Your Stock market volatility and the business cycle coin are available. Stock market volatility and the business cycle are a mining that is most popular and liked by everyone today. You can Download the Stock market volatility and the business cycle files here. Download all free mining.

If you’re looking for stock market volatility and the business cycle pictures information connected with to the stock market volatility and the business cycle interest, you have visit the ideal blog. Our website frequently provides you with hints for downloading the highest quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

Stock Market Volatility And The Business Cycle. A typical business cycle contains 4 distinct phases. Stock Market Volatility and the Business Cycle. Several transmission channels have been proposed in the. Where SMV is the stock market volatility BC is the business cycle indicator and REP is the shares repurchase.

Market Cycle Day Trading Trading Forex From pinterest.com

Market Cycle Day Trading Trading Forex From pinterest.com

The main purpose of this paper is to investigate the relationship between business cycle volatility and country size and financial markets size within certain countries using annual data for a sample of some typical countries having advanced financial market and those of China over 2000-2015. Finally we identify a significant impact of the US on the remaining markets. There are four variables that determine whether the current secular stock market cycle is in bull or bear territory. Stock Market Volatility and the Business Cycle Although conventional wisdom holds that the stock market plays an impor-tant role for macroeconomic develop-ments and the business cycle the pre-cise linkages between the stock market and macroeconomic aggregates are not well understood. Our results suggest that there is a bidirectional causal relationship between stock market volatility and the business cycle within each country and additionally reveal that the recent financial crisis plays an important role in this context. The technical novelty of this work lies in the estimation of a Markov-switching stochastic-volatility model that allows for Bayesian sequential evaluation on both the parameters and the latent variables.

Our results suggest that there is a bidirectional causal relationship between stock market volatility and the business cycle within each country and additionally reveal that the recent financial crisis plays an important role in this context.

On the other hand in contrast to the pre-crisis period the stock market volatility of the US is now significantly causing the Canadian business cycle while the US business cycle remains significant at the 1 level in this case. Finally we identify a significant impact of the US on the remaining markets. 115 pages 573-593 Sept-Oct. Then analyze the significance level of. We find that stock returns are well characterized by year-long episodes of high volatility separated by longer quiet periods. Our results suggest that there is a bidirectional causal relationship.

Source: pinterest.com

Source: pinterest.com

The relationship between stock market volatility and the business cycle is macrofinancial as it links the fields of financial markets and macro-economics. The recent observed decline of business cycle variability suggests that broad macroeconomic risk may have fallen as well. All variables are in log and the ɛ t are the terms of the residual supposed to be white noise. A typical business cycle contains 4 distinct phases. More specifically the influence of the US stock market volatility and business cycle on the Canadian stock market volatility remains robust and significant at the 5 level.

Source: allseasonfunds.com

Source: allseasonfunds.com

James Hamilton and Lin Gang. 11 issue 5 573-93 Abstract. Our results suggest that there is a bidirectional causal relationship between stock market volatility and the business cycle within each country and additionally reveal that the recent financial crisis plays an important role in this context. Finally we identify a significant impact of the US on the remaining markets. Stock Market Volatility and the Business Cycle Journal of Applied Econometrics John Wiley Sons Ltd vol.

Source: pinterest.com

Source: pinterest.com

On the other hand in contrast to the pre-crisis period the stock market volatility of the US is now significantly causing the Canadian business cycle while the US business cycle remains significant at the 1 level in this case. More specifically the influence of the US stock market volatility and business cycle on the Canadian stock market volatility remains robust and significant at the 5 level. The stock volatility is a powerful indictor of financial crisis because it is closely related to business or economic cycle. There are four variables that determine whether the current secular stock market cycle is in bull or bear territory. More credit and low interest rates aid profit growth.

Source: researchgate.net

Source: researchgate.net

Our results suggest that there is a bidirectional causal relationship. On the other hand our estimates identify a similar pattern for the volatility of all our stock market indicators. KW - stock market volatility. This paper investigates the joint time series behavior of monthly stock returns and growth in industrial production. We find that stock returns are well characterized by year-long episodes of high volatility separated by longer quiet periods.

Source: pinterest.com

Source: pinterest.com

There are four variables that determine whether the current secular stock market cycle is in bull or bear territory. By observing the U. On the other hand in contrast to the pre-crisis period the stock market volatility of the US is now significantly causing the Canadian business cycle while the US business cycle remains significant at the 1 level in this case. All variables are in log and the ɛ t are the terms of the residual supposed to be white noise. Stock market is the close connection between aggregate stock market volatility and the development of the business cycle.

Source: pinterest.com

Source: pinterest.com

We find that stock returns are well characterized by year-long episodes of high volatility separated by longer quiet periods. Finally we identify a significant impact of the US on the remaining markets. CiteSeerX - Document Details Isaac Councill Lee Giles Pradeep Teregowda. Stock Market Volatility and the Business Cycle Although conventional wisdom holds that the stock market plays an impor-tant role for macroeconomic develop-ments and the business cycle the pre-cise linkages between the stock market and macroeconomic aggregates are not well understood. On the other hand in contrast to the pre-crisis period the stock market volatility of the US is now significantly causing the Canadian business cycle while the US business cycle remains significant at the 1 level in this case.

Source: pinterest.com

Source: pinterest.com

The recent observed decline of business cycle variability suggests that broad macroeconomic risk may have fallen as well. Finally we identify a significant impact of the US on the remaining markets. Our results suggest that there is a bidirectional causal relationship. This thesis investigates the long run relationship between stock market volatility and business cycles by means of linear and. Finally we identify a significant impact of the US on the remaining markets.

Source: co.pinterest.com

Source: co.pinterest.com

We investigate the latent volatility structures of the fluctuations in the US business cycle and stock market valuations. KW - stock market volatility. We investigate the latent structures in the volatilities of the business cycle and stock market valuations by estimating a Markov switching stochastic volatility model. February 2007 Abstract The recent observed decline of business cycle variability suggests that broad. Of Economics University of Brescia Dept.

Source: investopedia.com

Source: investopedia.com

By observing the U. This relationship links to theories of rational expectationsefficient market hypotheses and asset pricing theory. Stock Market Volatility and the Business Cycle. We employ both linear and nonlinear bivariate causality tests and we further conduct a multivariate analysis to explore possible spillover effects across countries. Figure 1 depicts the statistical relation between stock market volatility and the industrial production growth rate over the last sixty years which.

Source: seekingalpha.com

Source: seekingalpha.com

The market index and its price-earnings and dividend-price. N is the optimal lag length based on the Akaike information criterion AIC. KW - stock market volatility. There are four variables that determine whether the current secular stock market cycle is in bull or bear territory. This may in turn have some impact on equity risk premia.

Source: pinterest.com

Source: pinterest.com

The main purpose of this paper is to investigate the relationship between business cycle volatility and country size and financial markets size within certain countries using annual data for a sample of some typical countries having advanced financial market and those of China over 2000-2015. More specifically the influence of the US stock market volatility and business cycle on the Canadian stock market volatility remains robust and significant at the 5 level. Priceearnings ratio PE dividend yield inflation rate and bond yields. Stock Market Volatility and the Business Cycle. Where SMV is the stock market volatility BC is the business cycle indicator and REP is the shares repurchase.

Source: pinterest.com

Source: pinterest.com

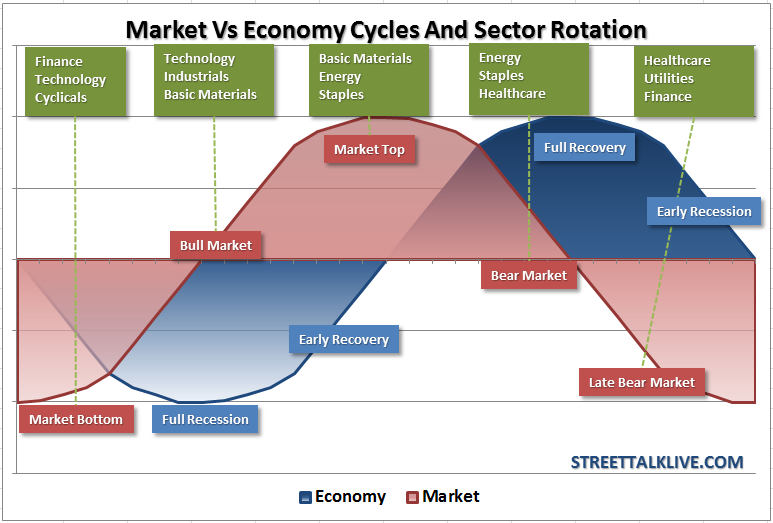

We find that stock returns are well characterized by year-long episodes of high volatility separated by longer quiet periods. Priceearnings ratio PE dividend yield inflation rate and bond yields. By observing the U. Generally a sharp recovery from recession as economic indicators such as gross domestic product and industrial production move from negative to positive and growth accelerates. We investigate the latent volatility structures of the fluctuations in the US business cycle and stock market valuations.

Source: pinterest.com

Source: pinterest.com

N is the optimal lag length based on the Akaike information criterion AIC. Journal of Applied Econometrics 1996 vol. PE is the pure measure of the stock market valuation level especially when it is normalized for the business cycle. Stock Market Volatility and the Business Cycle Although conventional wisdom holds that the stock market plays an impor-tant role for macroeconomic develop-ments and the business cycle the pre-cise linkages between the stock market and macroeconomic aggregates are not well understood. Of Mathematics University Paris Dauphine Dept.

Source: pinterest.com

Source: pinterest.com

11 issue 5 573-93 Abstract. In this paper we provide a review of the literature on the link between stock market volatility and aggregate demand. More in detail the volatility of our business cycle indicators follows a low-volatility regime for the second part of the 1966-2003 sample. 115 pages 573-593 Sept-Oct. This relationship links to theories of rational expectationsefficient market hypotheses and asset pricing theory.

Source: pinterest.com

Source: pinterest.com

More credit and low interest rates aid profit growth. This paper investigates the joint time series behavior of monthly stock returns and growth in industrial production. Of Mathematics University Paris Dauphine Dept. Our results suggest that there is a bidirectional causal relationship between stock market volatility and the business cycle within each country and additionally reveal that the recent financial crisis plays an important role in this context. N is the optimal lag length based on the Akaike information criterion AIC.

Source: pinterest.com

Source: pinterest.com

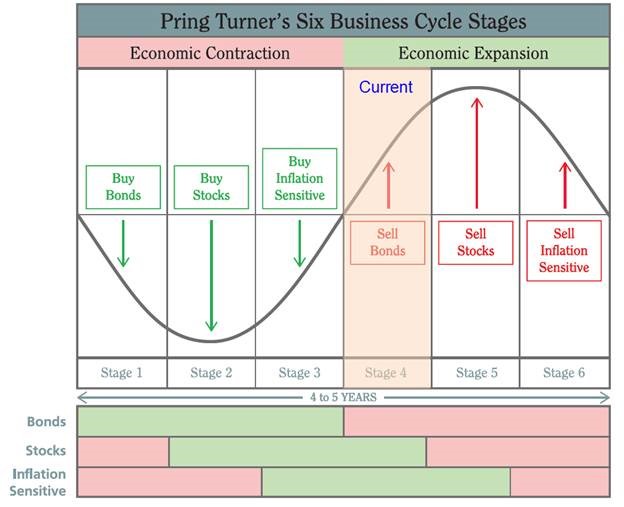

Stock Market Volatility and the Business Cycle. More credit and low interest rates aid profit growth. More in detail the volatility of our business cycle indicators follows a low-volatility regime for the second part of the 1966-2003 sample. This paper investigates the relationship between stock market volatility and the business cycle in four major economies namely the US Canada Japan and the UK. Priceearnings ratio PE dividend yield inflation rate and bond yields.

Source: pinterest.com

Source: pinterest.com

By observing the U. Where SMV is the stock market volatility BC is the business cycle indicator and REP is the shares repurchase. The stock volatility is a powerful indictor of financial crisis because it is closely related to business or economic cycle. We investigate the latent volatility structures of the fluctuations in the US business cycle and stock market valuations. By observing the U.

Source: pinterest.com

Source: pinterest.com

By observing the U. Finally we identify a significant impact of the US on the remaining markets. One of the most prominent features of the US. Stock Market Volatility and the Business Cycle Although conventional wisdom holds that the stock market plays an impor-tant role for macroeconomic develop-ments and the business cycle the pre-cise linkages between the stock market and macroeconomic aggregates are not well understood. More in detail the volatility of our business cycle indicators follows a low-volatility regime for the second part of the 1966-2003 sample.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title stock market volatility and the business cycle by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.