Your The market for financial adviser misconduct coin are ready. The market for financial adviser misconduct are a exchange that is most popular and liked by everyone now. You can Find and Download the The market for financial adviser misconduct files here. News all royalty-free news.

If you’re looking for the market for financial adviser misconduct images information connected with to the the market for financial adviser misconduct keyword, you have visit the right site. Our site frequently gives you hints for seeking the maximum quality video and image content, please kindly search and find more informative video articles and graphics that match your interests.

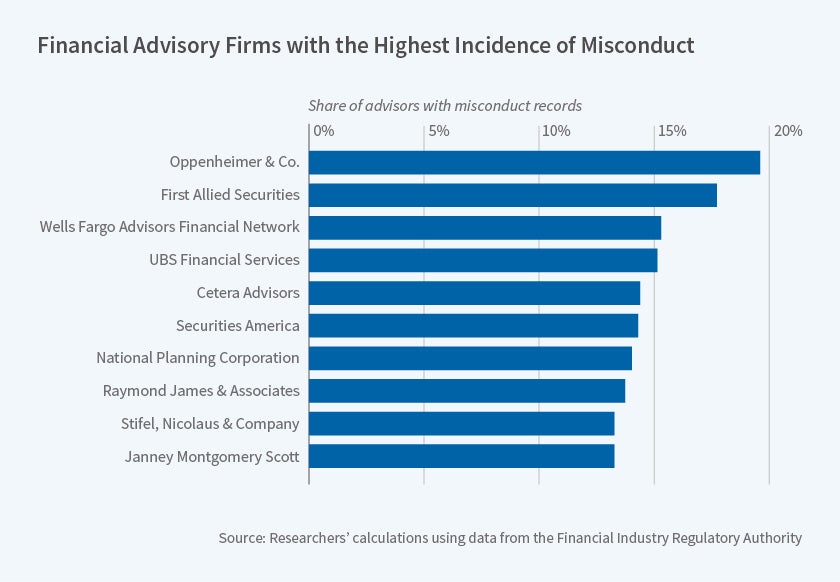

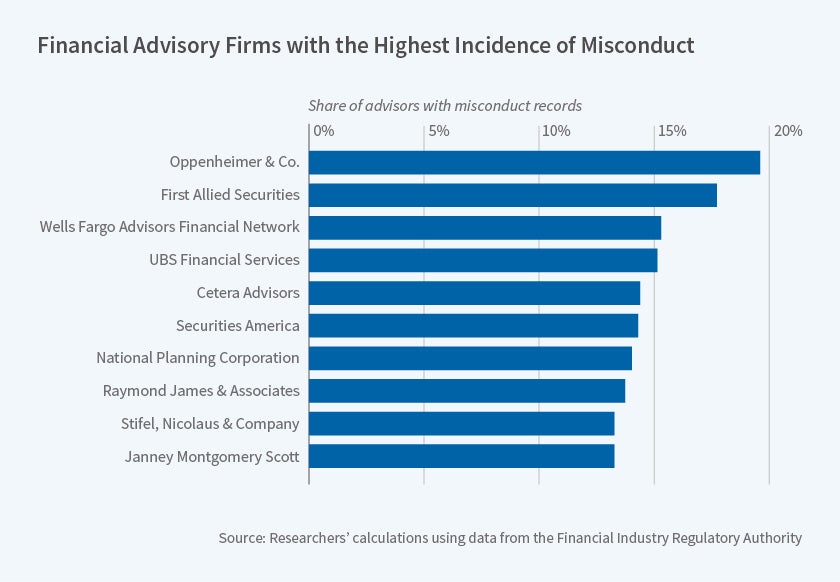

The Market For Financial Adviser Misconduct. Seven percent of advisers have misconduct records and this share reaches more than 15 at some of the largest advisory firms. The Market for Financial Adviser Misconduct. The Market for Financial Adviser Misconduct. The paper shows a number of different ways that adviser misconduct is concentrated among repeat offenders certain financial firms and.

The Labor Market For Financial Misconduct Nber From nber.org

The Labor Market For Financial Misconduct Nber From nber.org

Over 650000 registered financial advisers1 in the United States help manage over 30 trillion of investible assets and represent approximately 10 of total employment of the finance and insurance sector NAICS 52. Seven percent of advisers have misconduct records and this share reaches more than 15 at some of the largest advisory firms. The Market for Financial Adviser Misconduct Mark Egan Gregor Matvos and Amit Seru January 2017 Abstract eW construct a novel database containing the universe of nancial advisers in the United States from 2005 to 2015 representing approximately 10 of employment of. Mark Egan Gregor Matvos and Amit Seru. Seven percent of advisers have misconduct records and this share reaches more than 15 percent at some of the largest firms. Following misconduct advisers face longer unemployment spells and move to less reputable firms with a 10.

The Market for Financial Advisor Misconduct Financial advisors terminated for official misconduct often find work with another investment company.

We provide the first large-scale study that documents the economy-wide extent of misconduct among financial advisers and the associated labor market consequences of misconduct. The Market for Financial Adviser Misconduct Mark Egan Gregor Matvos and Amit Seru January 2017 Abstract eW construct a novel database containing the universe of nancial advisers in the United States from 2005 to 2015 representing approximately 10 of employment of. The Market for Financial Adviser Misconduct. Approximately half of financial advisers lose their job after misconduct. The Market For Financial Adviser Misconduct Introduction American households rely on financial advisers for financial planning and transaction services. We provide the first large-scale study that documents the economy-wide extent of misconduct among financial advisers and the associated labor market consequences of misconduct.

Source: researchgate.net

Source: researchgate.net

Seven percent of advisers have misconduct records and this share reaches more than 15 percent at some of the largest firms. The Market for Financial Adviser Misconduct Mark Egan Gregor Matvos and Amit Seru Economics Working Paper 16115 HOOVER INSTITUTION 434 GALVEZ MALL STANFORD UNIVERSITY STANFORD CA 94305-6010 March 2016 We construct a novel database containing the universe of financial advisers in the United States. Misconduct among financial advisers and the associated labor market consequences of misconduct. Mark Egan Gregor Matvos and Amit Seru. Egan - matvos - seru the market for financial advisor misconduct.

Source: nber.org

Source: nber.org

This index helps potential investors quantify risk by providing data about the percentage of advisors with a history of financial misconduct. We document the economywide extent of misconduct among financial advisers and the associated labor market consequences. In our recent paper The Market for Financial Misconduct we attempt to provide the first large-scale study that documents the economy-wide extent of misconduct among financial advisers and financial advisory firms. Misconduct among financial advisers and the associated labor market consequences of misconduct. Roughly one-third of advisers with misconduct are repeat offenders.

Source: pinterest.com

Source: pinterest.com

The Market for Financial Adviser Misconduct. Over 650000 registered financial advisers1 in the United States help manage over 30 trillion of investible assets and represent approximately 10 of total employment of the finance and insurance sector NAICS 52. Seven percent of advisers have misconduct records and this share reaches more than 15 percent at some of the largest firms. Roughly one third of advisers with misconduct are repeat offenders. We provide the first large-scale study that documents the economy-wide extent of misconduct among financial advisers and the associated labor market consequences of misconduct.

Source: journals.uchicago.edu

Source: journals.uchicago.edu

We provide the first large-scale study that documents the economy-wide extent of misconduct among financial advisers and the associated labor market consequences of misconduct. Approximately half of financial advisers lose their job after misconduct. The Market for Financial Adviser Misconduct. We provide the first large-scale study that documents the economy-wide extent of misconduct among financial advisers and the associated labor market consequences of misconduct. In our recent paper The Market for Financial Misconduct we attempt to provide the first large-scale study that documents the economy-wide extent of misconduct among financial advisers and financial advisory firms.

Source: in.pinterest.com

Source: in.pinterest.com

Journal of Political Economy 2019 vol. Roughly one third of advisers with misconduct are repeat offenders. Seven percent of advisers have misconduct records and this share reaches more than 15 at some of the largest advisory firms. 127 issue 1 233 - 295. Seven percent of advisers have misconduct records and this share reaches more than 15 at some of the largest advisory firms.

Source: mediateuk.co.uk

Source: mediateuk.co.uk

The Market For Financial Adviser Misconduct Mark Egan Gregor Matvos and Amit Seru ebruaryF 10 2016 Abstract eW construct a novel database containing the universe of nancial advisers in the US from 2005 to 2015 representing approximately 10 of employment of the nance and insurance sector. A recent paper The Market for Financial Adviser Misconduct Journal of Political Economy Publication Forthcoming raises some important and troubling issues about how the financial industry treats advisers who engage in serious misconduct. The Market for Financial Adviser Misconduct. Roughly one-third of advisers with misconduct are repeat offenders. In the first large-scale study documenting the economy-wide extent of misconduct among financial advisers and financial advisory firms in the United States researchers find that most financial advisers who engage in misconduct get to keep their jobsor are quickly rehired by another firm in the industry.

Source: masslawyersweekly.com

Source: masslawyersweekly.com

The Market For Financial Adviser Misconduct Introduction American households rely on financial advisers for financial planning and transaction services. Seven percent of advisers have misconduct records and this share reaches more than 15 percent at some of the largest firms. The labor market partially undoes firm-level discipline. The Market for Financial Adviser Misconduct. The paper shows a number of different ways that adviser misconduct is concentrated among repeat offenders certain financial firms and.

Source: researchgate.net

Source: researchgate.net

A recent paper The Market for Financial Adviser Misconduct Journal of Political Economy Publication Forthcoming raises some important and troubling issues about how the financial industry treats advisers who engage in serious misconduct. Over 650000 registered financial advisers1 in the United States help manage over 30 trillion of investible assets and represent approximately 10 of total employment of the finance and insurance sector NAICS 52. The Market For Financial Adviser Misconduct Introduction American households rely on financial advisers for financial planning and transaction services. Misconduct among financial advisers and the associated labor market consequences of misconduct. Roughly 7 of advisers have misconduct records.

Roughly one third of advisers with misconduct are repeat offenders. Seven percent of advisers have misconduct records and this share reaches more than 15 at some of the largest advisory firms. Firms discipline misconduct. Reemployment is not costless. Journal of Political Economy 2019 vol.

Source: journals.uchicago.edu

Source: journals.uchicago.edu

We provide the first large-scale study that documents the economy-wide extent of misconduct among financial advisers and the associated labor market consequences of misconduct. Seven percent of advisers have misconduct records and this share reaches more than 15 percent at some of the. The paper shows a number of different ways that adviser misconduct is concentrated among repeat offenders certain financial firms and. Roughly one third of advisers with misconduct are repeat offenders. We provide the first large-scale study that documents the economy-wide extent of misconduct among financial advisers and the associated labor market consequences of misconduct.

Source: journals.uchicago.edu

Source: journals.uchicago.edu

Roughly one third of advisers with misconduct are repeat offenders. The Market For Financial Adviser Misconduct Introduction American households rely on financial advisers for financial planning and transaction services. The Market for Financial Adviser Misconduct Mark Egan Gregor Matvos and Amit Seru February 2017 Abstract WeconstructanoveldatabasecontainingtheuniverseoffinancialadvisersintheUnitedStatesfrom. Seven percent of advisers have misconduct records and this share reaches more than 15 percent at some of the largest firms. The Market for Financial Adviser Misconduct.

Source: forbes.com

Source: forbes.com

The Market For Financial Adviser Misconduct Introduction American households rely on financial advisers for financial planning and transaction services. The Market for Financial Advisor Misconduct Financial advisors terminated for official misconduct often find work with another investment company. Roughly one third of advisers with misconduct are repeat offenders. Seven percent of advisers have misconduct records and this share reaches more than 15 at some of the largest advisory firms. Firms discipline misconductapproximately half of financial advisers lose their jobs after misconduct.

Source: elibrary.imf.org

Source: elibrary.imf.org

Roughly 7 of advisers have misconduct records. The Market for Financial Adviser Misconduct Mark Egan Gregor Matvos and Amit Seru January 2017 Abstract eW construct a novel database containing the universe of nancial advisers in the United States from 2005 to 2015 representing approximately 10 of employment of. The Market for Financial Adviser Misconduct. Of these advisers 44 are reemployed in the financial services industry within a year. The Market for Financial Adviser Misconduct.

Source: journals.uchicago.edu

Source: journals.uchicago.edu

The Market For Financial Adviser Misconduct Introduction American households rely on financial advisers for financial planning and transaction services. Over 650000 registered financial advisers1 in the United States help manage over 30 trillion of investible assets and represent approximately 10 of total employment of the finance and insurance sector NAICS 52. Journal of Political Economy 2019 vol. Seven percent of advisers have misconduct records and this share reaches more than 15 percent at some of the largest firms. We provide the first large-scale study that documents the economy-wide extent of misconduct among financial advisers and the associated labor market consequences of misconduct.

Source: fma.govt.nz

Source: fma.govt.nz

We construct a novel database containing the universe of financial advisers in the United States from 2005 to 2015 representing approximately 10 of employment of the finance and insurance sector. The Market for Financial Adviser Misconduct Mark Egan Gregor Matvos and Amit Seru Economics Working Paper 16115 HOOVER INSTITUTION 434 GALVEZ MALL STANFORD UNIVERSITY STANFORD CA 94305-6010 March 2016 We construct a novel database containing the universe of financial advisers in the United States. Journal of Political Economy 2019 vol. The Market For Financial Adviser Misconduct Mark Egan Gregor Matvos and Amit Seru ebruaryF 10 2016 Abstract eW construct a novel database containing the universe of nancial advisers in the US from 2005 to 2015 representing approximately 10 of employment of the nance and insurance sector. Seven percent of advisers have misconduct records and this share reaches more than 15 percent at some of the largest firms.

Source: journals.uchicago.edu

Source: journals.uchicago.edu

Seven percent of advisers have misconduct records and this share reaches more than 15 percent at some of the largest firms. Following misconduct advisers face longer unemployment spells and move to less reputable firms with a 10. Seven percent of advisers have misconduct records and this share reaches more than 15 percent at some of the largest firms. Reemployment is not costless. A recent paper The Market for Financial Adviser Misconduct Journal of Political Economy Publication Forthcoming raises some important and troubling issues about how the financial industry treats advisers who engage in serious misconduct.

Source: youtube.com

Source: youtube.com

Roughly one third of advisers with misconduct are repeat offenders. The Market For Financial Adviser Misconduct Introduction American households rely on financial advisers for financial planning and transaction services. As part of our analysis we examine the labor market consequences of misconduct and study the allocation of advisers across firms in the industry after misconduct is publicly revealed. Journal of Political Economy 2019 vol. The Market For Financial Adviser Misconduct Introduction American households rely on financial advisers for financial planning and transaction services.

Source: investopedia.com

Source: investopedia.com

Seven percent of advisers have misconduct records and this share reaches more than 15 at some of the largest advisory firms. A recent paper The Market for Financial Adviser Misconduct Journal of Political Economy Publication Forthcoming raises some important and troubling issues about how the financial industry treats advisers who engage in serious misconduct. We document the economywide extent of misconduct among financial advisers and the associated labor market consequences. Journal of Political Economy 2019 vol. The Market for Financial Adviser Misconduct.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title the market for financial adviser misconduct by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.