Your Stock market volatility and macroeconomic fundamentals bitcoin are available. Stock market volatility and macroeconomic fundamentals are a wallet that is most popular and liked by everyone today. You can News the Stock market volatility and macroeconomic fundamentals files here. Get all free exchange.

If you’re looking for stock market volatility and macroeconomic fundamentals images information connected with to the stock market volatility and macroeconomic fundamentals topic, you have pay a visit to the right blog. Our site always gives you hints for seeing the maximum quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

Stock Market Volatility And Macroeconomic Fundamentals. Financial market equity market asset return risk variance asset pricing. Abstract We revisit the relation between stock market volatility and macroeconomic activity using a new class of component models that distinguish short-run from long-run movements. Kredit and Kapital 31 400412. Stock Market Volatility and Macroeconomic Fundamentals.

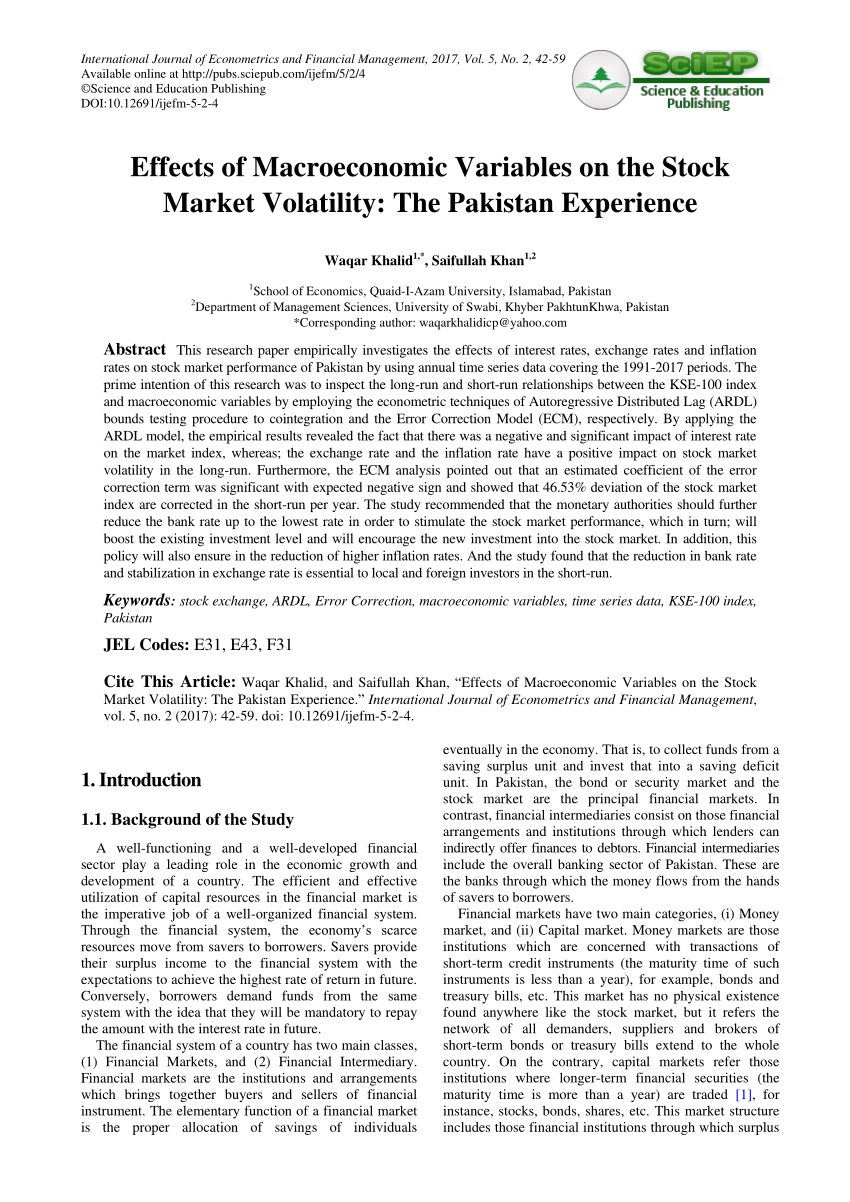

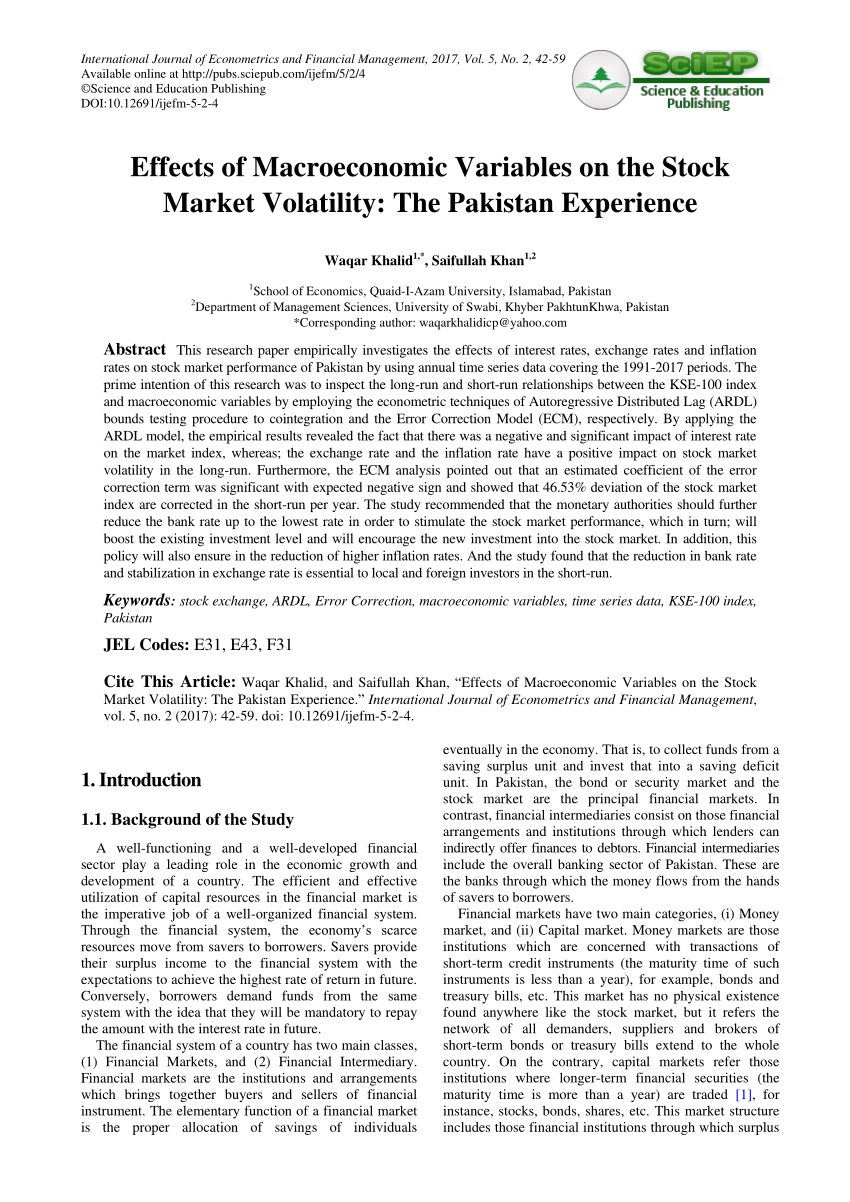

Pdf Effects Of Macroeconomic Variables On The Stock Market Volatility The Pakistan Experience From researchgate.net

Pdf Effects Of Macroeconomic Variables On The Stock Market Volatility The Pakistan Experience From researchgate.net

Aspergis N 1998 Stock market volatility and deviations from macroeconomic fundamentals. Macroeconomic causes of stock market volatility. In the first stage we estimate the long-term volatility of BIST100 index. Abstract We revisit the relation between stock market volatility and macroeconomic activity using a new class of component models that distinguish short-run from long-run movements. Using monthly data over the period July 2001June 2015. Relationship between the stock market volatility and volatility in the macroeconomic indicators.

We find a clear link between macroeconomic fundamentals and stock market volatilities with volatile fundamentals translating into volatile stock markets.

The first is Engle and. I higher volatility of US Economic Policy Uncertainty EPU elevated US financial uncertainty tighter credit conditions increased commodity prices and stronger infectious disease news impact on US equities all five economic. Journal of Econometrics 131 151177. Stock Market Volatility and Macroeconomic Fundamentals. We formulate models with the long-term component driven by inflation and industrial production growth that are in terms of pseudo out-of-sample prediction for horizons of one. Relationship between the stock market volatility and volatility in the macroeconomic indicators.

Source: researchgate.net

Source: researchgate.net

Stock Market Volatility and Macroeconomic Fundamentals. STOCK MARKET VOLATILITY AND MACROECONOMIC FUNDAMENTALS 777 asymmetric stock market volatility movements. The general failure to link macroeconomic fundamentals to asset return volatility certainly holds true for the case of stock returns. This research paper evaluates the volatility spillover symmetric and asymmetric effects between the macroeconomic fundamentals ie market risks interest rates exchange rates and bank stock returns for the listed banks of Pakistan. Practically speaking the research pursued in this paper is inspired by two recent contributions.

Source: researchgate.net

Source: researchgate.net

Stock Market Volatility and Macroeconomic Fundamentals. We revisit the relation between stock market volatility and macroeconomic activity using a new class of component models that distinguish short run from secular movements. Robert Engle Eric Ghysels and Bumjean Sohn Additional contact information Eric Ghysels. We study long. The importance of US uncertainty spillovers financial and health crises.

Source: dailyfx.com

Source: dailyfx.com

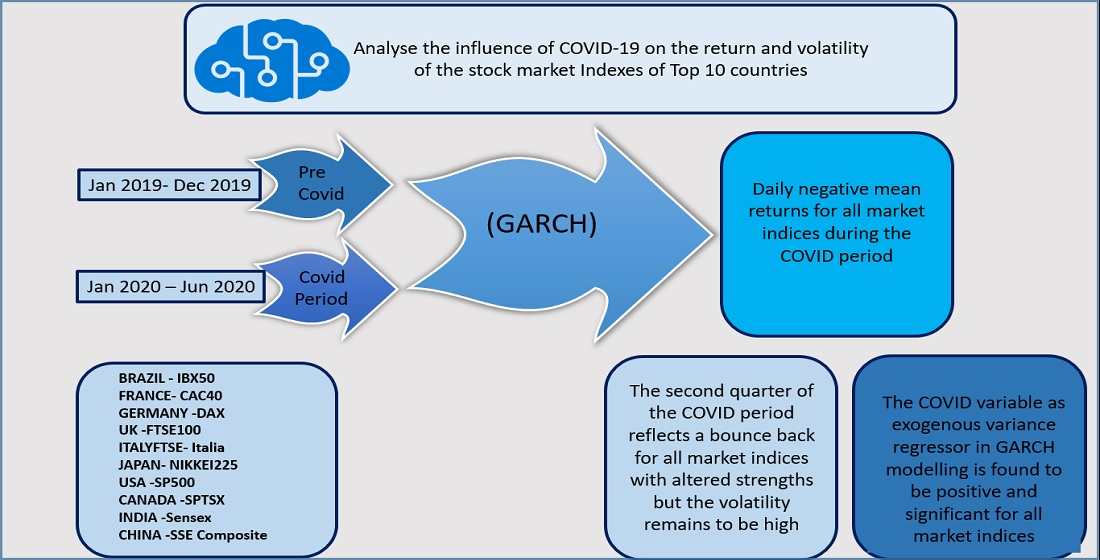

We find a clear link between macroeconomic fundamentals and stock market volatilities with volatile fundamentals translating into volatile stock markets. Volatility of stock returns and its determinants. The first is Engle and. Financial market equity market asset return risk variance asset pricing. Evidence from GARCH and GARCH-X models.

Source: pinterest.com

Source: pinterest.com

We revisit the relation between stock market volatility and macroeconomic activity using a new class of component models that distinguish short run from secular movements. This research paper evaluates the volatility spillover symmetric and asymmetric effects between the macroeconomic fundamentals ie market risks interest rates exchange rates and bank stock returns for the listed banks of Pakistan. Abstract We revisit the relation between stock market volatility and macroeconomic activity using a new class of component models that distinguish short-run from long-run movements. Relationship between the stock market volatility and volatility in the macroeconomic indicators. Volatility modeling practice should rely on macroeconomic condition metrics to demonstrate the macro-financial effects on stock market volatility driven either by the cash flow or the discount rates channel.

Source: researchgate.net

Source: researchgate.net

Purpose of the article. Notwithstanding its impressive contributions to empirical financial economics there remains a significant gap in the volatility literature namely its relative neglect of the connection between macroeconomic fundamentals and. Using a structural VAR model with Bayesian sign restrictions we show that adverse shocks to aggregate demand and supply cause an increase in the persistent component of both stock and bond market volatility and that adverse shocks to the persistent component of either stock or bond market volatility cause a deterioration in macroeconomic fundamentals. We progress by analyzing a broad international cross section of stock markets. Stock Market Volatility and Macroeconomic Fundamentals.

Source: sciencedirect.com

Source: sciencedirect.com

The general failure to link macroeconomic fundamentals to asset return volatility certainly holds true for the case of stock returns. Macroeconomic causes of stock market volatility. We show that adverse shocks to aggregate demand and aggregate supply cause an increase in both stock and bond market volatility and that adverse shocks to either stock or bond market volatility cause a deterioration in macroeconomic fundamentals. The general failure to link macroeconomic fundamentals to asset return volatility certainly holds true for the case of stock returns. STOCK MARKET VOLATILITY AND MACROECONOMIC FUNDAMENTALS 111 asymmetric stock market volatility movements.

Source: researchgate.net

Source: researchgate.net

We find a clear link between macroeconomic fundamentals and stock market volatilities with volatile fundamentals translating into volatile stock markets. The banking sector plays a crucial role in the worlds economic development. In particular the relationship between stock market volatility and uncertainty of macroeconomic fundamentals stay unstudied most of the times. And Yilmaz Kamil Macroeconomic Volatility and Stock Market Volatility Worldwide August 2008. Stock Market Volatility and Macroeconomic Fundamentals.

Source: researchgate.net

Source: researchgate.net

University of North Carolina at Chapel Hill Bumjean Sohn. Filling a notable gap of the academic literature related to the high-frequency macro-financial linkages in emerging economies our novel findings are summarized as follows. The first is Engle and. And Yilmaz Kamil Macroeconomic Volatility and Stock Market Volatility Worldwide August 2008. STOCK MARKET VOLATILITY AND MACROECONOMIC FUNDAMENTALS 777 asymmetric stock market volatility movements.

We find a clear link between macroeconomic fundamentals and stock market volatilities with volatile fundamentals translating into volatile stock markets. Aspergis N 1998 Stock market volatility and deviations from macroeconomic fundamentals. Emerging stock market volatility and economic fundamentals. Here we focus on stock market volatility. We revisit the relation between stock market volatility and macroeconomic activity using a new class of component models that distinguish short-run from long-run movements.

Source: pinterest.com

Source: pinterest.com

I higher volatility of US Economic Policy Uncertainty EPU elevated US financial uncertainty tighter credit conditions increased commodity prices and stronger infectious disease news impact on US equities all five economic. In particular the relationship between stock market volatility and uncertainty of macroeconomic fundamentals stay unstudied most of the times. STOCK MARKET VOLATILITY AND MACROECONOMIC FUNDAMENTALS 777 asymmetric stock market volatility movements. We find a clear link between macroeconomic fundamentals and stock market volatilities with volatile fundamentals translating into volatile stock markets. Relationship between the stock market volatility and volatility in the macroeconomic indicators.

Source: researchgate.net

Source: researchgate.net

The main purpose of this study is. Practically speaking the research pursued in this paper is inspired by two recent contributions. Macroeconomic Volatility and Stock Market Volatility Worldwide. The main purpose of this study is. Purpose of the article.

Source: researchgate.net

Source: researchgate.net

We formulate models with the long-term component. Stock Market Volatility and Macroeconomic Fundamentals. We revisit the relation between stock market volatility and macroeconomic activity using a new class of component models that distinguish short run from secular movements. Here we focus on stock market volatility. Since the present study is based on the first category some of the relevant literatures on the macroeconomic determinants of stock prices have been reviewed.

Source: pinterest.com

Source: pinterest.com

Emerging stock market volatility and economic fundamentals. The first is Engle and. Relationship between the stock market volatility and volatility in the macroeconomic indicators. University of North Carolina at Chapel Hill Bumjean Sohn. We find a clear link between macroeconomic fundamentals and stock market volatilities with volatile fundamentals translating into volatile stock markets.

Source: mdpi.com

Source: mdpi.com

Often the modeling and forecasting of capital market volatility is done. There are few studies attempting to link underlying macroeconomic fundamentals to stock return volatility and the studies that do exist have been largely unsuccessful. Robert Engle Eric Ghysels and Bumjean Sohn Additional contact information Eric Ghysels. Volatility modeling practice should rely on macroeconomic condition metrics to demonstrate the macro-financial effects on stock market volatility driven either by the cash flow or the discount rates channel. Often the modeling and forecasting of capital market volatility is done.

Source: researchgate.net

Source: researchgate.net

The banking sector plays a crucial role in the worlds economic development. We revisit the relation between stock market volatility and macroeconomic activity using a new class of component models that distinguish short run from secular movements. Between macroeconomic fundamentals and asset return volatility. Robert Engle Eric Ghysels and Bumjean Sohn Additional contact information Eric Ghysels. In particular the relationship between stock market volatility and uncertainty of macroeconomic fundamentals stay unstudied most of the times.

Source: researchgate.net

Source: researchgate.net

In the first stage we estimate the long-term volatility of BIST100 index. We revisit the relation between stock market volatility and macroeconomic activity using a new class of component models that distinguish short-run from long-run movements. There are few studies attempting to link underlying macroeconomic fundamentals to stock return volatility and the studies that do exist have been largely unsuccessful. The aim of this study is to investigate the relationship between the slowly moving long-run component of daily volatility of Turkish stock market and a set of monthly macroeconomic variables. We study long.

Source: pinterest.com

Source: pinterest.com

2013 link macroeconomic fundamentals to stock price volatility and incorporate macroeconomic variables in the long-term. Aspergis N 1998 Stock market volatility and deviations from macroeconomic fundamentals. Beltratti A and C Morana 2006 Breaks and persistency. We progress by analyzing a broad international cross section of stock markets. In the first stage we estimate the long-term volatility of BIST100 index.

Source: semanticscholar.org

Source: semanticscholar.org

Volatility of stock returns and its determinants. The first is Engle and. There are few studies attempting to link underlying macroeconomic fundamentals to stock return volatility and the studies that do exist have been largely unsuccessful. Macroeconomic causes of stock market volatility. Notwithstanding its impressive contributions to empirical financial economics there remains a significant gap in the volatility literature namely its relative neglect of the connection between macroeconomic fundamentals and.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title stock market volatility and macroeconomic fundamentals by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.