Your Mu implied volatility wallet are available. Mu implied volatility are a mining that is most popular and liked by everyone now. You can News the Mu implied volatility files here. Get all free exchange.

If you’re searching for mu implied volatility pictures information connected with to the mu implied volatility topic, you have come to the ideal blog. Our website always gives you hints for seeing the maximum quality video and picture content, please kindly search and find more informative video content and images that match your interests.

Mu Implied Volatility. For instance the payout from the put option is given by. MU Market volatility is starting to tick back up as macro headlines ranging from impeachment to drones striking Saudi oil complexes have ratcheted up uncertainty and nervousness. Function mapping Y to VIX function handle or symbolic function Y0. 90-Day 120-Day 150-Day 180-Day.

China S Market News Yuan Implied Volatility Stable Despite Record Low Levels Nasdaq From nasdaq.com

China S Market News Yuan Implied Volatility Stable Despite Record Low Levels Nasdaq From nasdaq.com

Initial value of Y scalar K. View volatility charts for Micron Technology MU including implied volatility and realized volatility. The options both put and call have payouts that are non-linear functions of the price of the underlying asset. 7-Day Implied Movement 1 Month 7-Day Implied Movement 12 Months Reset Zoom. As I earlier said MU is very undervalued. IV is a forward looking prediction of the likelihood of price change of the underlying asset with a higher IV signifying that the market expects significant price movement and a lower IV signifying the market expects the underlying asset price to remain within the current trading range.

The Volatility Rush takes advantage of increasing options premiums into earnings announcements EA caused by an anticipated rise in Implied Volatility IV.

10-Day 20-Day 30-Day 60-Day. The forecasted future volatility of the security over the selected time frame derived from the average of the put and call implied volatilities for options with the relevant expiration date. The continuously compounded rate of return over an interval 0t is fraclogS_t-logSt Given the current stock price S this rate follows the normal distribution mathcalNmu -sigma22sigma2t In plain English its logarithm is normally distributed with mean mu -sigma22 and variance sigma2t. Get out your trading breadboard. While it may have its limitations many investors rely on factors other than implied volatility such as Implied Volatility Rank IVR expected stock price ranges and Volatility Indexes as well. Implied Volatility Implied volatility refers to the volatility of an underlying asset which will return the theoretical value of an option equal to the options current market price.

Source: nasdaq.com

Source: nasdaq.com

Overlay and compare different stocks and volatility metrics using the interactive features. MU had 30-Day Implied Volatility Mean of 02552 for 2021-10-15. Implied Volatility is a measure of forward looking uncertainty. Implied volatility is an alternative measure of volatility that is constructed using the option valuation. IV is a forward looking prediction of the likelihood of price change of the underlying asset with a higher IV signifying that the market expects significant price movement and a lower IV signifying the market expects the underlying asset price to remain within the current trading range.

Source: link.springer.com

Source: link.springer.com

IV is a forward looking prediction of the likelihood of price change of the underlying asset with a higher IV signifying that the market expects significant price movement and a lower IV signifying the market expects the underlying asset price to remain within the current trading range. MU is catching up. As I earlier said MU is very undervalued. As MUs option prices and implied volatility go down heres a way to play the tech name. Implied Volatility is a measure of forward looking uncertainty.

The average implied volatility IV of the nearest monthly options contract. 90-Day 120-Day 150-Day 180-Day. The average implied volatility IV of the nearest monthly options contract. It begins by inheriting the oracle price and implied volatility to generate a normal distribution around the average price of -6 to 6 k standard deviations found through the implied volatility as is standard in traditional finance. Implied Volatility is a measure of forward looking uncertainty.

Source: isabelnet.com

Source: isabelnet.com

Initial value of Y scalar K. By MARK SEBASTIAN Oct 05 2021 0247 PM EDT. It is the value of volatility parameter derived from the market quote of options in BSM pricing model. IV is a forward looking prediction of the likelihood of price change of the underlying asset with a higher IV signifying that the market expects significant price movement and a lower IV signifying the market expects the underlying asset price to remain within the current trading range. Stock and Volatility Quotes for MU Option Calculators and Stock Screeners.

With this strategy Buy a Call and Put at-the-money a long straddle 2-3 weeks before the EA when IV is lower. As MUs option prices and implied volatility go down heres a way to play the tech name. The continuously compounded rate of return over an interval 0t is fraclogS_t-logSt Given the current stock price S this rate follows the normal distribution mathcalNmu -sigma22sigma2t In plain English its logarithm is normally distributed with mean mu -sigma22 and variance sigma2t. MU had 30-Day Implied Volatility Mean of 02552 for 2021-10-15. Overlay and compare different stocks and volatility metrics using the interactive features.

Implied volatility is an important aspect for determining a stocks potential future price movement especially for short-term option sellers. With this strategy Buy a Call and Put at-the-money a long straddle 2-3 weeks before the EA when IV is lower. As MUs option prices and implied volatility go down heres a way to play the tech name. The Volatility Rush takes advantage of increasing options premiums into earnings announcements EA caused by an anticipated rise in Implied Volatility IV. In the BlackScholes model the assets price is modeled as a log-normal random variable which means that the asset.

Source: nasdaq.com

Source: nasdaq.com

Expansion order integer between 0 and 4 Output. AMD is trading 2x market cap of MU. MU Market volatility is starting to tick back up as macro headlines ranging from impeachment to drones striking Saudi oil complexes have ratcheted up uncertainty and nervousness. For instance the payout from the put option is given by. As MUs option prices and implied volatility go down heres a way to play the tech name.

Source: researchgate.net

Source: researchgate.net

Implied volatility is a key parameter in option pricing. HOLD MU till at least 120. In contrast to historical volatility implied volatility is forward-looking and varies with different options contracts. The continuously compounded rate of return over an interval 0t is fraclogS_t-logSt Given the current stock price S this rate follows the normal distribution mathcalNmu -sigma22sigma2t In plain English its logarithm is normally distributed with mean mu -sigma22 and variance sigma2t. 10-Day 20-Day 30-Day 60-Day.

7-Day Implied Movement 1 Month 7-Day Implied Movement 12 Months Reset Zoom. Initial value of Y scalar K. For instance the payout from the put option is given by. Function mapping Y to VIX function handle or symbolic function Y0. Strike values vector T.

Source: researchgate.net

Source: researchgate.net

MU is catching up. For instance the payout from the put option is given by. Strike values vector T. HOLD MU till at least 120. The average implied volatility IV of the nearest monthly options contract.

Drift coefficient of Y function handle Eta. It begins by inheriting the oracle price and implied volatility to generate a normal distribution around the average price of -6 to 6 k standard deviations found through the implied volatility as is standard in traditional finance. The continuously compounded rate of return over an interval 0t is fraclogS_t-logSt Given the current stock price S this rate follows the normal distribution mathcalNmu -sigma22sigma2t In plain English its logarithm is normally distributed with mean mu -sigma22 and variance sigma2t. For an european option this would be a function of the strike and the. Expansion order integer between 0 and 4 Output.

The average implied volatility IV of the nearest monthly options contract. The Volatility Rush takes advantage of increasing options premiums into earnings announcements EA caused by an anticipated rise in Implied Volatility IV. Initial value of Y scalar K. 90-Day 120-Day 150-Day 180-Day. MU Market volatility is starting to tick back up as macro headlines ranging from impeachment to drones striking Saudi oil complexes have ratcheted up uncertainty and nervousness.

Source: thebluecollarinvestor.com

Source: thebluecollarinvestor.com

Implied volatility is a key parameter in option pricing. The average implied volatility IV of the nearest monthly options contract. Implied volatility is an important aspect for determining a stocks potential future price movement especially for short-term option sellers. View volatility charts for Micron Technology MU including implied volatility and realized volatility. MU had 30-Day Historical Volatility Close-to-Close of 03512 for 2021-11-19.

Source: nasdaq.com

Source: nasdaq.com

The average implied volatility IV of the nearest monthly options contract. IV is a forward looking prediction of the likelihood of price change of the underlying asset with a higher IV signifying that the market expects significant price movement and a lower IV signifying the market expects the underlying asset price to remain within the current trading range. In contrast to historical volatility implied volatility is forward-looking and varies with different options contracts. AMD is trading 2x market cap of MU. Read to find out how it all ties into volatility and vega in options.

IV is a forward looking prediction of the likelihood of price change of the underlying asset with a higher IV signifying that the market expects significant price movement and a lower IV signifying the market expects the underlying asset price to remain within the current trading range. 10-Day 20-Day 30-Day 60-Day. The Volatility Rush takes advantage of increasing options premiums into earnings announcements EA caused by an anticipated rise in Implied Volatility IV. The average implied volatility IV of the nearest monthly options contract. 7-Day Implied Movement 1 Month 7-Day Implied Movement 12 Months Reset Zoom.

It is the value of volatility parameter derived from the market quote of options in BSM pricing model. The average implied volatility IV of the nearest monthly options contract. MU had 30-Day Historical Volatility Close-to-Close of 03512 for 2021-11-19. The Volatility Rush takes advantage of increasing options premiums into earnings announcements EA caused by an anticipated rise in Implied Volatility IV. As I earlier said MU is very undervalued.

Source: researchgate.net

Source: researchgate.net

Diffusion coefficient of Y function handle Phi. MU had 30-Day Historical Volatility Close-to-Close of 03512 for 2021-11-19. Implied volatility is a key parameter in option pricing. By MARK SEBASTIAN Oct 05 2021 0247 PM EDT. Implied Volatility Implied volatility refers to the volatility of an underlying asset which will return the theoretical value of an option equal to the options current market price.

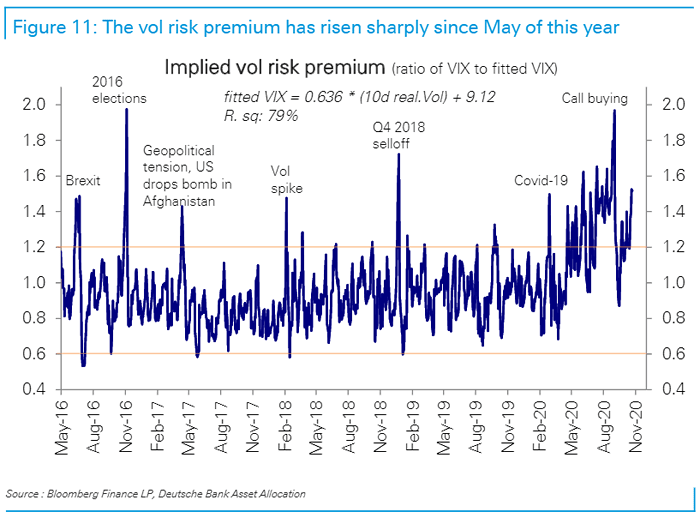

In terms of VIX and SP500 it seems very unrealistic to assume a scenario that is remotely related to Gamestop. Overlay and compare different stocks and volatility metrics using the interactive features. It is the value of volatility parameter derived from the market quote of options in BSM pricing model. Read to find out how it all ties into volatility and vega in options. IV is a forward looking prediction of the likelihood of price change of the underlying asset with a higher IV signifying that the market expects significant price movement and a lower IV signifying the market expects the underlying asset price to remain within the current trading range.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title mu implied volatility by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.