Your Panic index vix trading are available. Panic index vix are a wallet that is most popular and liked by everyone this time. You can Download the Panic index vix files here. Download all free exchange.

If you’re looking for panic index vix pictures information linked to the panic index vix topic, you have come to the right site. Our site frequently provides you with hints for seeing the highest quality video and picture content, please kindly hunt and find more informative video content and graphics that match your interests.

Panic Index Vix. The VIX index is calculated based on weekly and traditional SPX index option prices and their implied volatility levels. An index to protect you from panic. Known as the investor fear gauge the CBOE Volatility Index is a forward-looking options-based measurement of investor anxiety. A Complete Guide To The VIX Index.

Restrain Your Emotions Greed Excitement Euphoria Panic Or Fear Should Have No Place In Traders Calculations Volume Activities Trading Online Trading From pinterest.com

Restrain Your Emotions Greed Excitement Euphoria Panic Or Fear Should Have No Place In Traders Calculations Volume Activities Trading Online Trading From pinterest.com

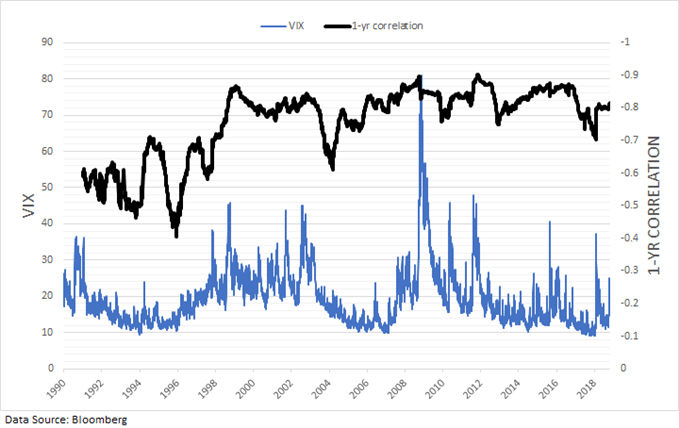

This indicator visualizes warning and panic signs which are shown separately. 408466 Figuratively the VIX volatility index can be represented in the form of. VIX A complete CBOE Volatility Index index overview by MarketWatch. The two trending articles have great explanations on the subject of the VIX and ways to play it. The Vix Hit Its Highest Level Since the Financial Crisis. Since the VIX index can be used to measure market sentiment the market also calls it the panic index.

The VIX set an all-time closing high on March 16.

By The Trading Skeptic Aug 24 2020. Since the VIX index can be used to measure market sentiment the market also calls it the panic index. If the market moves down the volatility index moves up. In mid-August when key stock indices were witnessing wild swings the fear index jumped to the highest level. The calculation method is very complicated. It is used as an indicator to see the possible abrupt changes in the stock market.

Source: pinterest.com

Source: pinterest.com

VIX is the volatility index of the SP 500 and ETF pages on the subject tend to trend quite a bit during market turmoil. The two trending articles have great explanations on the subject of the VIX and ways to play it. The VIX index is calculated based on weekly and traditional SPX index option prices and their implied volatility levels. The reason the volatility goes down is because there is no panic or uncertainty. The CBOE Volatility Index VIX is at 1791.

Source: nl.pinterest.com

Source: nl.pinterest.com

Tail risk is a risk that has a very low probability of occurring but if it does occur a significant decline is expected. Volatility Index at the Low End. When the market is in an uptrend the volatility in the overall market tends to go down. A spike in the VIX is typically either in line with or a precursor to a big selloff in the market. The VIX index is calculated based on weekly and traditional SPX index option prices and their implied volatility levels.

Source: pinterest.com

Source: pinterest.com

But one area that panic hasnt surfaced is the CBOE Volatility Index VIX. High volatility or high VIX reading occurs at periods of emotional stress and uncertainty when the market is peaking at panic bottom. Referred to as the fear index in financial media the VIX is simply a formula that indicates the implied volatility of the SP 500 over a 30 day period. The two trending articles have great explanations on the subject of the VIX and ways to play it. The Vix Hit Its Highest Level Since the Financial Crisis.

Source: pinterest.com

Source: pinterest.com

Since the VIX index can be used to measure market sentiment the market also calls it the panic index. The reason the volatility goes down is because there is no panic or uncertainty. The VIX index is calculated based on weekly and traditional SPX index option prices and their implied volatility levels. The index shows values between 0 extreme fear red and 100 extreme greed green. When you see that type of panic be on the lookout for the classic follow-through day to give the green light to begin buying stocks again.

Source: pinterest.com

Source: pinterest.com

By The Trading Skeptic Aug 24 2020. In this article learn how to use the VIX indicator in Forex trading. SKEW index representing the degree of tail risk. The VIX index is calculated based on weekly and traditional SPX index option prices and their implied volatility levels. It is calculated by the Chicago Board of Options Exchange CBOE in the US.

Source: pinterest.com

Source: pinterest.com

Nevertheless the CBOE has made a decision to continue base its calculation of the volatility index on the SP 100 under the new ticker - VXO volatility index. If the market moves up the Volatility index moves down. The Cboe Volatility Index VIX is a real-time index that represents the markets expectations for the relative strength of near-term price changes. 408466 Figuratively the VIX volatility index can be represented in the form of. Our Shorting the VIX and VIX ETF Options articles both saw traffic increases of 169 and 136 respectively this week.

Source: pinterest.com

Source: pinterest.com

When you see that type of panic be on the lookout for the classic follow-through day to give the green light to begin buying stocks again. Known as the investor fear gauge the CBOE Volatility Index is a forward-looking options-based measurement of investor anxiety. Since the VIX index can be used to measure market sentiment the market also calls it the panic index. This is a neutral reading and indicates that market risks appear low. If the market moves up the Volatility index moves down.

Source: pinterest.com

Source: pinterest.com

This is the VIX CBOE Volatility Index also known as the Chicago Market Volatility Index. Known as the investor fear gauge the CBOE Volatility Index is a forward-looking options-based measurement of investor anxiety. A spike in the VIX is typically either in line with or a precursor to a big selloff in the market. Since the VIX index can be used to measure market sentiment the market also calls it the panic index. A Complete Guide To The VIX Index.

Source: in.pinterest.com

Source: in.pinterest.com

The Vix Hit Its Highest Level Since the Financial Crisis. This index is based on the SP 500 and is one of the most consulted especially in the moments of greater agitation of the stock markets. VIX is the volatility index of the SP 500 and ETF pages on the subject tend to trend quite a bit during market turmoil. Values above 20 are red and below green. The calculation method is very complicated.

Source: pinterest.com

Source: pinterest.com

Simply put the index value reflects the level of fear of investors about the dynamics of market prices and helps to assess the panic or excessive optimism of the crowd regarding the stock market. Updated Nov 18 at 700pm. In mid-August when key stock indices were witnessing wild swings the fear index jumped to the highest level. The markets volatile stretch is continuing on Monday as stocks tumble across the board on renewed coronavirus. The VIX index is calculated based on weekly and traditional SPX index option prices and their implied volatility levels.

Source: in.pinterest.com

Source: in.pinterest.com

Section Fear Greed Approximation of the CNN Money Fear Greed index based on code of user MagicEins. The VIX moves opposite than the overall market. It is used as an indicator to see the possible abrupt changes in the stock market. 408466 Figuratively the VIX volatility index can be represented in the form of. Simply put the index value reflects the level of fear of investors about the dynamics of market prices and helps to assess the panic or excessive optimism of the crowd regarding the stock market.

Source: in.pinterest.com

Source: in.pinterest.com

When the market is in an uptrend the volatility in the overall market tends to go down. The Cboe Volatility Index VIX is a real-time index that represents the markets expectations for the relative strength of near-term price changes. In mid-August when key stock indices were witnessing wild swings the fear index jumped to the highest level. A high volatility index value indicates increased panic in the stock market. The calculation method is very complicated.

Source: pinterest.com

Source: pinterest.com

When the VIX is high it means more people are buying puts which protect from further downside than they are calls which anticipate further upside. The VIX currently stands at the highest level since 2011. In mid-August when key stock indices were witnessing wild swings the fear index jumped to the highest level. Section warning signs VIX. The Vix Hit Its Highest Level Since the Financial Crisis.

Source: pinterest.com

Source: pinterest.com

A low volatility index indicates more stability in. Since the VIX index can be used to measure market sentiment the market also calls it the panic index. VIX is the volatility index of the SP 500 and ETF pages on the subject tend to trend quite a bit during market turmoil. The Vix Hit Its Highest Level Since the Financial Crisis. Find the latest information on CBOE Volatility Index VIX including data charts related news and more from Yahoo Finance.

Source: pinterest.com

Source: pinterest.com

A Complete Guide To The VIX Index. It is used as an indicator to see the possible abrupt changes in the stock market. Last changed Oct 4 from an Extreme Fear rating. It is calculated by the Chicago Board of Options Exchange CBOE in the US. A spike in the VIX is typically either in line with or a precursor to a big selloff in the market.

Source: pinterest.com

Source: pinterest.com

All of that feels like panic. 408466 Figuratively the VIX volatility index can be represented in the form of. Nevertheless the CBOE has made a decision to continue base its calculation of the volatility index on the SP 100 under the new ticker - VXO volatility index. This is a neutral reading and indicates that market risks appear low. It is calculated by the Chicago Board of Options Exchange CBOE in the US.

Source: uk.pinterest.com

Source: uk.pinterest.com

This index is based on the SP 500 and is one of the most consulted especially in the moments of greater agitation of the stock markets. The index shows values between 0 extreme fear red and 100 extreme greed green. Since the VIX index can be used to measure market sentiment the market also calls it the panic index. More commonly the VIX is referred to as the panic index But since 2009 there hasnt been much panic to. When you see that type of panic be on the lookout for the classic follow-through day to give the green light to begin buying stocks again.

Source: pinterest.com

Source: pinterest.com

The Cboe Volatility Index VIX is a real-time index that represents the markets expectations for the relative strength of near-term price changes. Volatility Index at the Low End. Tail risk is a risk that has a very low probability of occurring but if it does occur a significant decline is expected. The Vix Hit Its Highest Level Since the Financial Crisis. In mid-August when key stock indices were witnessing wild swings the fear index jumped to the highest level.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title panic index vix by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.