Your Opportunity zone fund minimum investment wallet are ready. Opportunity zone fund minimum investment are a mining that is most popular and liked by everyone today. You can Find and Download the Opportunity zone fund minimum investment files here. News all free trading.

If you’re looking for opportunity zone fund minimum investment images information linked to the opportunity zone fund minimum investment keyword, you have come to the ideal blog. Our website frequently gives you hints for viewing the maximum quality video and image content, please kindly hunt and locate more informative video content and graphics that fit your interests.

Opportunity Zone Fund Minimum Investment. One difficult thing about opportunity zones is that they tie up your money. By deferring the taxes on capital gains investors are. Created through the Tax Cuts and. An investor sells an asset and generates a capital gain.

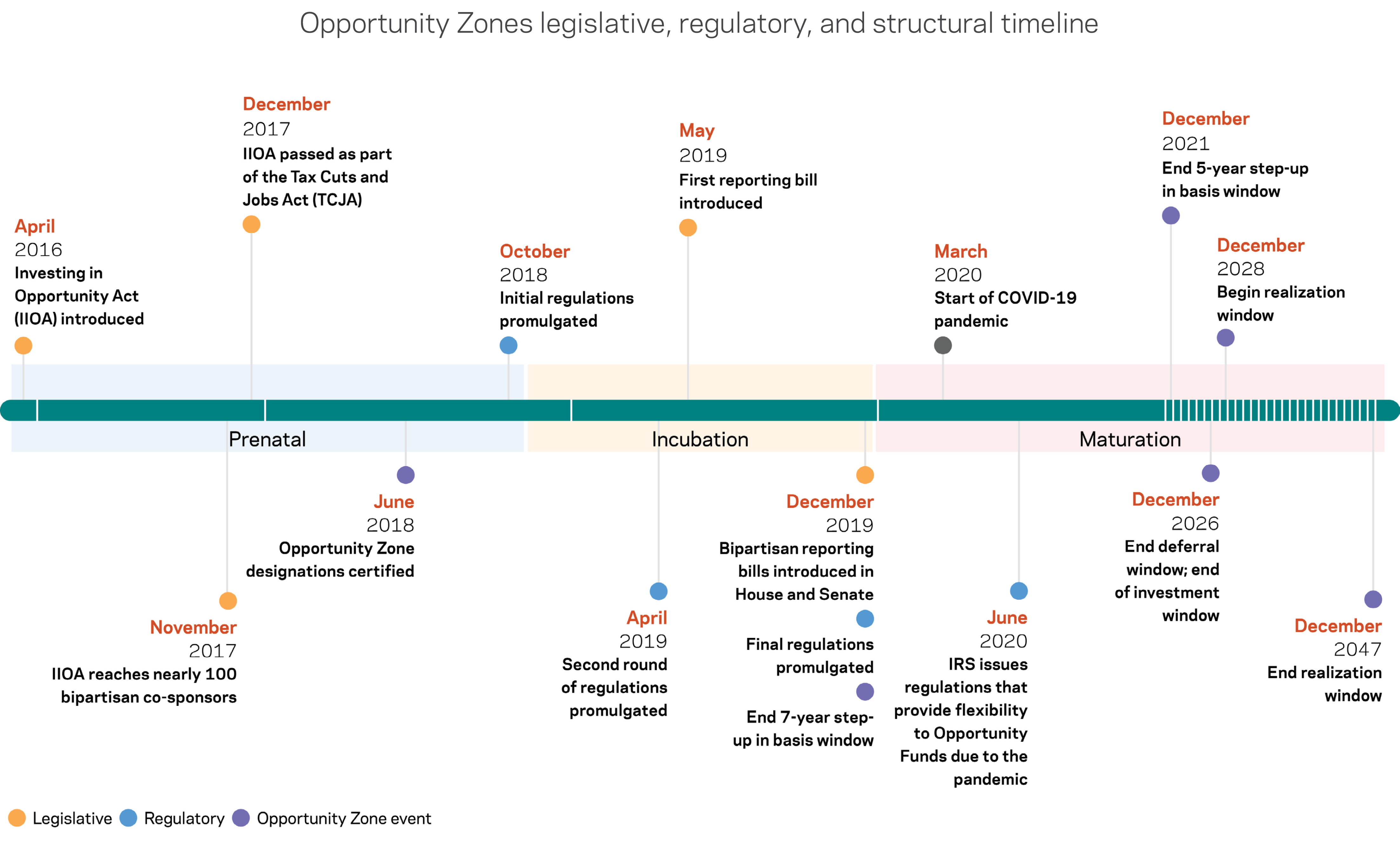

Using Opportunity Funds to invest in Opportunity Zones. Round A Offering 250 K. Maxus Opportunity Fund I. The OZ Fund will benefit from The Tax Cuts and Jobs Acts new federal incentive. Created through the Tax Cuts and. 31 2026 whichever is earlier.

The investment strategy will focus on student and multifamily real estate projects within qualified opportunity zone tracts established through the Tax Cuts and Jobs Act of 2017.

LJJ Opportunity Zone Fund I. Total Fund Size Authorized. Total Fund Size Authorized. Opportunity zones offer lots of promise for St. Investors intending to qualify for opportunity zone incentive tax benefits must be mindful of meeting all requirements and. Investing directly in Opportunity Zone funds often requires a minimum investment of tens or hundreds of thousands of dollars.

Source: investopedia.com

Source: investopedia.com

Any type of capital gain stocks Bitcoin precious metals and more qualify for Opportunity Zone investment. Investing directly in Opportunity Zone funds often requires a minimum investment of tens or hundreds of thousands of dollars. The length of time the taxpayer holds the QOF. Opportunity Zone Fund 10 M. Opportunity Funds may be created by syndicators to invest in a variety of QOZ opportunities such as residential rental property.

Source: wellsfargo.com

Source: wellsfargo.com

Many kinds of businesses qualify under the current guidelines but a few. Manus Bio Opportunity Zone Fund I. Round A Offering 250 K. Since investments require a minimum five-year investment money placed into a qualified opportunity zone fund is somewhat illiquid until the funds disposition or. 31 2026 whichever is earlier.

Source: wellsfargo.com

Source: wellsfargo.com

McGregor Interests Council Bluffs QOF LLC. Local Grown Salads Baltimore Opportunity Zone Fund. Opportunity zones offer lots of promise for St. Round A Offering 250 K. How does the opportunity zones investing program work.

Source: eig.org

Source: eig.org

Created through the Tax Cuts and. Investors intending to qualify for opportunity zone incentive tax benefits must be mindful of meeting all requirements and. Opportunity Funds may be created by syndicators to invest in a variety of QOZ opportunities such as residential rental property. The QOF will then make investments into designated Opportunity Zones OZ. CLASS B MINIMUM 100 000 000.

Source: pinterest.com

Source: pinterest.com

Opportunity Zone provisions are technical and complicated. The length of time the taxpayer holds the QOF. The QOF will then make investments into designated Opportunity Zones OZ. Opportunity Zone provisions are technical and complicated. One difficult thing about opportunity zones is that they tie up your money.

Source: pinterest.com

Source: pinterest.com

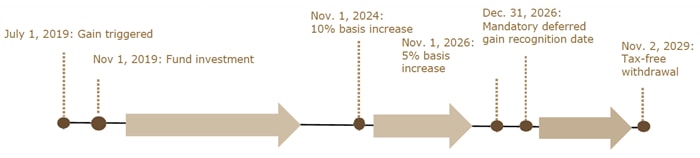

In general an OZ fund must invest at least 90 of its assets in businesses located within a qualified opportunity zone. Opportunity Zone Funds are just one way for wealthier investors to pay back their communities in a tangible way and the benefit of receiving referred and lowered taxes is an added bonus. Using Opportunity Funds to invest in Opportunity Zones. Since investments require a minimum five-year investment money placed into a qualified opportunity zone fund is somewhat illiquid until the funds disposition or. The taxpayer invests the entire amount in a Qualified Opportunity Fund within 180 days on November 1 2021.

Source: wheda.com

Source: wheda.com

The OZ Fund will benefit from The Tax Cuts and Jobs Acts new federal incentive. An investor sells an asset and generates a capital gain. Local Grown Salads Baltimore Opportunity Zone Fund. If youre investing for the tax benefit and the sense of philanthropy youre in the right mindset. Open to new investors.

Source: in.pinterest.com

Source: in.pinterest.com

It is for the most part. In general an OZ fund must invest at least 90 of its assets in businesses located within a qualified opportunity zone. How does the opportunity zones investing program work. Opportunity Funds may be created by syndicators to invest in a variety of QOZ opportunities such as residential rental property. Class B Minimum Subscription.

Source: eig.org

Source: eig.org

Opportunity Zone Fund Investment 1 000 000. Opportunity Funds may be created by syndicators to invest in a variety of QOZ opportunities such as residential rental property. By deferring the taxes on capital gains investors are. Any type of capital gain stocks Bitcoin precious metals and more qualify for Opportunity Zone investment. Opportunity Zone Fund Investment 1 000 000.

Source: opportunityzones.hud.gov

Source: opportunityzones.hud.gov

Louis but little action so far by St. Local Grown Salads Baltimore Opportunity Zone Fund. Any type of capital gain stocks Bitcoin precious metals and more qualify for Opportunity Zone investment. Quick Simple Investment Process. How does the opportunity zones investing program work.

Source: badermartin.com

Source: badermartin.com

If youre investing for the tax benefit and the sense of philanthropy youre in the right mindset. Quick Simple Investment Process. CLASS B MINIMUM 100 000 000. As long as the money from these capital gains is not needed right away an Opportunity Fund can help investors use their money to grow their wealth. Total Fund Size Authorized.

Source: badermartin.com

Source: badermartin.com

Investors can defer tax on the invested gain amounts until the date they sell or exchange the QOF investment or Dec. Many kinds of businesses qualify under the current guidelines but a few. In general an OZ fund must invest at least 90 of its assets in businesses located within a qualified opportunity zone. Digital Technology Cloud Computing. An investor sells an asset and generates a capital gain.

Source: pinterest.com

Source: pinterest.com

But you can get started with far less money by investing in Opportunity Zone REITs. Investing directly in Opportunity Zone funds often requires a minimum investment of tens or hundreds of thousands of dollars. LNWA OZ Fund I LLC. Total Fund Maximum Offering. Maxus Opportunity Fund I.

Source: pinterest.com

Source: pinterest.com

Class B Minimum Subscription. If youre investing for the tax benefit and the sense of philanthropy youre in the right mindset. Investors to defer all capital gains taxes for up to eight years from the enactment of the legislation as long as they invest or reinvest the profits into a Qualified Opportunity Fund QOF which enables them to defer paying any capital gains tax due on the original investment until through December 31 2026. To receive the full tax benefit of investing in one your money will need to stay put for a minimum of 5 years. Investors intending to qualify for opportunity zone incentive tax benefits must be mindful of meeting all requirements and.

Source: wheda.com

Source: wheda.com

Maxus Opportunity Fund I. Total Fund Size Authorized. It is for the most part. Created through the Tax Cuts and. Revive Qualified Opportunity Zone Fund will create jobs provide diverse income streams education and lower produce and energy costs.

Source: stessa.com

Source: stessa.com

Total Fund Maximum Offering. Opportunity Zones offer tax benefits to business or individual investors who can elect to temporarily defer tax on capital gains if they timely invest those gain amounts in a Qualified Opportunity Fund QOF. Investors can defer tax on the invested gain amounts until the date they sell or exchange the QOF investment or Dec. The program allows US. An OZ is a government-designated census tract.

Source: pinterest.com

Source: pinterest.com

CLASS B MINIMUM 100 000 000. Since investments require a minimum five-year investment money placed into a qualified opportunity zone fund is somewhat illiquid until the funds disposition or. Created through the Tax Cuts and. Using Opportunity Funds to invest in Opportunity Zones. The QOF will then make investments into designated Opportunity Zones OZ.

Round A Maximum Offering. McGregor Interests Council Bluffs QOF LLC. Any type of capital gain stocks Bitcoin precious metals and more qualify for Opportunity Zone investment. Class B Minimum Subscription. The taxpayer invests the entire amount in a Qualified Opportunity Fund within 180 days on November 1 2021.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title opportunity zone fund minimum investment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.