Your Sp500 implied volatility trading are ready in this website. Sp500 implied volatility are a wallet that is most popular and liked by everyone this time. You can News the Sp500 implied volatility files here. Get all royalty-free news.

If you’re looking for sp500 implied volatility pictures information linked to the sp500 implied volatility keyword, you have come to the ideal blog. Our website frequently provides you with hints for seeing the highest quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

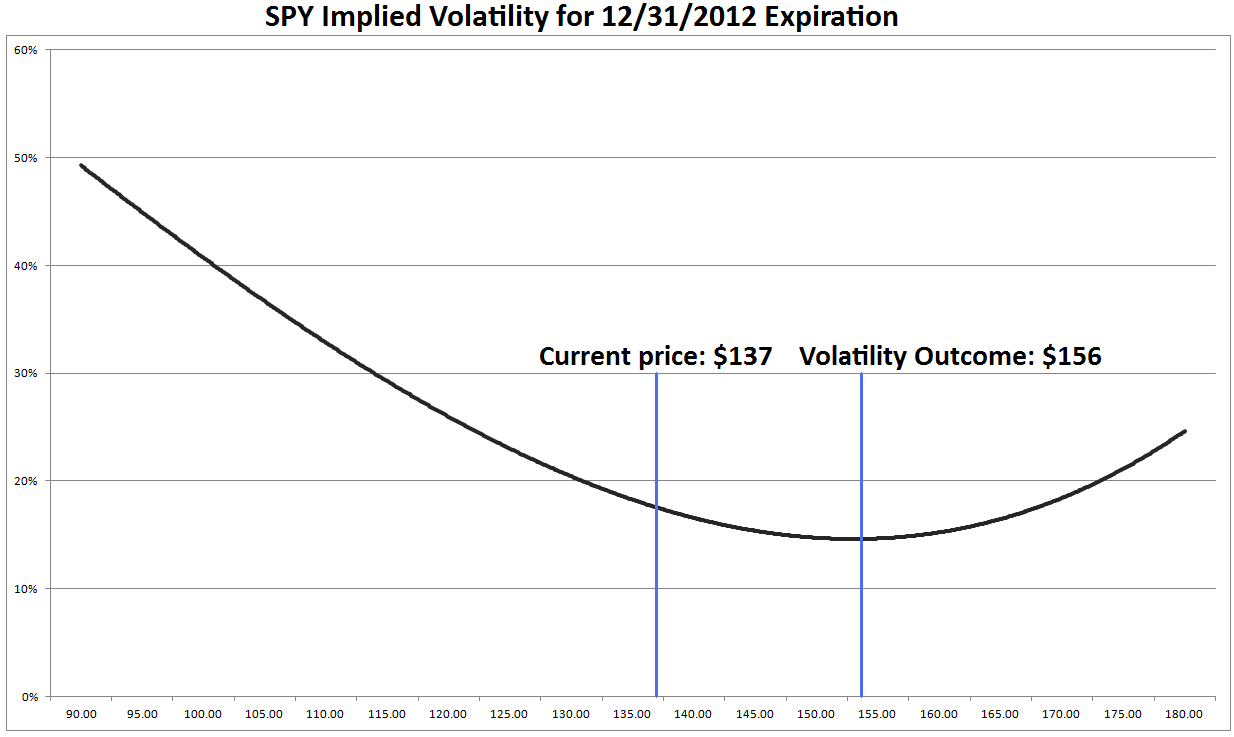

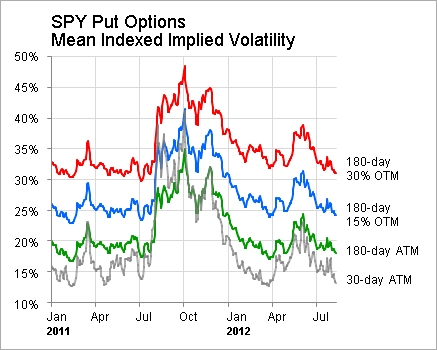

Sp500 Implied Volatility. It can therefore help traders make decisions about option pricing and whether it. In contrast to the VIX index VIX Futures represent forward expectations for volatility as well as the demand for insurance against tail events in the market. IV can help traders determine if options are fairly valued undervalued or overvalued. Volatility or VIX Futures are based on the SP500 index and are calculated from the implied volatility of different option strike prices across different expiration periods.

Implied Volatility Smile For S P500 Index For Short Left And Long Download Scientific Diagram From researchgate.net

Implied Volatility Smile For S P500 Index For Short Left And Long Download Scientific Diagram From researchgate.net

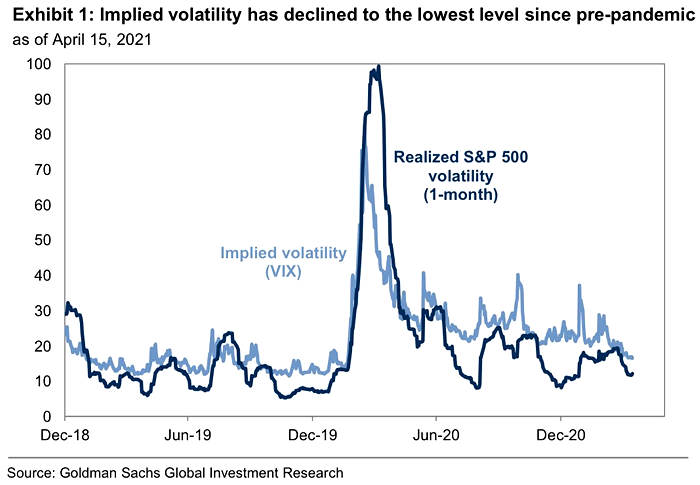

In the high-fear period the impact is even stronger. This script uses the close of the VIX on a daily resolution to provide the implied move for the E-mini SP500 futures. CBOE Indexes namely Implied Correlation Volatility of Volatility and Skew are measures incorporating option market information and expectations about the SP500 volatility in the near future. In contrast to the VIX index VIX Futures represent forward expectations for volatility as well as the demand for insurance against tail events in the market. Overlay and compare different stocks and volatility metrics using the interactive features. Two components are identified under a variety of criteria.

That said it is often useful to work with volatility.

All information for an index prior to its Launch Date is hypothetical back-tested not actual performance based on the. Index Futures Implied Volatility Skews SP500 and others Black Vols Business Calendar Hints. Subsequently we develop a Procrustes type rotation in order to. We investigate the number and shape of shocks that move implied volatility smiles and surfaces by applying Principal Components Analysis. When one does reverse engineering in the black and. This script uses the close of the VIX on a daily resolution to provide the implied move for the E-mini SP500 futures.

Source: slidetodoc.com

Source: slidetodoc.com

1382 USD 064 1 Day. The forecasted future volatility of the security over the selected time frame derived from the average of the put and call implied volatilities for options with the relevant expiration date. The CBOE provides updated daily and intra-day data on their websites. This index seeks to reflect the 1-Month realized volatility in the daily levels of the SP 500. When one does reverse engineering in the black and.

Source: seekingalpha.com

Source: seekingalpha.com

It is easy with Python to access download and plot the. SP 500 1-Month Realized Volatility Index. Implied Volatility - Implied Volatility IV is the estimated volatility of the underlying stock over the period of the option. The two most common types of. SPDR SP 500 ETF SPY had 30-Day Implied Volatility Mean of 01308 for 2021-11-18.

Source: researchgate.net

Source: researchgate.net

Create your own screens with over 150 different screening criteria. SPDR SP 500 ETF SPY had 10-Day Historical Volatility Close-to-Close of 00560 for 2021-11-19. Implied volatility is a forward-looking or future expectation estimate. 10-Day 20-Day 30-Day 60-Day. Variations of implied volatilities obtained from market data on SP500 and DAX options.

Source: isabelnet.com

Source: isabelnet.com

Implied volatility on the other hand is computed from the markets consensus of the fair value for a derivative instrument such as the SP500 index option contract. See a list of Highest Implied Volatility using the Yahoo Finance screener. We illustrate how this approach extends and improves the accuracy of the well-known sticky moneyness rule used by option traders for. SPDR SP 500 ETF SPY had 30-Day Implied Volatility Mean of 01308 for 2021-11-18. The CBOE provides updated daily and intra-day data on their websites.

Source: ugolini.co.th

Source: ugolini.co.th

Implied Volatility - Implied Volatility can help traders determine if options are fairly valued undervalued or overvalued. Implied volatility on the other hand is computed from the markets consensus of the fair value for a derivative instrument such as the SP500 index option contract. The past volatility of the security over the selected time frame calculated using the closing price on each trading day. See a list of Highest Implied Volatility using the Yahoo Finance screener. The CBOE provides updated daily and intra-day data on their websites.

Source: researchgate.net

Source: researchgate.net

Implied Volatility as Annual Standard Deviation. 1382 USD 064 1 Day. Check out our Year End 2020 wrap up of commodity markets at YearEnd2020. SPDR SP 500 ETF SPY had 10-Day Historical Volatility Close-to-Close of 00560 for 2021-11-19. Implied volatility is determined mathematically by using current option prices in a formula that.

Source: researchgate.net

Source: researchgate.net

SPDR SP 500 ETF SPY had 10-Day Historical Volatility Close-to-Close of 00560 for 2021-11-19. This empirical study is motivated by the literature on smile-consistent arbitrage pricing with stochastic volatility. SPDR SP 500 ETF SPY had 30-Day Implied Volatility Mean of 01308 for 2021-11-18. SP 500 1-Month Realized Volatility Index. It can therefore help traders make decisions about option pricing and whether it is a good time to buy or sell options.

Source: seekingalpha.com

Source: seekingalpha.com

Two components are identified under a variety of criteria. The CBOE provides updated daily and intra-day data on their websites. 10-Day 20-Day 30-Day 60-Day. See a list of Highest Implied Volatility using the Yahoo Finance screener. Implied volatility is determined mathematically by using current option prices in a formula that.

Source: researchgate.net

Source: researchgate.net

We illustrate how this approach extends and improves the accuracy of the well-known sticky moneyness rule used by option traders for. SP 500 1-Month Realized Volatility Index. Implied Volatility - Implied Volatility IV is the estimated volatility of the underlying stock over the period of the option. Implied volatility is a forward-looking or future expectation estimate. Download scientific diagram Typical profile of the implied volatility of SP500 options as a function of time to maturity and moneyness March 1999.

Source: barrons.com

Source: barrons.com

If the implied volatility is higher than the historical volatility this is an estimation that the stock will have more active price movements – however the implied volatility is just an estimate based on the market and is not a guarantee of increased price activity. The past volatility of the security over the selected time frame calculated using the closing price on each trading day. SPDR SP 500 ETF SPY had 30-Day Implied Volatility Mean of 01308 for 2021-11-18. Implied Volatility - Implied Volatility IV is the estimated volatility of the underlying stock over the period of the option. Implied volatility is the estimated volatility of an asset underlying an option and is derived from an options price.

Source: investopedia.com

Source: investopedia.com

The CBOE provides updated daily and intra-day data on their websites. Two components are identified under a variety of criteria. These indices track the performance of the futures contracts that settle to VIX the CBOE Volatility Index and the leading measure of the stock markets expectation of volatility as implied by SP 500 options. Implied Volatility - Implied Volatility IV is the estimated volatility of the underlying stock over the period of the option. Implied Volatility as Annual Standard Deviation.

Source: researchgate.net

Source: researchgate.net

Create your own screens with over 150 different screening criteria. Launched in 1993 the VIX has now become a fixture on many a traders monitor and the home page to many financial. In contrast to the VIX index VIX Futures represent forward expectations for volatility as well as the demand for insurance against tail events in the market. Subsequently we develop a Procrustes type rotation in order to. Overlay and compare different stocks and volatility metrics using the interactive features.

Source: researchgate.net

Source: researchgate.net

Our data and models were used in a major paper on the negative oil prices GCARD. Implied Volatility - Implied Volatility can help traders determine if options are fairly valued undervalued or overvalued. Dynamics of Implied. We investigate the number and shape of shocks that move implied volatility smiles and surfaces by applying Principal Components Analysis. These indices track the performance of the futures contracts that settle to VIX the CBOE Volatility Index and the leading measure of the stock markets expectation of volatility as implied by SP 500 options.

Source: seekingalpha.com

Source: seekingalpha.com

Implied volatility is a forward-looking or future expectation estimate. SP 500 1-Month Realized Volatility Index. It can therefore help traders make decisions about option pricing and whether it. The two most common types of. These indices track the performance of the futures contracts that settle to VIX the CBOE Volatility Index and the leading measure of the stock markets expectation of volatility as implied by SP 500 options.

Source: researchgate.net

Source: researchgate.net

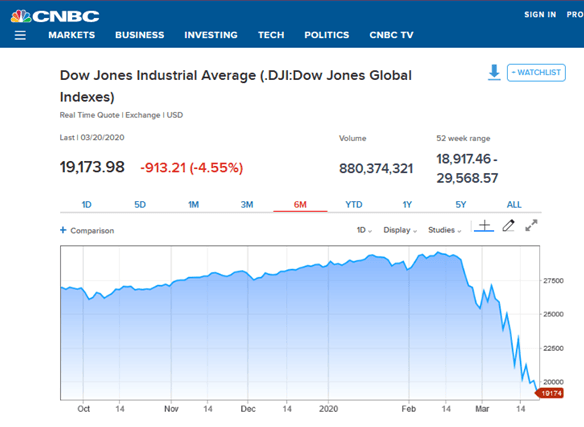

10-Day 20-Day 30-Day 60-Day. If the implied volatility is higher than the historical volatility this is an estimation that the stock will have more active price movements – however the implied volatility is just an estimate based on the market and is not a guarantee of increased price activity. Implied volatility goes up when there is strong demand for options and this typically happens during declines in the price of the SP 500 as market. IV can help traders determine if options are fairly valued undervalued or overvalued. See a list of Highest Implied Volatility using the Yahoo Finance screener.

Source: equityclock.com

Source: equityclock.com

Check out our Year End 2020 wrap up of commodity markets at YearEnd2020. Our data and models were used in a major paper on the negative oil prices GCARD. This script uses the close of the VIX on a daily resolution to provide the implied move for the E-mini SP500 futures. These indices track the performance of the futures contracts that settle to VIX the CBOE Volatility Index and the leading measure of the stock markets expectation of volatility as implied by SP 500 options. CBOE Indexes namely Implied Correlation Volatility of Volatility and Skew are measures incorporating option market information and expectations about the SP500 volatility in the near future.

Source: energi.media

Source: energi.media

This script uses the close of the VIX on a daily resolution to provide the implied move for the E-mini SP500 futures. This index seeks to reflect the 1-Month realized volatility in the daily levels of the SP 500. Subsequently we develop a Procrustes type rotation in order to. SPDR SP 500 ETF SPY had 10-Day Historical Volatility Close-to-Close of 00560 for 2021-11-19. When one does reverse engineering in the black and.

Source: theatlas.com

Source: theatlas.com

The CBOE Volatility Index or VIX is a measure of implied volatility on SP 500 ticker SPX options. September 10 2019. The two most common types of. We illustrate how this approach extends and improves the accuracy of the well-known sticky moneyness rule used by option traders for. All information for an index prior to its Launch Date is hypothetical back-tested not actual performance based on the.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title sp500 implied volatility by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.