Your Stock price volatility meaning trading are ready. Stock price volatility meaning are a wallet that is most popular and liked by everyone this time. You can News the Stock price volatility meaning files here. Download all free bitcoin.

If you’re looking for stock price volatility meaning images information related to the stock price volatility meaning topic, you have pay a visit to the right site. Our site always gives you suggestions for viewing the maximum quality video and picture content, please kindly hunt and find more informative video articles and graphics that fit your interests.

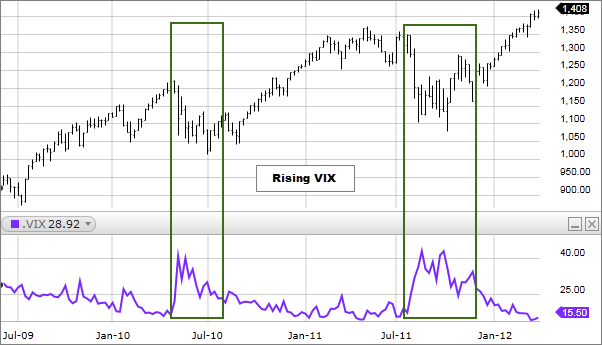

Stock Price Volatility Meaning. If the prices of a security fluctuate slowly in a longer time span it is termed to have low volatility. And if volatility is high for the overall market get ready to swoon and not in a celebrity-sighting kind of way. A stock with a price that fluctuates wildlyhits new highs and lows or moves erraticallyis. If volatility is high for a stock that means it could be a risky bet because of wild price swings.

What Is The Best Measure Of Stock Price Volatility From investopedia.com

What Is The Best Measure Of Stock Price Volatility From investopedia.com

Even if you were the best trader in the world you would never make any profit on a stock with a constant price zero volatility. If the prices of a security fluctuate slowly in a longer time span it is termed to have low volatility. High volatility means that a stocks price moves a lot. Stock volatility refers to the potential for a given stock to experience a drastic decrease or increase in value within a predetermined period of time. The most simple definition of volatility is a reflection of the degree to which price moves. Volatility represents how large an assets prices swing around the mean priceit is a statistical measure of its dispersion of returns.

When volatility is high the dispersion will be.

A stock with a price that fluctuates wildlyhits new highs and lows or moves erraticallyis. More than 30-years of experience says major swings are a sign of uncertainty. In most cases a surge or dive of 1 in market indexes classifies it as a volatile market. A stock with a high amount of volatility is riskier. What Volatility Means For Stock Prices. Volatility means how much something moves.

Source: study.com

Source: study.com

When you hear that volatility of a stock increased from 20 to 30 you. The Science of Algorithmic Trading and Portfolio Management 2014. In the long term volatility is good for traders because it gives them opportunities. Nevertheless volatility is not a singular concept or measurement but rather multi-faceted. When you buy a volatile investment you enhance your chances of success while also increasing failure risk remember that the higher the risk the.

Source: investopedia.com

Source: investopedia.com

In the stock market context rapid price fluctuation in either direction is considered as volatility. Unlike the usual way people look at prices of securities and their changes up or down the volatility point of view does not care about the direction so much. When you hear that volatility of a stock increased from 20 to 30 you. Down a 1000 here up 600 there. When you buy a volatile investment you enhance your chances of success while also increasing failure risk remember that the higher the risk the.

Source: capital.com

Source: capital.com

The most simple definition of volatility is a reflection of the degree to which price moves. Volatility risk is specifically related to the breadth of the trading range between the high and low price levels at which a stock or commodity has traded. Another variable that analysts closely track is the volatility of the stock price. Volatility is a measure of how much something tends to change. It measures how fast those movements are how often they occur and how big they are.

Source: investopedia.com

Source: investopedia.com

Another variable that analysts closely track is the volatility of the stock price. In the stock market context rapid price fluctuation in either direction is considered as volatility. High volatility means that a stocks price moves a lot. If volatility is high for a stock that means it could be a risky bet because of wild price swings. If the prices of a security fluctuate rapidly in a short time span it is termed to have high volatility.

Source: study.com

Source: study.com

Volatility indicates the pricing behavior of the security and helps estimate the fluctuations that may happen in a short period of time. In fact it does not distinguish between up and down. Experts often point to high market volatility as an indicator that a big drop and potential bear market is on the way. When you hear that volatility of a stock increased from 20 to 30 you. Volatility indicates the pricing behavior of the security and helps estimate the fluctuations that may happen in a short period of time.

Source: mdpi.com

Source: mdpi.com

Down a 1000 here up 600 there. When you buy a volatile investment you enhance your chances of success while also increasing failure risk remember that the higher the risk the. Hopefully your financial neck-brace is fitted otherwise you could suffer from stock price whiplash. Price volatility simply means the degree of change in the price of a stock over time. Volatility refers to amount of risk related to the amount person has invested on the stock.

Source: investopedia.com

Source: investopedia.com

Volatility is a measure of how much something tends to change. When volatility is high the dispersion will be. In fact it does not distinguish between up and down. Experts often point to high market volatility as an indicator that a big drop and potential bear market is on the way. Investors evaluate the volatility of stock before making a decision to purchase a new stock offering buy additional shares of a stock already in the portfolio or sell stock currently in the possession of the investor.

Source: investopedia.com

Source: investopedia.com

Nevertheless volatility is not a singular concept or measurement but rather multi-faceted. Volatility represents how large an assets prices swing around the mean priceit is a statistical measure of its dispersion of returns. Some investment opportunities have a high degree of change or high price volatility and some have a low. The Science of Algorithmic Trading and Portfolio Management 2014. Down a 1000 here up 600 there.

Source: fidelity.com

Source: fidelity.com

Stock volatility refers to the potential for a given stock to experience a drastic decrease or increase in value within a predetermined period of time. Some investment opportunities have a high degree of change or high price volatility and some have a low. Another variable that analysts closely track is the volatility of the stock price. A stock with a price that fluctuates wildlyhits new highs and lows or moves erraticallyis. Price volatility simply means the degree of change in the price of a stock over time.

Source: investopedia.com

Source: investopedia.com

In the long term volatility is good for traders because it gives them opportunities. Investors evaluate the volatility of stock before making a decision to purchase a new stock offering buy additional shares of a stock already in the portfolio or sell stock currently in the possession of the investor. In the long term volatility is good for traders because it gives them opportunities. Stock market computed based on real-time quote prices of SP 500 call and put options Put Options Put Option is a financial. Where have you heard about volatility risk.

Source: youtube.com

Source: youtube.com

If volatility is high for a stock that means it could be a risky bet because of wild price swings. When volatility is high the dispersion will be. When you buy a volatile investment you enhance your chances of success while also increasing failure risk remember that the higher the risk the. In the long term volatility is good for traders because it gives them opportunities. Volatility is a measure of how much something tends to change.

Source: fidelity.com

Source: fidelity.com

More than 30-years of experience says major swings are a sign of uncertainty. Volatility is a measure of how much something tends to change. Volatility risk is specifically related to the breadth of the trading range between the high and low price levels at which a stock or commodity has traded. Investors evaluate the volatility of stock before making a decision to purchase a new stock offering buy additional shares of a stock already in the portfolio or sell stock currently in the possession of the investor. Some investment opportunities have a high degree of change or high price volatility and some have a low.

Source: investopedia.com

Source: investopedia.com

When volatility is high the dispersion will be. Down a 1000 here up 600 there. VIX is a measure of the 30-day expected volatility of the US. When you hear that volatility of a stock increased from 20 to 30 you. In most cases a surge or dive of 1 in market indexes classifies it as a volatile market.

Source: ruleoneinvesting.com

Source: ruleoneinvesting.com

Posted on March 2 2021 March 4 2021 by Rich Meyers. Another variable that analysts closely track is the volatility of the stock price. The Science of Algorithmic Trading and Portfolio Management 2014. If volatility is high for a stock that means it could be a risky bet because of wild price swings. More than 30-years of experience says major swings are a sign of uncertainty.

Source: sciencedirect.com

Source: sciencedirect.com

If the prices of a security fluctuate rapidly in a short time span it is termed to have high volatility. Since stocks trade and are priced on every business day a lot more stock price data. Volatility refers to amount of risk related to the amount person has invested on the stock. Price volatility simply means the degree of change in the price of a stock over time. What Volatility Means For Stock Prices.

Source: investopedia.com

Source: investopedia.com

Price volatility causes the underlying stock price to be either higher or lower than estimated due to market movement and noise. Price volatility causes the underlying stock price to be either higher or lower than estimated due to market movement and noise. When you buy a volatile investment you enhance your chances of success while also increasing failure risk remember that the higher the risk the. Price volatility simply means the degree of change in the price of a stock over time. A stock with low volatility has a generally steady price.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Nevertheless volatility is not a singular concept or measurement but rather multi-faceted. A more volatile trade has the potential for significant gains but also substantial losses. It measures how fast those movements are how often they occur and how big they are. Stock market volatility refers to the range of price movement of a stock over time. Volatility refers to amount of risk related to the amount person has invested on the stock.

Unlike the usual way people look at prices of securities and their changes up or down the volatility point of view does not care about the direction so much. When volatility is high the dispersion will be. Therefore a high standard deviation value means prices can dynamically rise or fall and vice versa. Posted on March 2 2021 March 4 2021 by Rich Meyers. Where have you heard about volatility risk.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title stock price volatility meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.