Your Sp 500 realized volatility wallet are available in this site. Sp 500 realized volatility are a coin that is most popular and liked by everyone now. You can Find and Download the Sp 500 realized volatility files here. Download all free bitcoin.

If you’re looking for sp 500 realized volatility pictures information linked to the sp 500 realized volatility keyword, you have come to the ideal blog. Our site always provides you with hints for viewing the maximum quality video and picture content, please kindly search and find more informative video content and images that fit your interests.

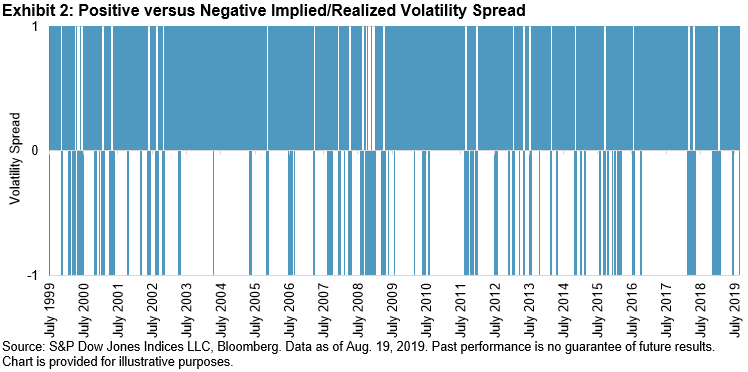

Sp 500 Realized Volatility. Realized volatility measures the variations in the price of a security over a given period. Since 1990 the average spread between the VIX and the realized volatility of the SP 500 Index was positive with one exception2008. From there the SP 500 fell another 27 in about five weeks which saw short-term volatility rocket to 97. Find the latest information on CBOE SP 500 3-Month Volatility VIX3M including data charts related news and more from Yahoo Finance.

Modern Portfolio Theory Portfolio Management In Python Modern Portfolio Theory Portfolio Management Theories From in.pinterest.com

Modern Portfolio Theory Portfolio Management In Python Modern Portfolio Theory Portfolio Management Theories From in.pinterest.com

Realized volatility remains remarkably low. While everyone has been concerned about the inverted yield curve the CBOE Volatility Index VIX has been under the 21-trading-day realized volatility of the SP 500 since Aug. VIX Dropped Below SP 500 Realized Volatility. Graph and download economic data for CBOE SP 500 3-Month Volatility Index VXVCLS from 2007-12-04 to 2021-11-18 about VIX volatility 3-month stock market and USA. Despite a narrowing election race and a deluge of earnings the SP 500 has not seen a daily change greater than 1 in nearly four weeks. As an introductory example Exhibit 1 shows the long-term behavior of the SP 500.

We then estimate the models using maximum likelihood on SP 500 returns.

Overlay and compare different stocks and volatility metrics using the interactive features. The SP Realized Volatility Indices can be used to analyze broad or specific market risk environments and they provide a perspective on how the market has reacted to historical events. Our realized volatility indices measure the variations of security prices over a given period by calculating the realized volatility in the daily levels of an underlying index. But the CBOE Volatility Index VIX a predictive measure of future volatility that is often seen as Wall Streets fear gauge. SPDR SP 500 ETF SPY had 30-Day Implied Volatility Mean of 01308 for 2021-11-18. Get historical data for the SP 500 Low Volatility Index SP500LVOL on Yahoo Finance.

Source: seekingalpha.com

Source: seekingalpha.com

View volatility charts for SPDR SP 500 ETF Trust SPY including implied volatility and realized volatility. SP 500 Utilities 1-Month Realized Volatility Index. Realized volatility remains remarkably low. From there the SP 500 fell another 27 in about five weeks which saw short-term volatility rocket to 97. Despite a narrowing election race and a deluge of earnings the SP 500 has not seen a daily change greater than 1 in nearly four weeks.

Source: researchgate.net

Source: researchgate.net

VIX Dropped Below SP 500 Realized Volatility. VIX is holding the Trump card. View and download daily weekly or monthly data to help your investment decisions. Historically implied volatility tends to stay above realized volatility due to the skewed distribution of stock returns. Since volatility traders care not only about what is expected but also what actually transpired the spread between implied volatility and realized volatility is one of the most important gauges for them to keep.

Source: jeroenbloklandblog.com

Source: jeroenbloklandblog.com

Despite a narrowing election race and a deluge of earnings the SP 500 has not seen a daily change greater than 1 in nearly four weeks. Goldman Sachs Global Investment Research. SP 500 Utilities 1-Month Realized Volatility Index. Despite a narrowing election race and a deluge of earnings the SP 500 has not seen a daily change greater than 1 in nearly four weeks. At the close of yesterday 19112019 the 1-Month Realized Volatility stood at 627.

Source: researchgate.net

Source: researchgate.net

Realized volatility measures the variations in the price of a security over a given period. In an empirical application for SP 500 index futures we show that allowing for time-varying volatility of realized volatility and logarithmic realized variance substantially improves the fit as. Realized volatility measures the variations in the price of a security over a given period. While everyone has been concerned about the inverted yield curve the CBOE Volatility Index VIX has been under the 21-trading-day realized volatility of the SP 500 since Aug. This paper studies the relationship between implied and realized volatility by using daily SP 500 index option prices over the period between January 1995 and December 1999.

Source: investopedia.com

Source: investopedia.com

From there the SP 500 fell another 27 in about five weeks which saw short-term volatility rocket to 97. In an empirical application for SP 500 index futures we show that allowing for time-varying volatility of realized volatility and logarithmic realized variance substantially improves the fit as. We first use realized volatilities to assess the properties of the SQR model and to guide us in the search for alternative specifications. Find the latest information on CBOE SP 500 3-Month Volatility VIX3M including data charts related news and more from Yahoo Finance. Get historical data for the SP 500 Low Volatility Index SP500LVOL on Yahoo Finance.

Source: pinterest.com

Source: pinterest.com

For the last 10years SP 500 1-Month Realized Volatility has averaged 13. Since volatility traders care not only about what is expected but also what actually transpired the spread between implied volatility and realized volatility is one of the most important gauges for them to keep. We then estimate the models using maximum likelihood on SP 500 returns. Our realized volatility indices measure the variations of security prices over a given period by calculating the realized volatility in the daily levels of an underlying index. For the last 10years SP 500 1-Month Realized Volatility has averaged 13.

Source: pinterest.com

Source: pinterest.com

Historical Volatility Close-to-Close. View and download daily weekly or monthly data to help your investment decisions. We then estimate the models using maximum likelihood on SP 500 returns. Graph and download economic data for CBOE SP 500 3-Month Volatility Index VXVCLS from 2007-12-04 to 2021-11-18 about VIX volatility 3-month stock market and USA. The forecasted future volatility of the security over the selected time frame derived from the average of the put and call implied volatilities for options with the relevant expiration date.

Source: researchgate.net

Source: researchgate.net

It can be seen that for all indices except for the DAX the average squared return is larger than the average realized volatility in the same time - 4 -. SP 500 Realized Volatility by Year 2020 volatility estimate of 147 is above the median but below the mean data from January 1929 to December 2019. Overlay and compare different stocks and volatility metrics using the interactive features. Find the latest information on CBOE SP 500 3-Month Volatility VIX3M including data charts related news and more from Yahoo Finance. We provide empirical evidence from three different sources.

Source: researchgate.net

Source: researchgate.net

SPDR SP 500 ETF SPY had 30-Day Implied Volatility Mean of 01308 for 2021-11-18. View and download daily weekly or monthly data to help your investment decisions. This index reflects the 1-Month realized volatility in the daily levels of the SP 500 Utilities Index. Despite a narrowing election race and a deluge of earnings the SP 500 has not seen a daily change greater than 1 in nearly four weeks. Goldman Sachs Global Investment Research.

Source: ar.pinterest.com

Source: ar.pinterest.com

We would like to show you a description here but the site wont allow us. Finally we employ nonlinear least squares on a panel of option data. Following the volatility below tracks this spread. View and download daily weekly or monthly data to help your investment decisions. We would like to show you a description here but the site wont allow us.

Source: in.pinterest.com

Source: in.pinterest.com

The past volatility of the security over the selected time frame calculated using the closing price on each trading day. SPDR SP 500 ETF SPY had 10-Day Historical Volatility Close-to-Close of 00560 for 2021-11-19. For the last 10years SP 500 1-Month Realized Volatility has averaged 13. View volatility charts for SPDR SP 500 ETF Trust SPY including implied volatility and realized volatility. Overlay and compare different stocks and volatility metrics using the interactive features.

Source: pinterest.com

Source: pinterest.com

It can be seen that for all indices except for the DAX the average squared return is larger than the average realized volatility in the same time - 4 -. Since 1990 the average spread between the VIX and the realized volatility of the SP 500 Index was positive with one exception2008. Since volatility traders care not only about what is expected but also what actually transpired the spread between implied volatility and realized volatility is one of the most important gauges for them to keep. Get historical data for the SP 500 Low Volatility Index SP500LVOL on Yahoo Finance. We then estimate the models using maximum likelihood on SP 500 returns.

Source: pinterest.com

Source: pinterest.com

SP 500 Realized Volatility by Year 2020 volatility estimate of 147 is above the median but below the mean data from January 1929 to December 2019. Our realized volatility indices measure the variations of security prices over a given period by calculating the realized volatility in the daily levels of an underlying index. Finally we employ nonlinear least squares on a panel of option data. The SP Realized Volatility Indices can be used to analyze broad or specific market risk environments and they provide a perspective on how the market has reacted to historical events. As an introductory example Exhibit 1 shows the long-term behavior of the SP 500.

Source: id.pinterest.com

Source: id.pinterest.com

Following the volatility below tracks this spread. The past volatility of the security over the selected time frame calculated using the closing price on each trading day. Following the volatility below tracks this spread. We provide empirical evidence from three different sources. We first use realized volatilities to assess the properties of the SQR model and to guide us in the search for alternative specifications.

Source: in.pinterest.com

Source: in.pinterest.com

Find the latest information on CBOE SP 500 3-Month Volatility VIX3M including data charts related news and more from Yahoo Finance. Since volatility traders care not only about what is expected but also what actually transpired the spread between implied volatility and realized volatility is one of the most important gauges for them to keep. Goldman Sachs Global Investment Research. The SP Realized Volatility Indices can be used to analyze broad or specific market risk environments and they provide a perspective on how the market has reacted to historical events. The forecasted future volatility of the security over the selected time frame derived from the average of the put and call implied volatilities for options with the relevant expiration date.

Source: pinterest.com

Source: pinterest.com

It can be seen that for all indices except for the DAX the average squared return is larger than the average realized volatility in the same time - 4 -. We would like to show you a description here but the site wont allow us. The forecasted future volatility of the security over the selected time frame derived from the average of the put and call implied volatilities for options with the relevant expiration date. Finally we employ nonlinear least squares on a panel of option data. VIX Dropped Below SP 500 Realized Volatility.

Source: pinterest.com

Source: pinterest.com

Our realized volatility indices measure the variations of security prices over a given period by calculating the realized volatility in the daily levels of an underlying index. At the close of yesterday 19112019 the 1-Month Realized Volatility stood at 627. Realized volatility measures the variations in the price of a security over a given period. This paper studies the relationship between implied and realized volatility by using daily SP 500 index option prices over the period between January 1995 and December 1999. Get historical data for the SP 500 Low Volatility Index SP500LVOL on Yahoo Finance.

Source: pinterest.com

Source: pinterest.com

As an introductory example Exhibit 1 shows the long-term behavior of the SP 500. Annualized average squared return for 22 commonly considered indices such as the SP 500 the DAX and the SSEC. Since volatility traders care not only about what is expected but also what actually transpired the spread between implied volatility and realized volatility is one of the most important gauges for them to keep. Goldman Sachs Global Investment Research. At the close of yesterday 19112019 the 1-Month Realized Volatility stood at 627.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title sp 500 realized volatility by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.