Your Vix volatility index meaning mining are ready in this website. Vix volatility index meaning are a coin that is most popular and liked by everyone now. You can News the Vix volatility index meaning files here. Get all free bitcoin.

If you’re looking for vix volatility index meaning images information connected with to the vix volatility index meaning keyword, you have visit the right site. Our site always gives you hints for seeking the highest quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

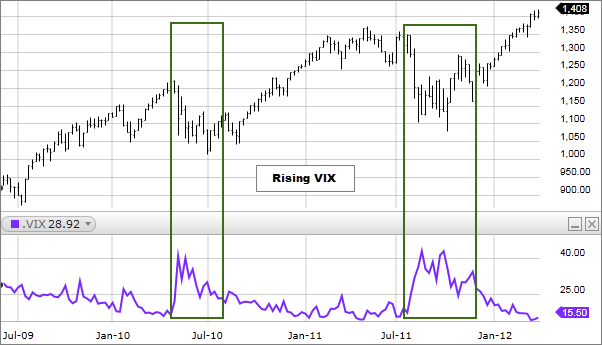

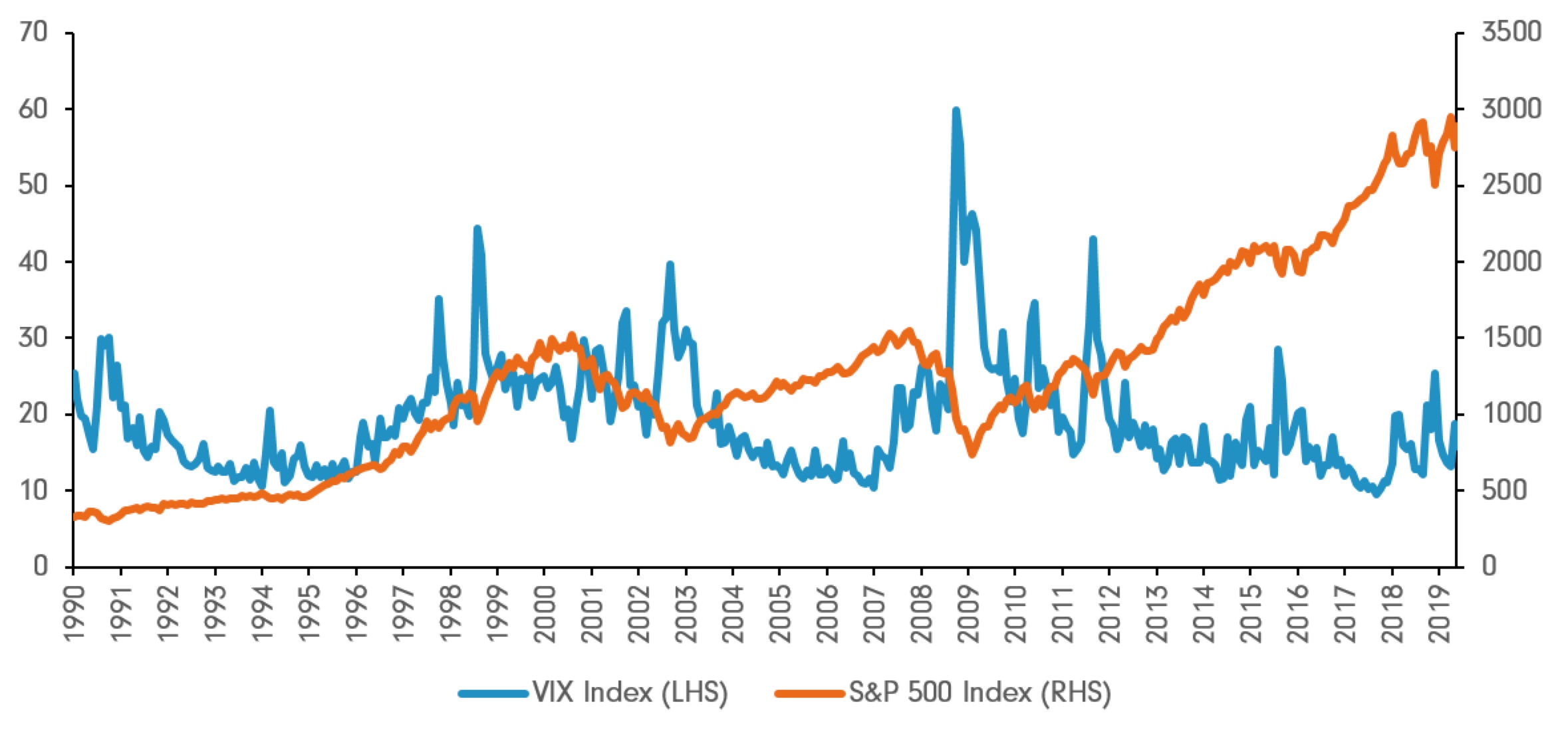

Vix Volatility Index Meaning. The CBOE volatility index also referred to as VIX is a volatility based market index that measures the expected future volatility over the next 30 day period. If the SP spikes up the VIX is at low reading down. The Volatility Index VIX is widely considered the foremost indicator of stock market volatility and investor sentiment. Most of the time futures markets converge toward the spot prices as expiration approaches.

What Is The Vix Volatility Index And How Do You Trade It From ig.com

What Is The Vix Volatility Index And How Do You Trade It From ig.com

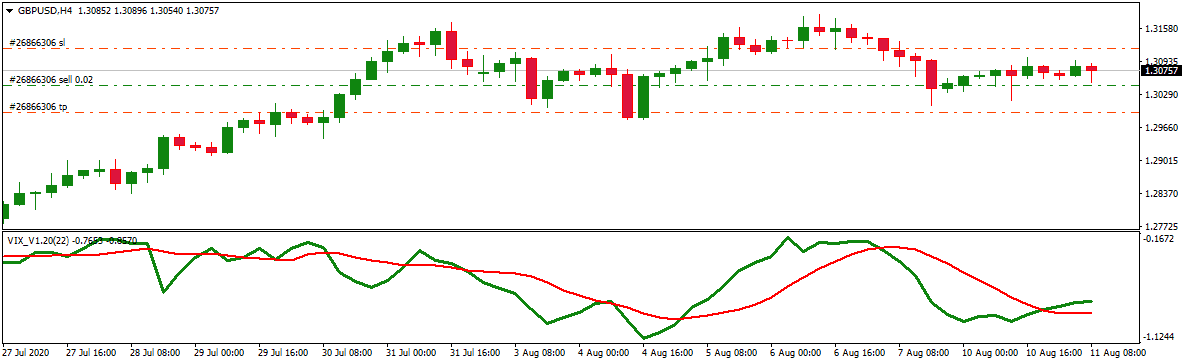

However pinpointing exactly what VIX is indicating about future volatility is slightly trickier. The VIX is shorthand for the volatility index. The VIX was introduced in 1993 by the Chicago Board of Options Exchange. Most of the time futures markets converge toward the spot prices as expiration approaches. The VIX is intended to be used as an indicator of market uncertainty as reflected by the level of volatility. The Cboe Volatility Index VIX is a real-time index that represents the markets expectations for the relative strength of near-term price changes of the SP 500 index SPX.

If the SP spikes up the VIX is at low reading down.

It is a measure of the markets expectation of near term volatility of the prices of US 500 stock index options. Meaning of Volatility Index Volatility Index VIX is a key measure of market expectations of near term volatility. Thus when the markets are highly volatile market tends to move steeply up or down and during this time volatility index tends to. India VIX is a volatility index computed by NSE and is based on out of the money Options of Nifty In simple terms India Vix represents how much traders expect Nifty to move in near term. The VIX Index is based on options of the SP 500 Index considered the leading indicator of. And the meaning of a given VIX level is frequently misunderstood.

Source: blog.investyadnya.in

Source: blog.investyadnya.in

However pinpointing exactly what VIX is indicating about future volatility is slightly trickier. Most of the time futures markets converge toward the spot prices as expiration approaches. The CBOE Volatility Index more commonly known as the VIX is a real-time index that tracks the markets expectations of changes in the SP 500. It is often dubbed the fear index. Thus when the markets are highly volatile market tends to move steeply up or down and during this time volatility index tends to.

Source: investopedia.com

Source: investopedia.com

The CBOE Volatility Index more commonly known as the VIX is a real-time index that tracks the markets expectations of changes in the SP 500. A low VIX valuereading means no sharp upside or downside volatility on the underlying. VIX is an index that measures the implied volatility of SP 500. The VIX Index is based on options of the SP 500 Index considered the leading indicator of. The VIX is a measure of expected future volatility.

Source: study.com

Source: study.com

If the SP spikes up the VIX is at low reading down. One common misconception is that VIX levels correspond directly to the volatility observed 30 days laterassuming that a VIX level of 25 means an anticipated volatility of 25 for instance. The VIX was introduced in 1993 by the Chicago Board of Options Exchange. It is calculated from the options on the SP 500 market index. However pinpointing exactly what VIX is indicating about future volatility is slightly trickier.

Source: investing.com

Source: investing.com

A higher India Vix represents there is expectation of sharp move in Nifty in coming days. One common misconception is that VIX levels correspond directly to the volatility observed 30 days laterassuming that a VIX level of 25 means an anticipated volatility of 25 for instance. The contracts are in contango which means the future prices are higher the longer we get from the spot price the index. The VIX was introduced in 1993 by the Chicago Board of Options Exchange. It is calculated from the options on the SP 500 market index.

Source: thestreet.com

Source: thestreet.com

The Volatility Index VIX is widely considered the foremost indicator of stock market volatility and investor sentiment. Its perceived by many as an indicator of when traders and investors can make bets about future market performances. In simple terms VIX refers to a markets expectations of price volatility or fluctuations in the next 30 days. It provides a measure of market risk and investors sentiments. Most of the time futures markets converge toward the spot prices as expiration approaches.

Source: fidelity.com

Source: fidelity.com

The index is forward-looking in that it seeks to predict variability of future market price action. The results are known as India VIX. India VIX is the index of market volatility. A low VIX valuereading means no sharp upside or downside volatility on the underlying. If the SP drops to the lower side sharply the VIX.

Source: ig.com

Source: ig.com

As we understand volatility implies the ability to change. Investors research analysts and portfolio managers look to VIX. The Volatility Index VIX is widely considered the foremost indicator of stock market volatility and investor sentiment. But unlike major indices you dont buy an exchange-traded product that owns the underlying investments like stocks in the SP 500 Instead you must buy VXX or to. Cboe Global Markets revolutionized investing with the creation of the Cboe Volatility Index VIX Index the first benchmark index to measure the markets expectation of future volatility.

Source: investopedia.com

Source: investopedia.com

This is because when the VIX increases the SP 500 tend to decrease. If the SP drops to the lower side sharply the VIX. The CBOE Volatility Index more commonly known as the VIX is a real-time index that tracks the markets expectations of changes in the SP 500. And the meaning of a given VIX level is frequently misunderstood. The VIX is a measure of expected future volatility.

Source: forex.in.rs

Source: forex.in.rs

If the SP spikes up the VIX is at low reading down. The VIX was introduced in 1993 by the Chicago Board of Options Exchange. The CBOE volatility index also referred to as VIX is a volatility based market index that measures the expected future volatility over the next 30 day period. The Volatility Index or VIX is a real-time market index that represents the markets expectation of 30-day forward-looking volatility. A higher India Vix represents there is expectation of sharp move in Nifty in coming days.

Source: school.stockcharts.com

Source: school.stockcharts.com

The CBOE Volatility Index more commonly known as the VIX is a real-time index that tracks the markets expectations of changes in the SP 500. Also called VIX it is a tool that investors in the stock markets use before buying or selling stocks. Most of the time futures markets converge toward the spot prices as expiration approaches. The VIX Index is based on options of the SP 500 Index considered the leading indicator of. The purpose of this paper is to providewithout requiring a prior knowledge of the sophisticated mathematics involved in option pricinga.

Source: ig.com

Source: ig.com

It was started by the NSE in 2010 as a niche product in the Indian securities market. The CBOE Volatility Index otherwise known as VIX is a measure of. It provides a measure of market risk and investors sentiments. The CBOE Volatility Index more commonly known as the VIX is a real-time index that tracks the markets expectations of changes in the SP 500. In simple terms VIX refers to a markets expectations of price volatility or fluctuations in the next 30 days.

Source: pinterest.com

Source: pinterest.com

VIX is an index that measures the implied volatility of SP 500. Like all indices you cant buy the VIX directly. India VIX is a volatility index computed by NSE and is based on out of the money Options of Nifty In simple terms India Vix represents how much traders expect Nifty to move in near term. Investobull 22nd April 2020. A spike in the Volatility Index means prices of the underlying has spiked either up or down.

Source: tradingview.com

Source: tradingview.com

As we understand volatility implies the ability to change. Thus when the markets are highly volatile market tends to move steeply up or down and during this time volatility index tends to. The results are known as India VIX. It is used to measure and predict the amount or level of volatility the SP 500 will have for the following updated 30 days. In simple terms VIX refers to a markets expectations of price volatility or fluctuations in the next 30 days.

Source: school.stockcharts.com

Source: school.stockcharts.com

Cboe Global Markets revolutionized investing with the creation of the Cboe Volatility Index VIX Index the first benchmark index to measure the markets expectation of future volatility. The index is forward-looking in that it seeks to predict variability of future market price action. It is used to measure and predict the amount or level of volatility the SP 500 will have for the following updated 30 days. It is often dubbed the fear index. The VIX Index is based on options of the SP 500 Index considered the leading indicator of.

Source: investopedia.com

Source: investopedia.com

Most of the time futures markets converge toward the spot prices as expiration approaches. But unlike major indices you dont buy an exchange-traded product that owns the underlying investments like stocks in the SP 500 Instead you must buy VXX or to. It is also known by other names like Fear Gauge or Fear Index. In this post we will be looking at what the VIX is and why it has that special relationship with the SP 500. It is a measure of the markets expectation of near term volatility of the prices of US 500 stock index options.

Source: blog.investyadnya.in

Source: blog.investyadnya.in

India VIX is a volatility index computed by NSE and is based on out of the money Options of Nifty In simple terms India Vix represents how much traders expect Nifty to move in near term. Also called VIX it is a tool that investors in the stock markets use before buying or selling stocks. The snapshot shows the VIX index and the May and June 2021 mini-contracts the VIX index is April. Cboe Global Markets revolutionized investing with the creation of the Cboe Volatility Index VIX Index the first benchmark index to measure the markets expectation of future volatility. It is also known by other names like Fear Gauge or Fear Index.

Source: fidelity.com.hk

Source: fidelity.com.hk

The CBOE Volatility Index VIX is a measure of expected price fluctuations in the SP 500 Index options over the next 30 days. If the SP drops to the lower side sharply the VIX. The results are known as India VIX. In simple terms VIX refers to a markets expectations of price volatility or fluctuations in the next 30 days. A higher India Vix represents there is expectation of sharp move in Nifty in coming days.

Source: school.stockcharts.com

Source: school.stockcharts.com

It is a measure of the markets expectation of near term volatility of the prices of US 500 stock index options. However pinpointing exactly what VIX is indicating about future volatility is slightly trickier. The purpose of this paper is to providewithout requiring a prior knowledge of the sophisticated mathematics involved in option pricinga. It provides a measure of market risk and investors sentiments. The CBOE Volatility Index VIX is a measure of expected price fluctuations in the SP 500 Index options over the next 30 days.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title vix volatility index meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.