value of equity is. What Does Market Value Per Share Mean.

Source: slideplayer.com

Source: slideplayer.com

Demandsupply price is determined at that equilibrium point. Full year highlights Underlying sales growth of. Calculate the firms stock price book value from the balance sheet. As the bar reaches equilibrium ie. Others include dividend yield.

Source: transtutors.com

Source: transtutors.com

Demandsupply price is determined at that equilibrium point. Others include dividend yield. Step 1 Identify the market price of the stock. Over this period what was the change in GEs. Multiply the two figures.

Source: youtube.com

Source: youtube.com

G Sustainable Growth Rate. R Required Rate of Return. Read more to increase the number of shares. Justified PE Dividend Payout Ratio R G. Market Value of Equity US 8791 X 295 billion shares US 25934 billion.

Source: cnx.org

Source: cnx.org

Market Value of Equity US 8791 X 295 billion shares US 25934 billion. As the bar reaches equilibrium ie. Quarterly dividend payable in March 2021 04268 per share See note 10 for more information on dividends. Market Value of Equity Market price per share X Total number of outstanding shares. The market price of a stock can be evaluated as cheap fair or rich by comparison with earnings per share book value per share or sales per share.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title market price per share in financial statement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.